Homebuyers are concerned about the effect rising interest rates have on their ability to afford a home, but not enough to spoil their plans, according to a recent survey issued by Zillow Group Mortgages. Eighty-three percent of homebuyers who plan to purchase a home in the next three years expect to see those plans through, even if their monthly mortgage payment increases by $100 due to rising rates. Forty-nine percent will forge ahead even if their payment increases by $200.

Rising rates will have an impact, however, on the location and size homebuyers settle on, according to the survey. Twenty-five percent of homebuyers with $100 in additional costs would change their plans, opting for a home with less square footage or in a more affordable community.

“For years, falling interest rates have been a boon to the U.S. housing market, keeping monthly mortgage payments low for first-time and move-up buyers alike, even as home values rose,” says Erin Lantz, vice president of Mortgages for Zillow Group. “As rates rise this year, first-time buyers and those looking to buy in expensive markets where affordability is already an issue will feel the pinch of higher rates on their budget.”

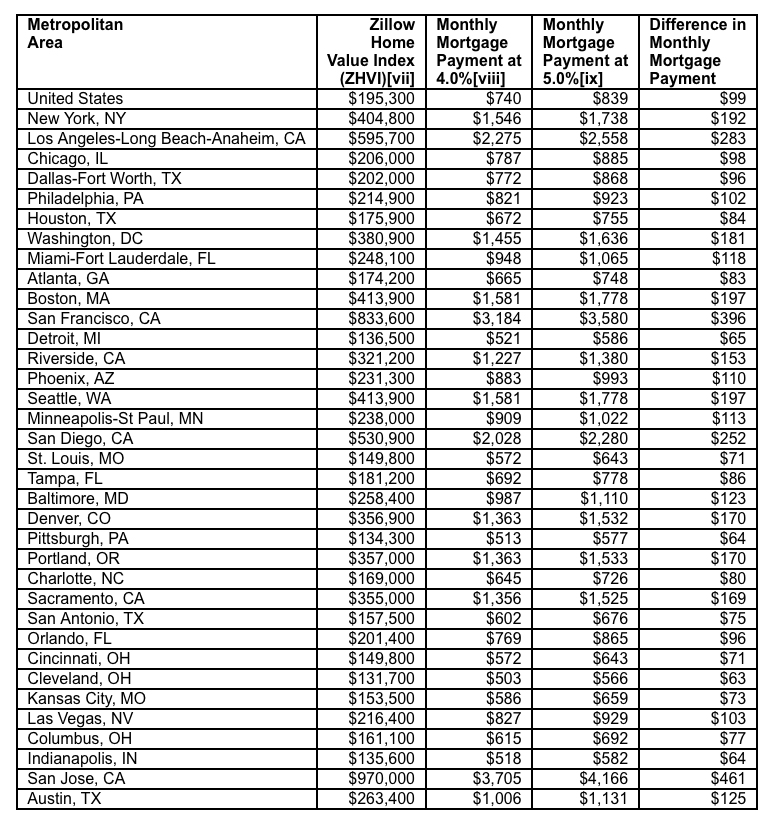

Homebuyers overall in the majority of the top 35 metropolitan areas would have minimal added expense if their mortgage rate were to rise from 4 percent to 4.25 percent—in fact, a 4.25 percent rate on a median-valued home ($195,300) would tack on about $23 to a monthly mortgage payment. Comparing an even higher increase in specific areas:

“For most borrowers, there is quite a bit of head room for rates to rise before home-buying becomes unaffordable,” Lantz says.

For more information, please visit www.zillow.com.

For the latest real estate news and trends, bookmark RISMedia.com.