Appraisals were, on average, 0.45 percent below the expectations of homeowners, according to the December Quicken Loans National Home Price Perception Index (HPPI), while appraised home values were up 5.15 percent year-over-year, according to the Quicken Loans National Home Value Index.

Home Price Perception Index (HPPI)

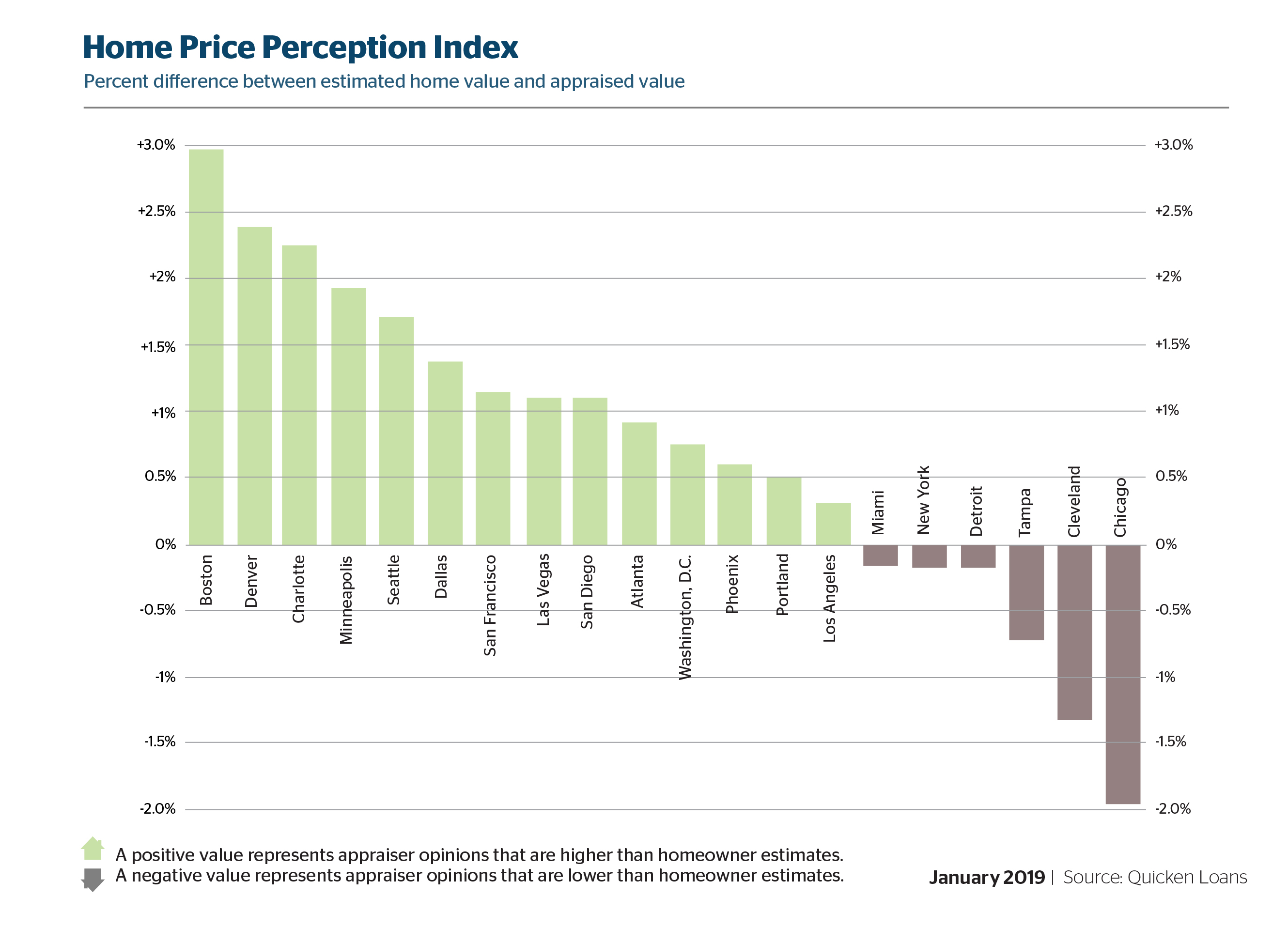

The HPPI—Quicken Loans’ exclusive measure of homeowners’ opinion of home values—continued to show a small difference between owners’ and appraisers’ opinions on a national level, but the appraisals in the vast majority of metro areas were higher than the owner expected in December. Homeowners in Boston, for example, saw appraisals coming back an average of 2.98 percent higher than what the homeowners expected. Based on the area’s median home value, that is an average of about $15,000 in extra equity the owners don’t realize they had.

“Many consumers don’t think about their home’s value until they start thinking about selling it. They may not be watching their local housing market as closely as appraisers who are reviewing home sales every day—leading the owners to incorrectly estimate their home’s value,” says Bill Banfield, executive vice president of Capital Markets at Quicken Loans. “The fact of the matter is that the there are many ways a homeowner can make their equity can work for them if they have a realistic estimate of their home’s value. Tapping into home equity to consolidate high-interest debt or make home improvements are very popular options right now.”

Home Value Index (HVI)

The Quicken Loans HVI, the only measure of home value change based exclusively on appraisal data, reported increasingly rising appraisal values across the country. The National HVI showed that home values rose steadily from November to December, increasing 0.79 percent. The annual growth is even stronger, with the average appraisal rising 5.15 percent over last year’s level. Another sign of the housing market’s health is that all four regions measured by the study reported modest growth on both the monthly and annual measures. The appraisal values ranged from 4.41 percent annual growth in the Northeast to a 5.98 percent year-over-year increase in the West.

“Any consumer who has read recent news about the housing market and has the impression that it is slowing to a halt should see that the HVI proves that this could not be farther from the truth,” says Banfield. “Home value growth is now at a more normal, sustainable clip—keeping pace with inflation and wage growth more than we have seen in the past few years.”

For more information, please visit QuickenLoans.com/Indexes.