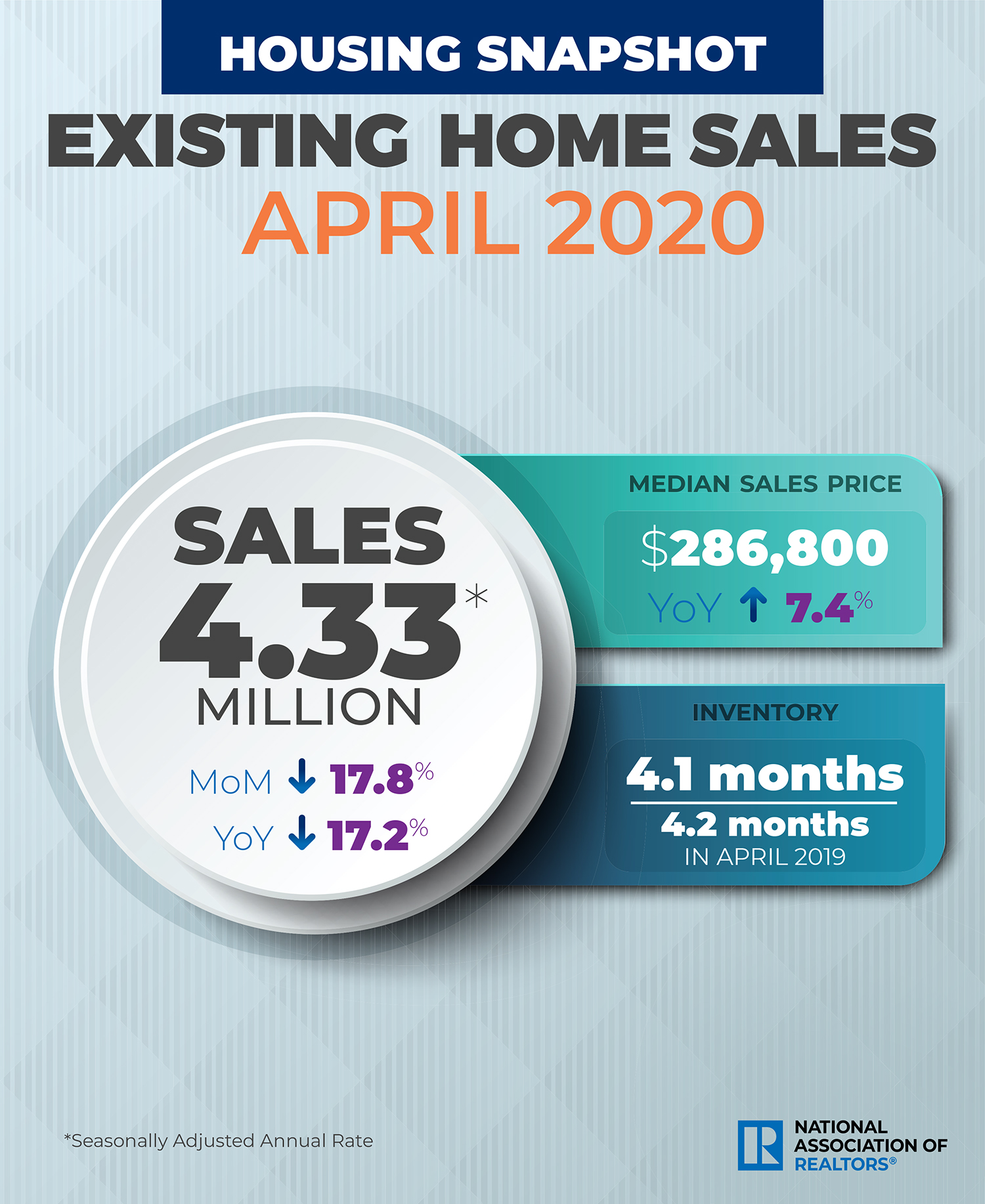

Existing-home sales continue on a downward trend amidst the coronavirus pandemic, according to the April National Association of REALTORS® (NAR) report. The adjusted annualized rate of sales in April 2020 totaled 4.33 million, down from 5.23 million in April 2019—a 17.2 percent decrease YoY and the lowest level of sales since July 2010. Month-over-month, existing home sales dropped 17.8 percent from March.

Prices, however, continue their upward momentum, albeit at a slower pace than pre-coronavirus. Across all housing types, the median existing-home price in April was $286,800, increasing 7.4 percent YoY. According to new realtor.com® data, median listing prices increased 4 percent YoY in the first two weeks in March; in the week ending May 16, however, they increased only 1.5 percent YoY, slightly higher than the 1.4 percent increase during the week of May 9.

The inventory crunch continues, driven by a lack of sellers in the market due to COVID-19 concerns. According to NAR, total housing inventory at the end of April was 1.47 million units, a 1.3 percent decrease from March and 19.7 percent decrease YoY. Realtor.com® reports that new listings were down 28 percent last week, and total inventory is down 20 percent since the last Weekly Housing Trends report.

The pandemic is influencing Days on Market as well, with properties staying on the market for 27 days in April, according to NAR—seasonally down from 29 days in March, but up 24 days YoY. Realtor.com® reports a more pessimistic summary, with days on market currently 15 days slower than last year.

Market Activity According to NAR:

Single-Family Existing-Home Sales – 3.94 million

MoM Change: -16.9%

YoY Change: -15.5%

Median Price: $288,700, YoY Change: +7.3%

Condo/Co-Op Existing-Home Sales – 390,000

MoM Change: -26.4%

YoY Change: -31.6%

Median Price: $267,200, YoY Change: +7.1%

Distressed Sales: Make up 3 percent of all sales in April, flat YoY and MoM

All-Cash Sales: Make up 15 percent of all April transactions (-19% MoM, -20% YoY)

Midwest

Existing-Home Sales: 1.10 million (-8.3% YoY)

Median Price: $229,200 (+9.3% YoY)

Northeast

Existing-Home Sales: 540,000 (-18.2% YoY)

Median Price: $312,500 (+8.7% YoY)

South

Existing-Home Sales: 1.88 million (-16.8% YoY)

Median Price: $249,400 (+6.4% YoY)

West

Existing-Home Sales: 810,000 (-27.0%)

Median Price: $419,300 (+6.1%)

What the Industry Is Saying:

“The economic lockdowns—occurring from mid-March through April in most states—have temporarily disrupted home sales. But the listings that are on the market are still attracting buyers and boosting home prices. Record-low mortgage rates are likely to remain in place for the rest of the year, and will be the key factor driving housing demand as state economies steadily reopen. Still, more listings and increased home construction will be needed to tame price growth. There appears to be a shift in preference for single-family homes over condominium dwellings. This trend could be long-lasting as remote work and larger housing needs will become widely prevalent even after we emerge from this pandemic.” — Lawrence Yun, Chief Economist, NAR

“While virtually every sector of the American economy has been hit hard by this pandemic, our nation’s 1.4 million REALTORS® have continued to show an undying commitment to their profession, their clients and America’s real estate industry. As we find during any time of crisis, we have a tremendous opportunity to evolve and emerge stronger and more efficient. Having renewed our focus on new, innovative ways to serve American consumers, I am confident the real estate sector and our nation’s REALTORS® are uniquely positioned to lead America’s economic recovery.” — Vince Malta, President, NAR

“Mid-May is normally the time of year when homes sell the fastest, but today’s median time on market is more like what we usually see in late February or November. While the real estate industry has leveraged technology to help buyers find homes and get to the closing table, virtual or physical, sellers will note that the pandemic has had a dramatic impact on the time it takes to find a buyer. Looking forward, we expect time on market figures to improve in late summer, especially as buyers try to make up for the missed spring season.” — Danielle Hale, Chief Economist, realtor.com®

“While April’s figures may seem bleak, there is a bright spot in all of this. We will likely see strong interest from homebuyers in June and July once they are able to leave their homes and go on tours of properties again. Home purchases may be even lower in May, but the housing market will rebound once we get through this difficult time.” — Bill Banfield, Quicken Loans Executive Vice President of Capital Markets

“We expect existing home sales to continue to trail below 2019 levels as we move into the summer months. Sales are likely to decline again in the range of 20 percent to 30 percent year-over-year in May, as consumers remain cautious and the economic impact of the shutdown continues to weigh on decision making. Reopening measures are unfolding in every state now, but the impact on the real estate sector has likely been a result of voluntary social distancing, given real estate’s status as an essential industry in almost every state, rather than as a result of direct policy measures.

“The recovery in existing home sales will likely need to be driven by confidence that the virus is genuinely receding and overall economic conditions improving. Looking forward, it is necessary that we continue to provide aid to those impacted in ways that allow people to stay current on their mortgage and rent payments to the greatest extent possible while still prudently managing the continuing risk from COVID-19. Mortgage forbearance programs remain critical, and as we move forward, having clear paths out of forbearance that provide reasonable options for homeowners will be a crucial factor for continued health in the housing market in the medium term.” — Ruben Gonzalez, Chief Economist, Keller Williams

As the coronavirus and its impact on the industry unfold, RISMedia is providing resources and updates. Get the latest.

Liz Dominguez is RISMedia’s senior editor. Email her your story ideas to ldominguez@rismedia.com.

Liz Dominguez is RISMedia’s senior editor. Email her your story ideas to ldominguez@rismedia.com.