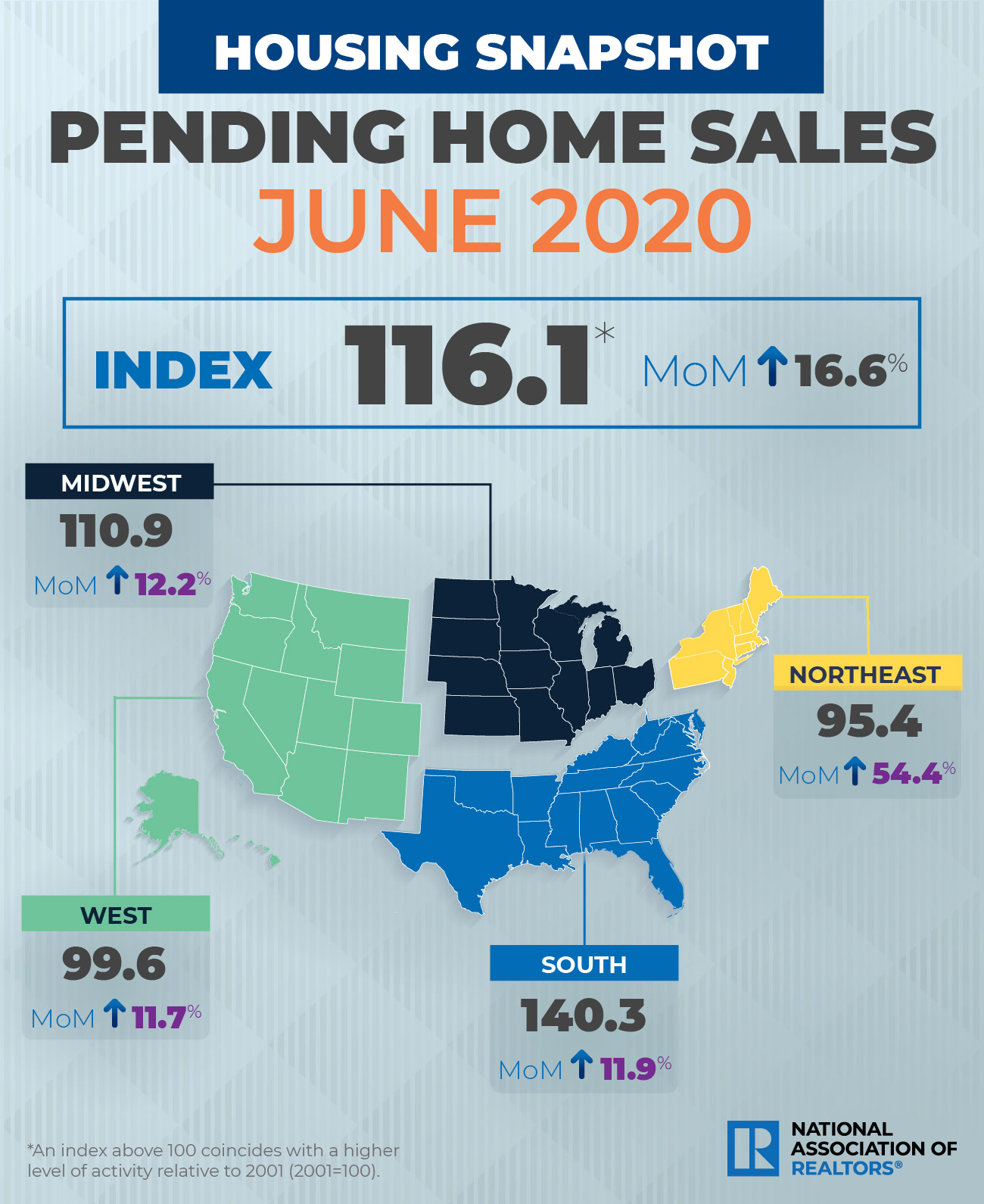

The recent flare-up in COVID cases hasn’t slowed the U.S. housing markets, according to the latest Pending Home Sales Index (PHSI) from the National Association of REALTORS® (NAR). For June, pending home sales increased 16.6 percent, marking the second consecutive month of increasing contract activity. The index is now at 116.1 on a national level—according to NAR, an index of 100 is equal to the level of contract activity in 2001.

All four major regions saw month-over-month growth in June. The Northeast, however, was the only region to not record YoY increases in pending transactions.

NAR revised its forecast for the remainder of 2020, expecting existing-home sales to decline by only 3 percent, with sales increasing to 5.6 million by the fourth quarter. In addition, NAR expects a positive GDP growth of 4 percent in 2021, which could help boost existing and new-home sales, forecasted to grow by 7 and 16 percent, respectively. In terms of mortgage interest rates, NAR predicts they will stay near 3 percent over the next 18 months, while home prices are forecast to increase by 4 percent in 2020 before moderating to 3 percent in 2021 with the addition of new supply.

Regional Breakdown:

Northeast

+54.4% MoM – Now 95.4 PHSI

-0.9% YoY

Midwest

+12.2% MoM – Now 110.9 PHSI

+5.1% YoY

South

+11.0% MoM – Now 140.3 PHSI

+10.3% YoY

West

+11.7% MoM – 99.6 PHSI

+4.7% YoY

Here’s What the Industry’s Saying:

“It is quite surprising and remarkable that, in the midst of a global pandemic, contract activity for home purchases is higher compared to one year ago. Consumers are taking advantage of record-low mortgage rates resulting from the Federal Reserve’s maximum liquidity monetary policy. The Northeast’s strong bounce back comes after a lengthier lockdown, while the South has consistently outperformed the rest of the country. These remarkable rebounds speak to exceptionally high buyer demand. While the outlook is promising, sharply rising lumber prices are concerning. A reduction in tariffs—even if temporary—would help increase home building and thereby spur faster economic growth.” — Lawrence Yun, Chief Economist, National Association of REALTORS®

“Pending home sales followed up their May rebound with another solid increase in June, as strong housing demand and low mortgage rates drive purchase activity. Pending sales were up over 6 percent compared to June 2019, which is consistent with the now 10 straight weeks of annual increases in home purchase applications we have reported. While this is another piece of positive news for the housing market, there is some uncertainty ahead. COVID-19 cases are rising in many parts of the country, the unemployment benefits extension remains in doubt, and housing inventory remains tight.” — Joel Kan, AVP of Economic and Industry Forecasting, Mortgage Bankers Association

“Housing market activity in June was strong, with buyers benefiting from extremely low mortgage rates that have continued declining all the way through July. Pending sales reflect contracts in June, which will close in July and August, and increasing sales in July are consistent with other data we are monitoring. Inventory has remained low, and we have seen new home sales pick up substantially as a result of pent-up demand and low levels of existing home inventory.

“The impacts of social distancing seem to have more lasting impacts on supply, as new listings remain well below the 2019 levels despite the resurgence of demand we saw in May and June. The dynamics created by pent-up demand and low levels of supply likely will result in an acceleration in price growth in July. If we see a further slowing in the pace of new listings coming on the market as a result of the recent surge in coronavirus cases, and mortgage rates continue to spur demand, we could continue to see upward pressure on home prices. It’s still not clear to what extent demand has been impacted in the second half of July by the case surge, but we expect to see some drop-off in demand as social distancing increases. Recent innovations that have made virtual tours straightforward and consumers adapting to fewer in-person showings are likely to reduce some of the impact of the surge.” — Ruben Gonzalez, Chief Economist, Keller Williams

For more information, please visit www.nar.realtor.