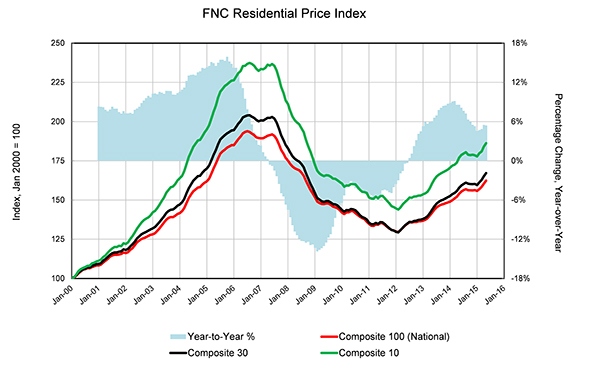

In a sign that the U.S. housing market is on track for a strong spring/summer buying season, home prices continue to show solid gains in May, according to the latest FNC Residential Price Index™ (RPI). Prices across the country climbed 1.2 percent following an upwardly-revised April, which saw the largest March-to-April seasonal gain since 2005.

With homes selling at rapid pace, supply in many local markets remains relatively challenged amid rising sales. “While the participation of first-time homebuyers has reportedly reached record highs, rising demand from potential trade-up buyers has also contributed importantly to the price growth in many markets,” says Bob Dorsey, FNC’s chief data and analytics officer. “Trade-up buyers continue to capture moderate to modest gains on their investment; in May 2015, realized home price appreciation, measured at an annualized rate, averages 2.6 percent across the country.”

Foreclosure sales have dropped to their lowest levels since October 2007. In May 2015, completed final sales of foreclosed and REO properties comprised about 10.3 percent of total existing home sales, a decline of nearly two percentage points from April’s 12.2 percent.

Average time-on-market drops rapidly, down to 85 days in June, compared to 96 days in May. Meanwhile, sellers are taking smaller cuts off their asking price, averaging 3.1 percent in May, compared to April’s 3.6 percent. Preliminary June estimates show a continued drop in the asking price discount nationwide, with buyers in the San Francisco market bidding up prices to pay an average of 4.8 percent above the listing price.

FNC’s RPI is the mortgage industry’s first hedonic price index built on a comprehensive database that blends public records of residential sales prices with real-time appraisals of property and neighborhood attributes. As a gauge of underlying home values, the RPI excludes final sales of REO and foreclosed homes, which are frequently sold with large price discounts, often reflecting poor property conditions.

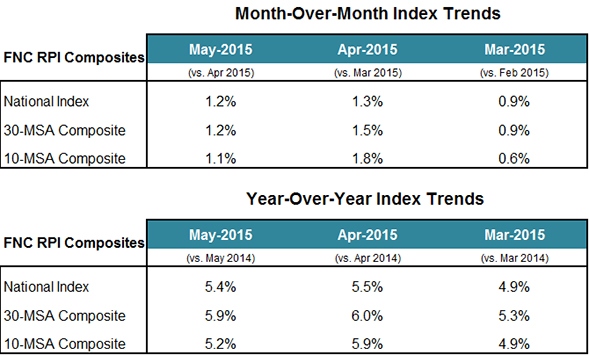

The table below shows seasonally unadjusted month-over-month (MOM) and year-over-year (YOY) changes in three RPI composite indices. The national index is based on recorded sales of non-distressed properties (existing and new homes) in the 100 largest metropolitan areas. All three indices were up by more than one percentage point at a seasonally unadjusted rate, moderating slightly when compared to April, particularly by the narrow 10-MSA composite. Year over year, prices are rising by 5.4 percent nationwide.

The hedonic procedures used to create the index are described in “Hedonic versus repeat-sales housing price indexes for measuring the recent boom-bust cycle,” by Dorsey, R.E., Hu, H., Mayer, W.J., and Wang, H.C., Journal of Housing Economics 19 (2), 75-93. The FNC National Residential Price Index is a volume-weighted aggregate price index consisting of 100 major metropolitan areas across different regions of the U.S. All FNC Residential Price Indices are constructed to capture unsmoothed home price trends.

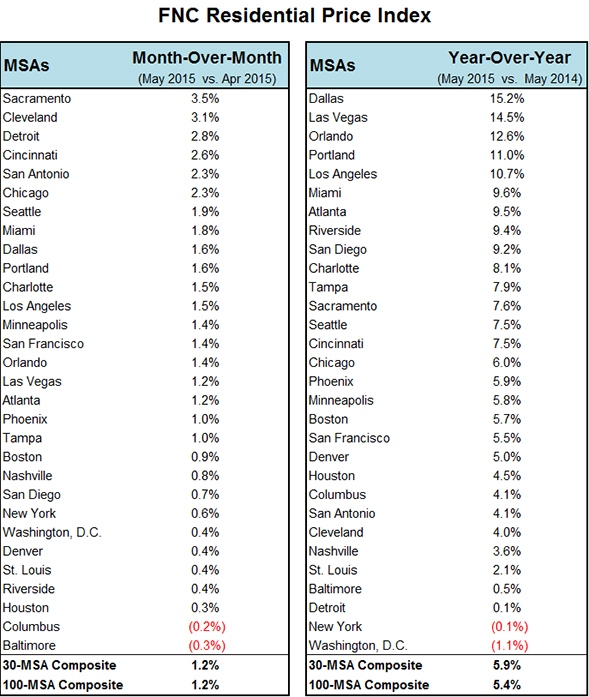

The chart below tabulates the latest MOM and YOY price trends for each MSA in the FNC 30-MSA composite index.

For more information, visit www.fncinc.com