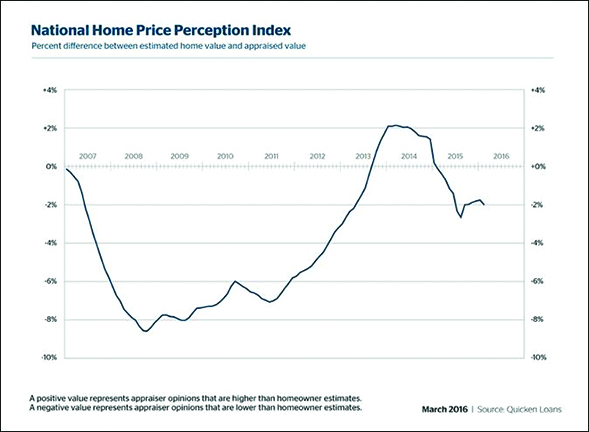

Home appraisals were an average of 1.99 percent lower than what homeowners expected in February, according to Quicken Loans proprietary Home Price Perception Index (HPPI). The study compares actual appraised values to what refinancing homeowners estimated their home was worth at the beginning of the mortgage process. February brings a reversal to the previous five-month trend of a narrowing gap between the two data points.

Home appraisals were an average of 1.99 percent lower than what homeowners expected in February, according to Quicken Loans proprietary Home Price Perception Index (HPPI). The study compares actual appraised values to what refinancing homeowners estimated their home was worth at the beginning of the mortgage process. February brings a reversal to the previous five-month trend of a narrowing gap between the two data points.

Home values showed continued growth in February, making up for the slight dip in January. Nationally, appraised values increased an average of 1.51 percent according to the Quicken Loans Home Value Index (HVI) – the only measure of home values based solely on appraisals. The index has increased 3.89 percent when compared to February 2015.

Home Price Perception Index (HPPI)

The gap between homeowner estimates and appraiser opinions of value widened for the first time in six months. Owners’ estimates of their homes value exceeded appraiser estimates by an average of 1.99 percent in February, according the national HPPI. The areas where appraisers valued homes higher than homeowners estimated were largely found in the West. San Jose leads the group, with appraisals 4.35 percent higher than expected. On the other side of the spectrum, appraised values were 3.64 percent lower than homeowners expected in Philadelphia.

“While it is always disappointing for homeowners to learn they don’t have quite the home equity they expected, the national HPPI is still within a normal range,” says Quicken Loans Chief Economist Bob Walters. “In an ever-changing real estate market, home values fluctuate and these changes are most quickly realized by appraisers who are evaluating local sales every single day.”

Home Value Index (HVI)

Home appreciation continued when viewed nationally, and in most of the regions measured by the HVI. The nation’s average appraisal value increased 1.51 percent in February and has grown 3.89 percent since February 2015. At the regional level, the monthly growth was led by the Midwest with home values rising 3.37 percent. The South lagged with flat growth.

“A lack of inventory continues to affect home values as eager buyers compete for a small selection of homes. This can be seen as home values jump in the Midwest right as the harsh winter hits, keeping some from listing their home,” explains Walters. “Home prices continue their long march back from the big price drops experienced in the financial crash. As more and more Americans gain equity, this increases the number of homeowners who are financially able to sell their home and buy another one. We’re seeing the benefits of this virtuous cycle in rising home prices which is also being greatly aided by historically low mortgage rates.”

For more information, visit www.QuickenLoans.com/Indexes.