Another closely watched trend is not directly related to commission rates or specific new policies, but is definitely affected by these factors. The fees and splits that determine what ends up in an agent’s bank account at the end of the day is highly dependent on the macro environment, and where companies see opportunity or risk.

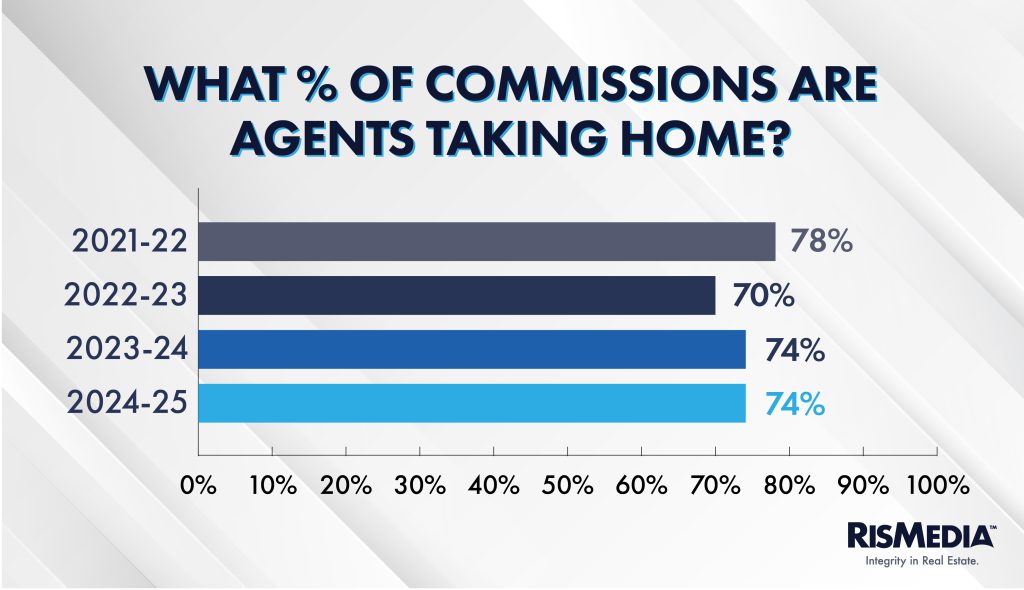

For context, the average commission that agents took home peaked at nearly 80% in the pandemic boom market, but quickly reverted back toward 70% as real estate transactions shrank. There was also little indication in the early days of the settlement that brokerages were rushing to change their fees or splits—but what about a year later?

So far, the new policies appear to have only slightly affected splits, as they held above 2022-2023 levels through this year.

Agents who took home 100% of their commission—a model that appeared to be experiencing significant growth over the last couple years—actually shrank, with 8% of agents working under this split, compared to 12% the previous year.

National franchises continue to offer a slightly higher split to agents than independents, 76% to 72%, which was the same gap as last year. Alternative models are noticeably lower, likely because these companies include non-traditional systems and niche brokerages.

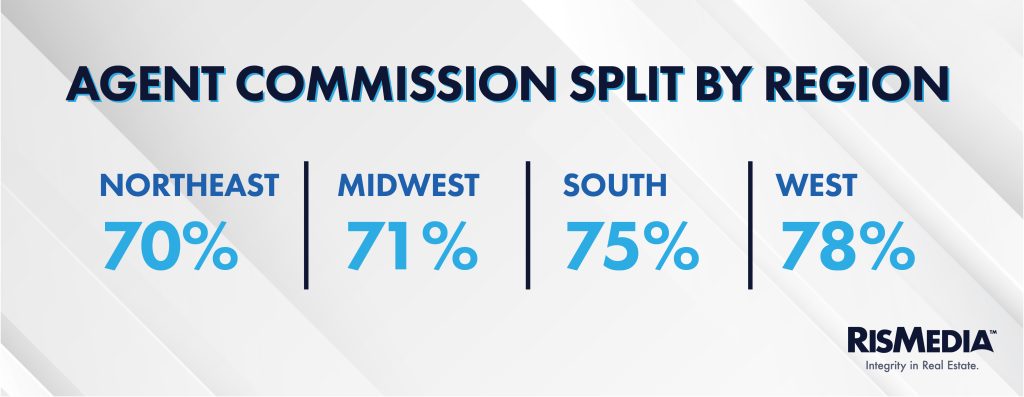

The median split shifted from 70-30 to 80-20 this year, possibly more evidence that brokerages are more concerned about attracting agents than they are about falling revenue from a dip in rates or transactions. But there were also regional disparities, indicating that these numbers could be driven by local market conditions.

The biggest change from last year is in the West, where average splits were 73% in 2023-2024. That region has seen some of the biggest home-price swings, with median prices actually decreasing slightly from a year ago, according to NAR data.

Another important place where companies and agents have a chance to adjust is through fees. Could these macro policy changes force companies to rethink how they bill agents for services, or push agents toward lower-cost models?

The mixed bag of fees would seem to indicate an industry in flux. Companies may be seeking to shift how and where they bill agents for services and support, both due to policy changes and a larger trend of mergers and acquisitions as big brokerages vie for marketshare.

Technology fees make up most of the annual fees agents pay, averaging $866, not far off from last year, when the average was $890. Transaction fees were up slightly, from $344 to $366 per transaction.

In terms of brokerage model, national franchises charged much higher annual fees compared to independents: an average of $1,261, compared to $672. But independents charged higher fees for every closed deal, $426 compared to $336 on average for national franchises.

That is actually a change from the previous year, when national franchises charged higher fees across the board. While there isn’t enough data to draw more concrete conclusions, it would appear that big companies are better able to shield their agents from the consequences of a down market, or perhaps are finding more efficiencies as they scale.

But notably, agents and brokers at independents saw their technology fees decrease more than those at national franchises—by 17% from the previous year. National franchises still saw a decrease of 10% in these fees, though it is unclear whether companies are decreasing their offerings in tech, or have found ways to provide more for less through AI or other means.

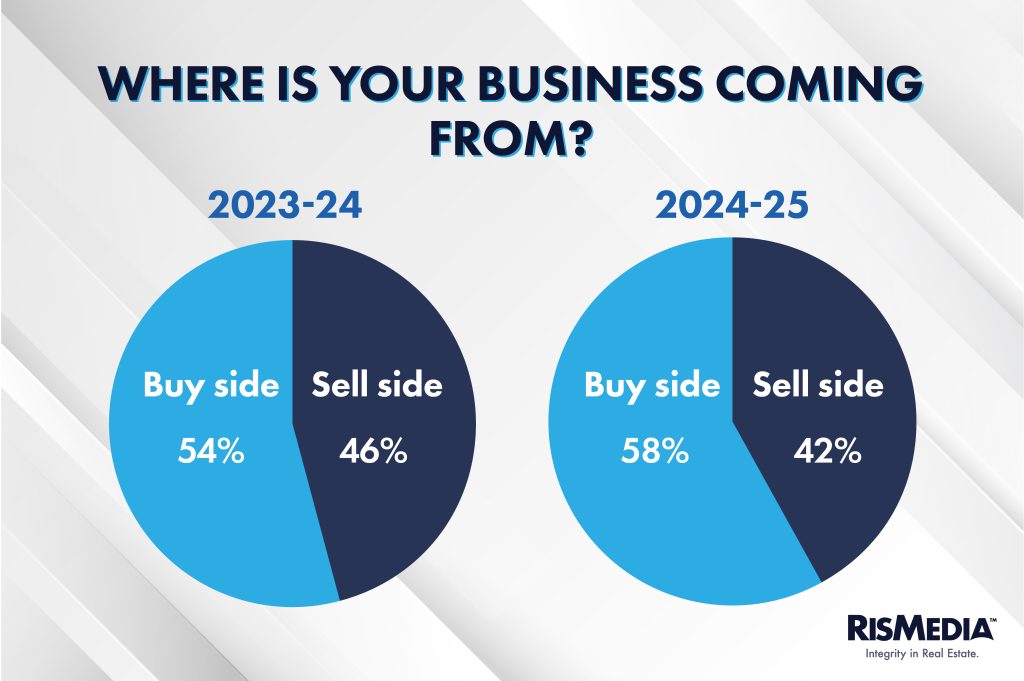

Possibly transcending these sorts of business decisions is the balance of listing and buying activity. Industry leaders and observers previously posited that more agents might specialize in one side of the transaction over the other, or de-emphasize buyer deals based on increased complexity, lower commissions or more unrepresented buyers post-settlement.

There was a slight shift toward buy-side deals this year, but certainly not anything seismic, with the overall balance of the market likely responsible for much or all of it. While there has not been a consensus on how much of the country is currently in a “buyer’s market,” most housing economists have acknowledged that higher inventory and lower demand has given buyers more power in recent months after multiple years of seller advantage.

Brokerage models did not have any measurable effect on listing vs. buyer preference, but experience did—agents with more time in the industry (10-plus years) attributed about 7% more of their business to listing compared to those with less experience.

Another business model that potentially could be affected by recent policy changes is profit sharing, with companies like Keller Williams and eXp appearing ascendent during the pandemic.

These models may have plateaued, however, as the number of agents who reported working for a company that offered profit sharing fell modestly this year, from 20% to 15%. Notably, real estate agents on the younger side (age 18-54) who were previously much more likely to work under this model are now only slightly more likely to work for a profit-sharing company, 22% compared to 16% for older agents (55-plus).

In 2022-2023, a whopping 71% of the very youngest cohort (age 18-34) said they worked for a profit-sharing brokerage.