Four years ago, many in the industry as well as a few pundits, predicted that commission offers being removed from the MLS would essentially be a doomsday scenario for those practicing traditional real estate, or at least result in a total reconfiguring of how agents and brokers made a living.

As the threat of this change grew closer, cooler heads offered another scenario—that this shift might be disruptive, but not apocalyptic, at least if the industry could adapt.

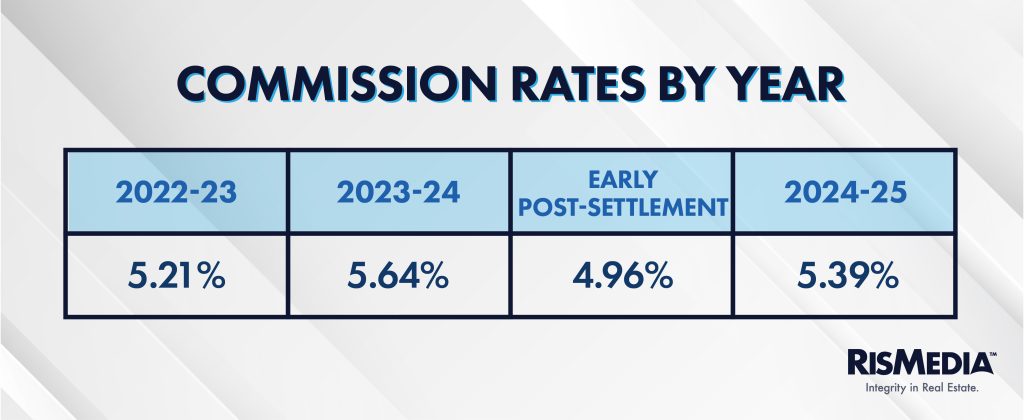

That appears to be the current trajectory as even though commissions remain down, they are within a historically normal range of year-to-year fluctuations, especially given today’s uncertain market.

While it will likely still take years for the full impact to filter down, RISMedia’s latest study has already identified a major shift since the initial impact of the commission lawsuit settlement: Experience is no longer a major factor in commission rates. For both listing agents and buyer agents, the difference in average commission rate was negligible between those who claimed 10 or more years in the industry, and those with less than 10 years of real estate practice.

That is at odds with what industry critics—or even some more impartial observers—predicted would happen based on the new policies. One of the criticisms advanced by class-action attorneys was that an agent with a month of experience and one with decades in real estate were charging the same commission. That appears to still be true, even a full year after policy changes.

The shift for less experienced agents represents a significant portion of the rebound this year, as buyer agents with less than 10 years of experience only charged an average of 2.10% commission in the weeks after the settlement. Buyer agents with 10 or more years of experience averaged 2.33% in that same time period, meaning both groups saw average commission rates return to the norm.

On the listing side, the trend was nearly identical: less experienced listing agents took in 2.71% of commissions in 2024-2025, up from 2.46% in the weeks after the settlement. That was essentially the same as agents with 10 or more years of experience, who averaged 2.76% commission this past year, up from 2.74% post-settlement.

This data provides at least some evidence for a theory put forward by many brokers and industry leaders: That newer real estate professionals can adapt faster or more effectively to policy changes than those who are stuck in old patterns.

Expressed in dollar amounts, the rebound appears even more significant. For a newer buyer agent, the 0.47% commission rebound represents $1,930 per transaction (on a median-priced home*), or just over $23,100 in yearly GCI for an agent closing the median number of deals.

For newer listing agents, the breakdown is $1,027 per transaction, and $12,324 in annual GCI.

There also appeared to be a general return to historic norms on the buyer side in terms of commission practices. Immediately post-settlement, 33% of buyer agents worked for less than 2.5% commission. That fell to 2.3% for the whole year.

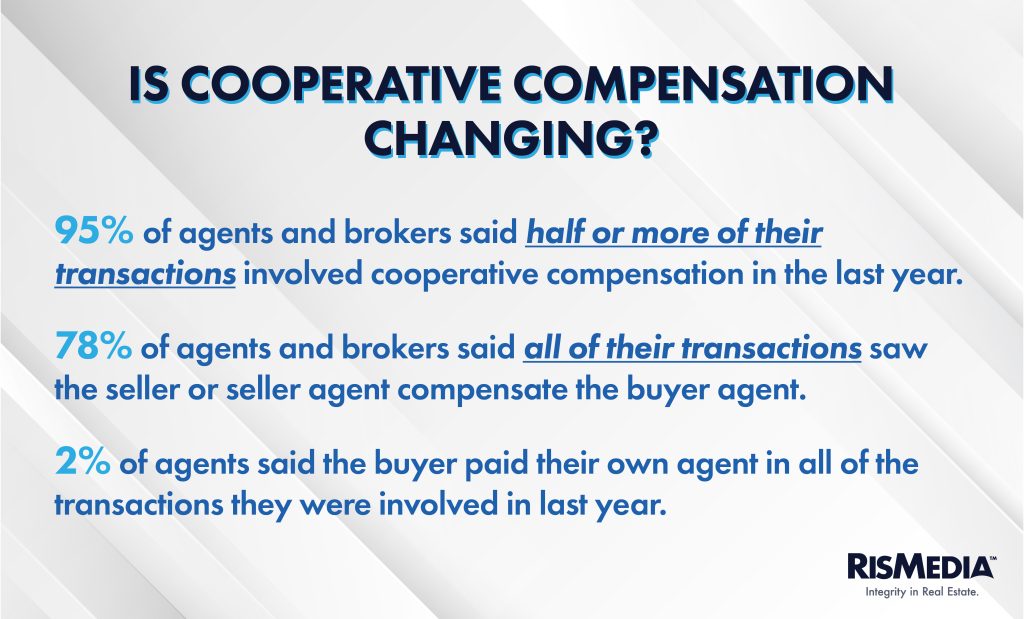

In the early weeks of the settlement, 71% of agents said the seller always provided compensation for the buyer agent. That rose to 78% this year—not quite matching the 86% of agents who saw this cooperative compensation pre-settlement, but still a notable rebound.

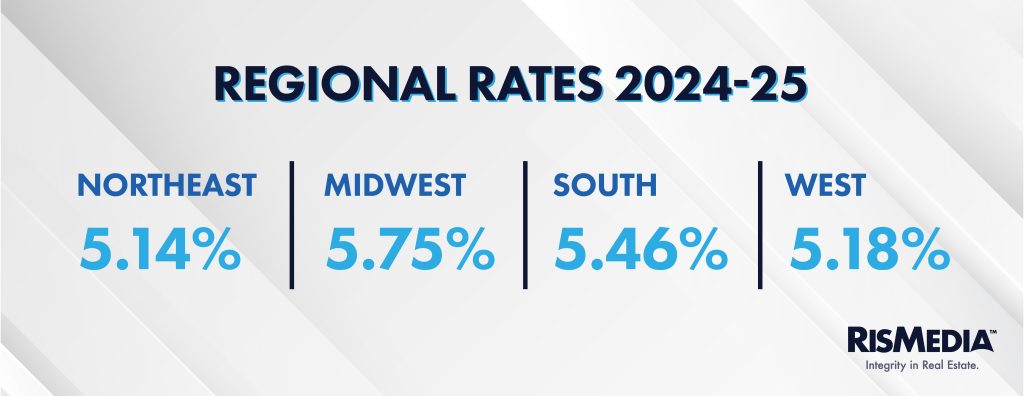

Another area of significant interest is in the regional breakdowns for commissions. The Northeast notably saw a smaller initial impact from the policy changes, due at least partially to the long-term prevalence of buyer agreements and a major MLS unaffiliated with the National Association of Realtors® (NAR), and therefore, not subject to the changes.

While market factors are also likely significant, this year saw continued regional differences in commission rates, with the Midwest trailing other regions in terms of buyer commission, and the West (with its more expensive homes) seeing overall lower commission rates.

Notable also is that the Midwest still claims the highest average listing commission at 3.13%, and highest commission overall, while buyer agents are paid the highest in the South at 2.66%.

Last year, Alabama passed a law that superseded the NAR settlement and banned any requirement that buyers sign an agreement with their agent before touring a house. Whether that had any impact on rates is unclear.

Buyer commissions in the South were only down by 0.06% from pre-settlement (and 0.02% in the Northeast), compared to 0.23% in the Midwest and 0.10% in the West.

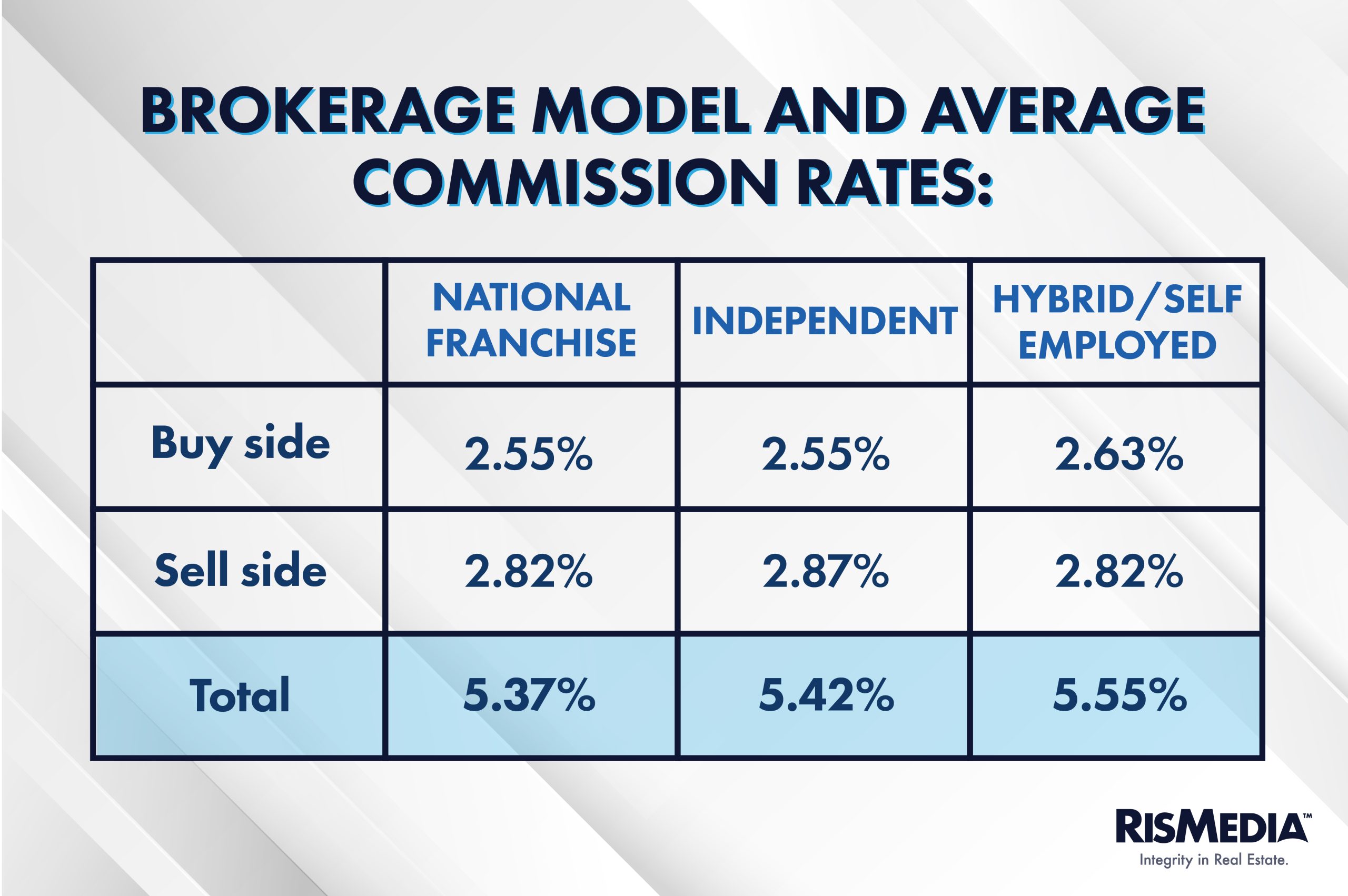

Finally, and perhaps data with immediate and practical importance for agents deciding what company to affiliate with, brokerage model this year had no major impact on commission. While last year, national franchises appeared to have been somewhat insulated from the initial shock of new policy changes, all types of brokerages saw commission rates rebound to near the same levels in 2024-2025.

The fact that self-employed or hybrid-buyer agents charged slightly more commission is notable as this cohort saw the largest initial drop in the weeks after the settlement—seemingly showing these models have larger flexibility to charge both higher and lower commissions.

But the overall tight range in average commission rates across models provides some evidence that there is no single approach, adaptation or system that is winning agents higher commission rates, as the industry appears to broadly rubber-band back toward historic norms.

*based on federal reserve data from Q2 2025.

This survey was conducted by a national market research firm on behalf of RISMedia. Invitations were sent to respondents by RISMedia from a database of more than 130,000 real estate professionals and data was collected from a sample of 623 individuals between July 31 and August 24. Broker/owners and other real estate professionals who do not work on a commission structure were terminated from the survey.