Despite all the talk of a “new era” for real estate, what hasn’t changed in over three years is a difficult market. Agents and brokers are facing a prolonged period of low sales, driven by a sharp increase in mortgage rates and more recently, economic anxiety. Affordability remains a primary barrier to many buyers, and the so-called “golden handcuffs” of locked-in low mortgage rates continues to shackle sellers to properties.

As NAR projects a drop of around 300,000 members by early next year, how are agents and brokers shifting their energy, approach and priorities to match this challenge?

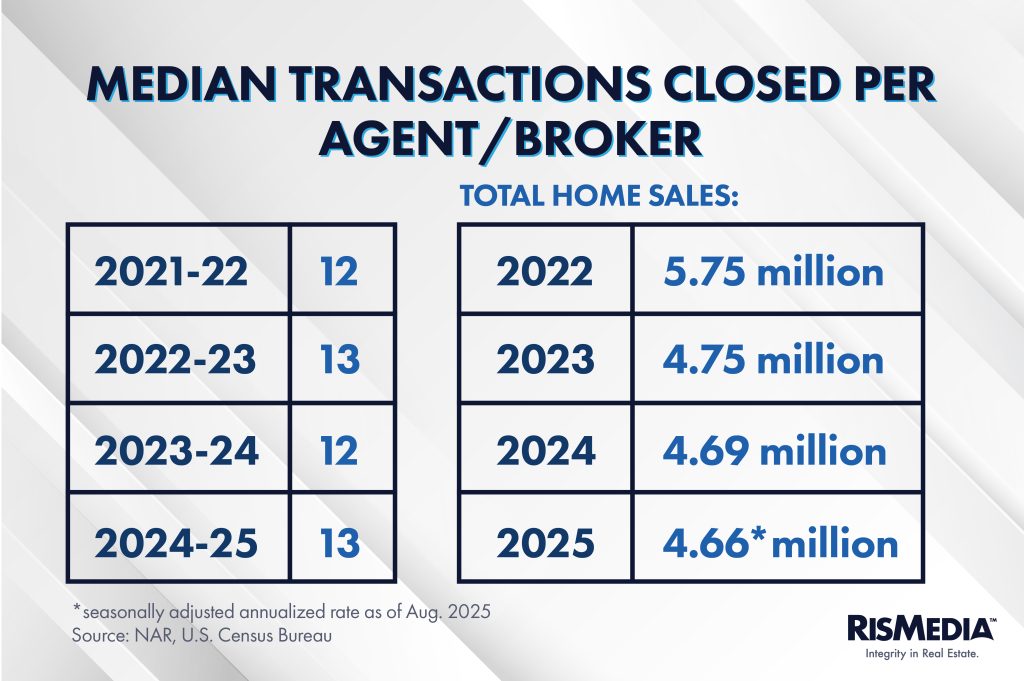

The average and median number of sales per agent both rose by one this year, meaning agents have maintained their productivity against current headwinds, and affirming what many industry leaders have claimed: that most people leaving the industry are inactive or not producing.

Notably, national franchise agents were just slightly more productive than the average, with a median number of 14 sales this year. Independents closed 12 sides, while self-employed agents claimed a median of 16 deals last year.

Regionally, agents in the Midwest were more productive on average, with 19 transactions per agent last year, while the Northeast saw a median of 15. Agents in the South and West closed a median of 12 transactions.

Agents who identified as part-time closed a median of six deals, while full-timers closed 14.

Some of this data could be an encouraging signal for those who have urged the industry to tighten the requirements for becoming an agent and raise standards for practicing real estate, with at least some brokerage and association leaders claiming that disengaged or poorly trained agents are a root cause for legal issues or bad industry reputation with consumers.

The proportion of agents and brokers who closed four or fewer deals fell this year, from 19% to 14%, and those who closed one or fewer dropped from 5% to 2%.

Something else that has been a source of some controversy is physical office presence. The number of agents and brokers who said they never went into an office fell very slightly, from 17% to 15%.

As far as what is best for a real estate professional’s bottom line, the gap in commission rates between all-remote agents and those who had an office to go to also moved back toward recent norms.

In the weeks after the settlement, remote agents were taking in 0.31% less than those who spent at least some time in the office. The year before (2023 – 24), the difference was only 0.10%. That means going into the office doesn’t have a dramatic impact on how much agents charge.

However, remote agents continue to close fewer transactions than average—a median of 10 in 2024-2025. That supports the hypothesis that a physical office location offers access to more leads or prospective clients, something many companies have long emphasized even as the pandemic pushed more agents toward remote work.

Another cadre of agents that were disproportionately hit by the initial policy changes were part-timers. Average commission for agents who identified as part-time fell below 4% (in total, meaning combined buy and sell side) in the weeks after the new rules, with part-time buyer agents taking an average of just 1.76%.

That also almost entirely reverted this year. Before the settlement, part-timers only made slightly less than full-timers, and with a year of adaptations, that appears to be the case again. Part-time buyer agents brought in 2.54%, right in line with the average, and 2.47% on the listing side—lower than average but not massively so.

Although this result could fuel more criticism of the industry based on accusations that low-skilled agents charge the same as highly experienced professionals, it is also important to note that many self-identified part-time agents have decades of experience and previously worked full-time, with the loose nature of real estate allowing people to transition more easily between these part- and full-time roles.

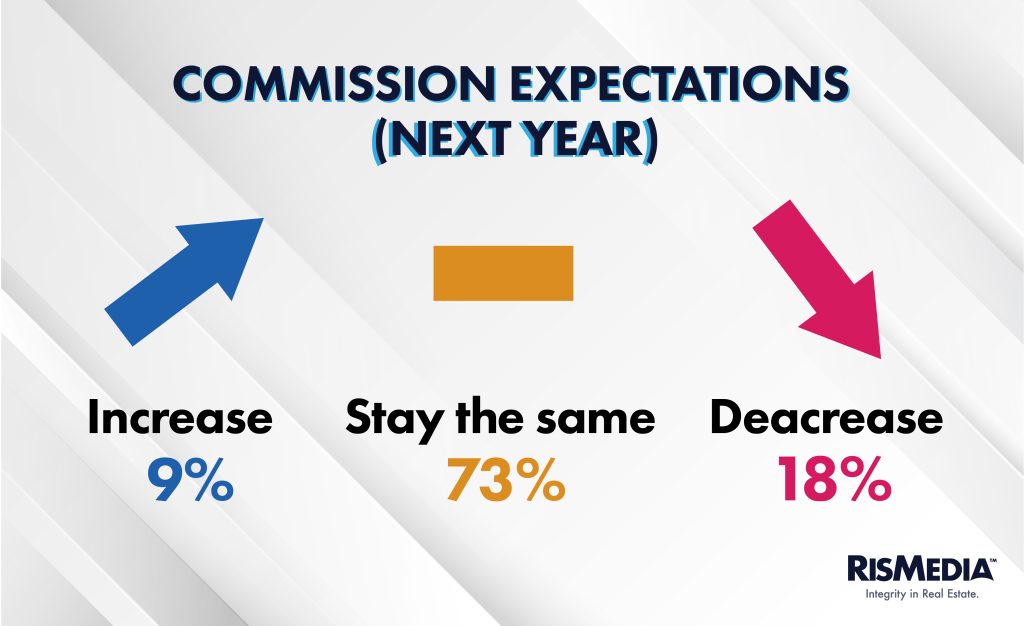

Something else to keep an eye on are the qualitative expectations of agents and brokers. Notable but not surprising, real estate professionals are no longer expecting further drops in commission, seemingly believing the industry has mostly overcome or adapted to new policies.

Of the 18% who expect further commission drops, only 3% anticipate that drop to be “significant.” Last year, right after the settlement, 37% of agents planned for commissions to fall, with 7% expecting the change to be significant.

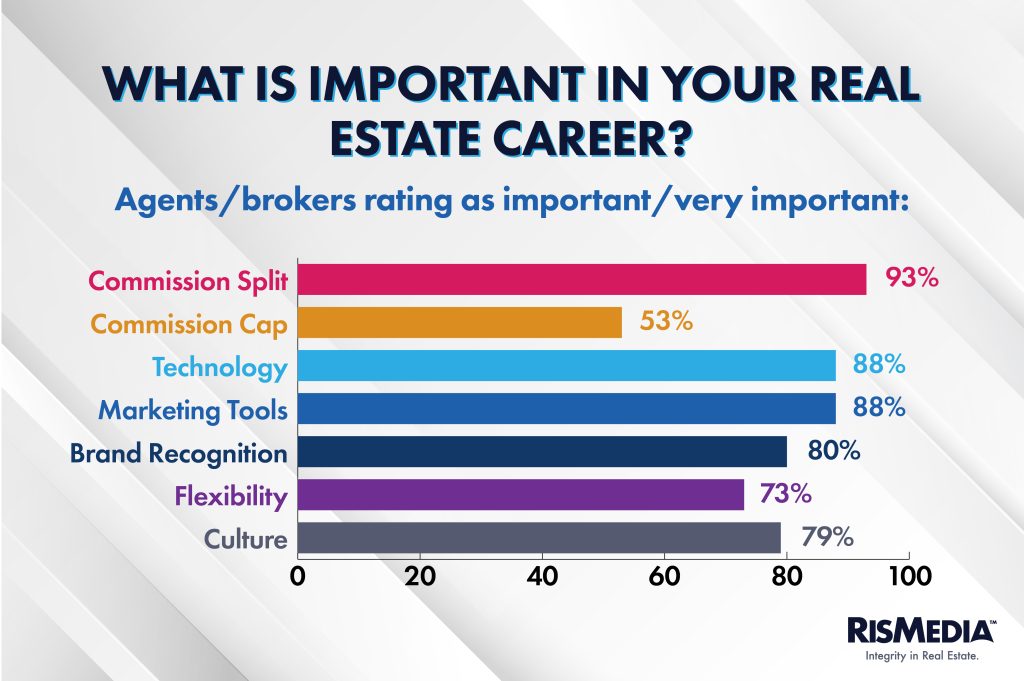

More qualitatively, agents and brokers still have broadly the same values and priorities for what they look for in their careers, indicating that at least so far, the upheaval and uncertainty of lawsuits, policy changes and market fluctuations have not shaken the fundamental values of real estate professionals.

All of this is almost unchanged from 2021-2022, the first year RISMedia conducted the survey. Flexibility was actually rated higher back in the pre-lawsuit days, with 82% of agents marking that as important in 2021 and 81% in 2022, potentially indicating that agents and brokers are actually looking for more structure now.

The importance of technology also fell very slightly, from 93% in 2021, as did culture, from 83%.