How agents are being compensated might be just as important as how much they are being compensated. With significant evidence that commission rates rebounded, the question of what adaptations—or “workarounds”—are being used should concern real estate professionals, both in the short-term practical view and the long-term compliance conversations.

Maybe most notable is how cooperative compensation remains the default, despite a lack of MLS communication on commission offers. Immediately post-settlement, 17% of agents and brokers said that none of their transactions involved cooperative compensation.

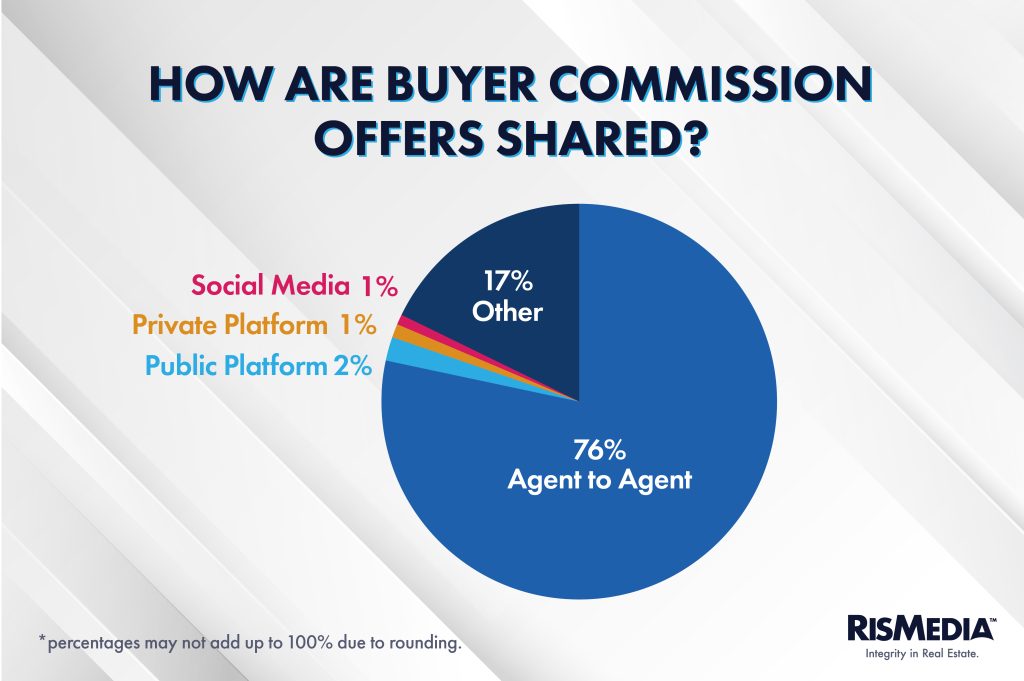

That fell to a negligible 2% this past year, with 96% of respondents saying that the majority of their transactions saw sell-side compensation for buyer agents. Very importantly, that appears to be happening without the need for some sort of non-MLS-affiliated platform—agents and brokers are simply picking up the phone.

In the early days of the settlement, a handful of startups offered services to advertise commission offers outside of the MLS—something which did not violate the NAR settlement deal, but was still controversial since it essentially ignored the spirit of the new policies.

None of these platforms appear to have caught on, and by far the most common way commissions are advertised across regions is directly between real estate professionals.

Notably, commission offers are still allowed on MLSs not affiliated with NAR, and some regional disparities appear to show agents in certain areas continue with that traditional practice. In the West, 10% of agents said commissions are still most commonly advertised on the MLS, possibly reflecting the size and influence of the Northwest Multiple Listing Service (NWMLS, based in Washington State), which claimed around 32,000 members in 2024.

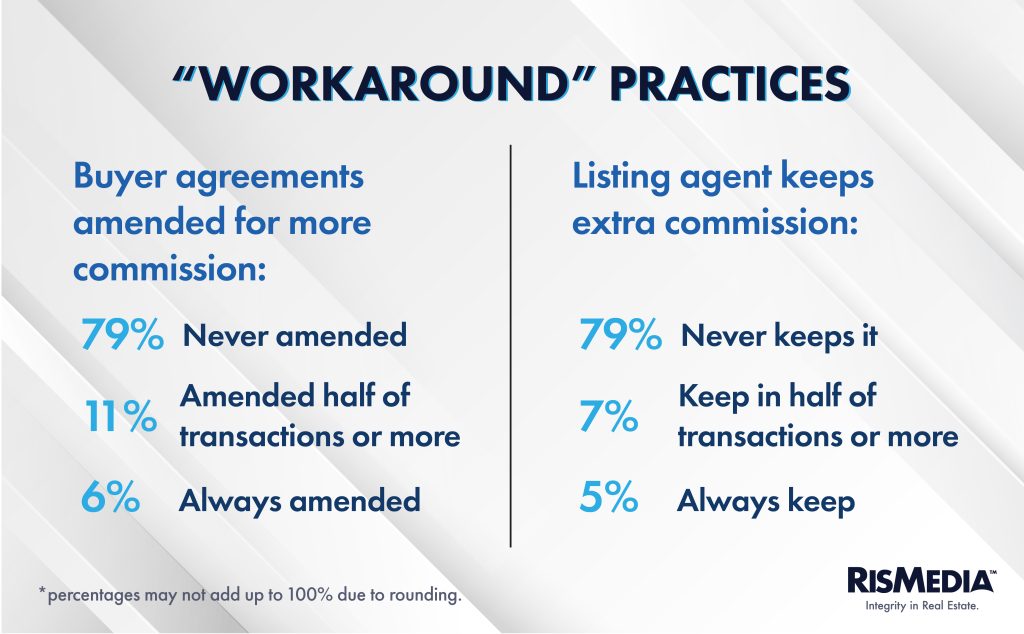

But other “workarounds” surfaced in the months since the policy changes went into effect. Most prominently, agents modifying buyer agreements in order to obtain additional compensation offered by a seller is a gray area that was promoted by some state and local associations after the settlement.

Additionally, many listing agents simply keep excess commission that is paid to a buyer agent—something that is perfectly acceptable under the new rules, but which critics point to as evidence of underhanded and anti-consumer behavior.

Data shows that these practices, while not universal, are at least somewhat common in the post-settlement world—across brokerage models, regions and demographics.

These numbers did not deviate hugely across regions or demographics, although there were some outliers. Real estate practitioners in the West were slightly less apt to amend buyer agreements or keep commission on the listing side (84% of respondents saying they never did).

Inexperienced agents and brokers were also less likely to engage in these “workarounds,” with about 8% more of those with less than 10 years of experience saying they never amended contracts or kept excess commission.

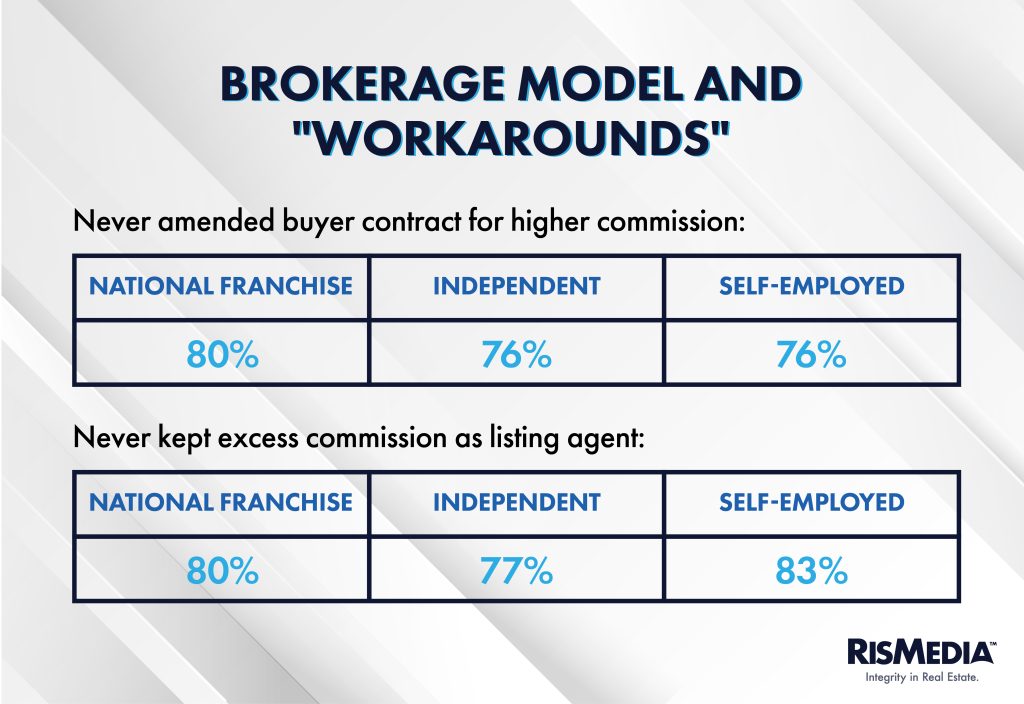

But also notable, these practices were utilized across brokerage models. In fact, “workarounds” were sometimes less common among self-employed or hybrid models, with 83% saying they never “hogged” commission.

On the other hand, 10% of practitioners at national franchises reported that in 50% or more of their transactions, the listing agent kept excess commission and/or the buyer amended their agreement. Independents were similar: 12% of agents said that half or more transactions involved amended buyer agreements, and 13% saw listing agents “hog” commission in the majority of transactions.

Whether or not these practices are in direct violation of the settlement, they do appear to be attracting scrutiny. Plaintiff attorneys in the class-action lawsuits recently requested information from MLSs around the country to ensure compliance with the settlement, and critics of the industry contend these practices are what has kept commissions from falling.

Buyer contracts themselves also remain a point of contention. Data from shortly after the settlement showed a relatively sluggish adoption of agreements, with barely over half of practitioners saying they always signed agreements, despite them being mandatory.

But the changes appear to be catching on. Notably, buyer contracts remained common across demographics and regions, with little or no deviations. That would appear to affirm both the practical implementation and NAR’s argument that these agreements are an important and positive development coming out of the policy changes.

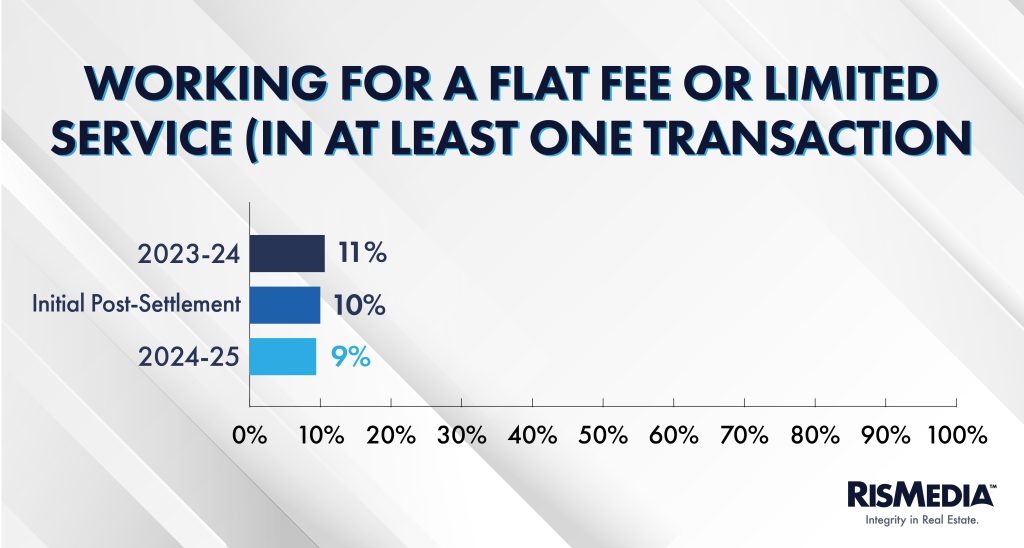

Another shift that many expected to emerge from the settlement was agents—particularly buyer agents—working for a flat fee or offering some sort of a la carte service. Initial data actually showed a slight decrease in agents or brokers working under these auspices, and after a full year, there is still no significant movement.

Again, there were essentially no exceptions or regional distinctions—these types of offerings remain just as uncommon a year after the settlement as they were before.

But it is also possible that these sorts of services are being offered by people who don’t identify as agents or brokers, with some services claiming to offer discount home sale options without the use of an agent at all.

Another small but significant detail amid the evolution of commissions is so-called “clustering.” Despite protestations that there are no “standard” commission rates, most agents report rates at specific amounts—specifically 2.5% or 3%.

In the first few weeks post-settlement, that “clustering” decreased slightly, with about 59% of agents and brokers reporting exactly these amounts—down from 70% the year before. This year, 64% of practitioners reported one of these “standard” rates as their average commission.

This survey was conducted by a national market research firm on behalf of RISMedia. Invitations were sent to respondents by RISMedia from a database of more than 130,000 real estate professionals and data was collected from a sample of 623 individuals between July 31 and August 24. Broker/owners and other real estate professionals who do not work on a commission structure were terminated from the survey.