Clear Capital recently released its Home Data Index™ (HDI) Market Report with data through April 2014, showing that for many, the American dream is still accessible. Using a broad array of public and proprietary data sources, the HDI Market Report publishes the most granular home data and analysis earlier than nearly any other index provider in the industry.

Clear Capital recently released its Home Data Index™ (HDI) Market Report with data through April 2014, showing that for many, the American dream is still accessible. Using a broad array of public and proprietary data sources, the HDI Market Report publishes the most granular home data and analysis earlier than nearly any other index provider in the industry.

“Very interesting dynamics are at play as we head into spring,” says Dr. Alex Villacorta, vice president of research and analytics at Clear Capital. “Though our April data suggests the spring buying season is off to a slow start, we aren’t concerned about the sustainability of the recovery. To be clear, there are lots of adjustments taking place in housing markets across the country. Everything from lender regulation, consumer confidence, investors tapering purchases, local economics, and rising home prices have forced participants to continually adjust to a market that has been anything but stable. ”

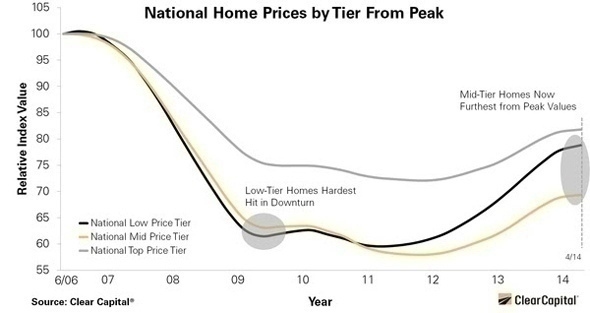

Best deals move from low-tier to mid-tier. Following more than two years of recovery, the mid-tier price sector now offers home buyers the best deals, relative to peak values. After 32.3 percent growth from the trough in 2011, low-tier deals appear to be played out compared to mid-tier deals (homes selling between $95,000 and $310,000 nationally), with prices still 30.6 percent off peak values. The strong rebound in the low-tier price sector left homes, on average, just 21.5 percent below peak values. Top tier homes are just 18.2 percent off peak values.

Early signs show the spring buying season is off to a tepid start in April. We observe quarterly rates of growth for the nation and three of the four regions virtually unchanged over last month. Stability in this new moderating pattern, back toward historical norms of 3 percent-5 percent annually, will help restore first time and owner occupant buyers’ confidence in the market.

Real estate is local again. Yes, moderating price trends are converging toward one another (with just a one percentage point spread in quarterly rates of growth for the top performing 15 MSAs). But underlying drivers, like distressed sale saturation and local job markets, remain drastically different. Between Chicago’s 39.7 percent and San Jose’s 7.9 percent, the spread in distressed saturation within the top 15 performing MSAs is nearly 32 percentage points. Chicago will likely see more demand from investors looking for great deals on distressed sales (with median prices around $160,000), while higher priced markets like San Jose (with median prices around $650,000), supported by a relatively healthy local economy, may see stronger appetites from owner occupied buyers.

“Generally speaking, we see price growth stabilizing throughout 2014, which should help boost the confidence and purchase activity from buyers on the fence,” says Villacorta. “Looking at home price trends by tier, it’s apparent the impact of investor activity has been concentrated in the low price tier segment. Conversely, the segment of the market that represents the middle 50 percent of all transactions is still more than 30 percent off peak values. This suggests that there is good price growth potential and could motivate enough buyers to sustain an overall rate of home price growth consistent with historical norms. The days of double digit price gains are behind us, and the market will continue to calibrate to the new reality of annual growth rates between 3 percent and 5 percent. A strong spring buying season might be a casualty of the major adjustments underway, but it’s no reason to ring the alarm bells quite yet.”

For more information, visit www.clearcapital.com.