The Federal Reserve Board recently released its survey of senior bank loan officers. The October 2014 Senior Loan Officer Opinion Survey on Bank Lending Practices (SLOOS) addressed changes in the standards and terms on, and demand for, bank loans to businesses and households over the third quarter of 2014.

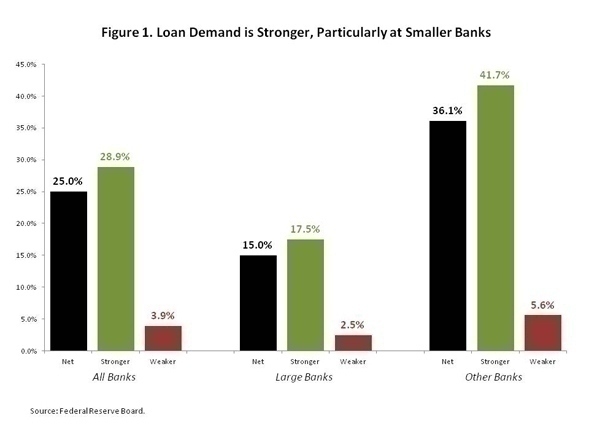

Included in the portion of the survey aimed at bank lending to businesses are questions about loans secured by multifamily residential properties. According to the results of the survey, demand for loans secured by multifamily residential properties strengthened on net over the past three months of 2014, particularly at other, smaller banks. The net change is calculated by subtracting the share of banks reporting weaker demand from the portion reporting stronger demand.

As illustrated in Figure 1, a net share of 25.0% of all banks reported stronger demand for loans secured by multifamily residential properties, 28.9% of banks saw stronger demand while 3.9% of banks reported weaker demand. Although robust demand was reported at large banks, other, smaller banks saw even stronger demand for these kinds of loans. A net share of 15.0% of large banks reported higher demand for loans secured by multifamily residential properties, 17.5% reported stronger demand while 2.5% reported weaker demand.

Meanwhile, 36.1% of other, smaller banks reported stronger demand for loans secured by multifamily residential properties as 41.7% of banks reported stronger demand, but 5.6% reported weaker demand. Large banks refer to large, national banks while “other” banks encompass large but regional banks.

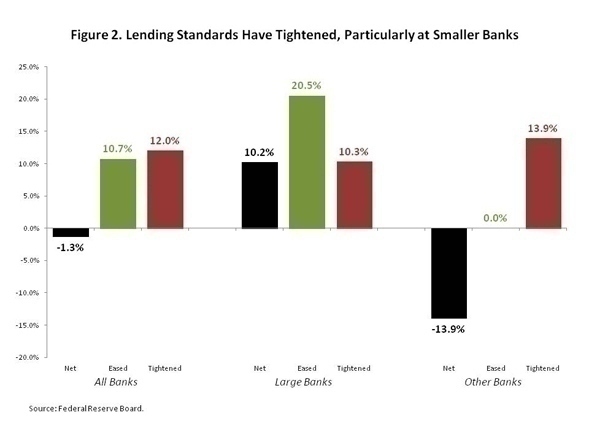

However, lending standards for loans secured by multifamily residential properties, a measure of loan supply, tightened on net over the past three months of 2014. Overall tightening in lending standards for loans secured by multifamily residential properties reflected a tightening of standards in the loans made by other, smaller banks. In contrast, lending standards at large banks eased on net. The net change is calculated by subtracting the share of banks reporting tighter lending standards from the portion reporting easier standards.

As depicted in Figure 2, although 10.7% of surveyed banks reported easing lending standards on loans secured by multifamily residential properties, 12.0% of banks reported tighter standards on these same loans. On net, 1.3% of all banks reported tighter lending standards. Figure 2 also shows that, on net, 10.2% of large banks reported that lending standards on loans secured by multifamily residential properties eased over the past three months as 20.5% of large bank respondents reported that easier lending standards and 10.3% reported tighter lending standards. In contrast, 13.9% of other, smaller banks reported tighter lending standards on net largely because none of these banks eased their lending standards on loans secured by multifamily residential properties over the past 3 months.

View this original post on the NAHB blog, Eye on Housing.