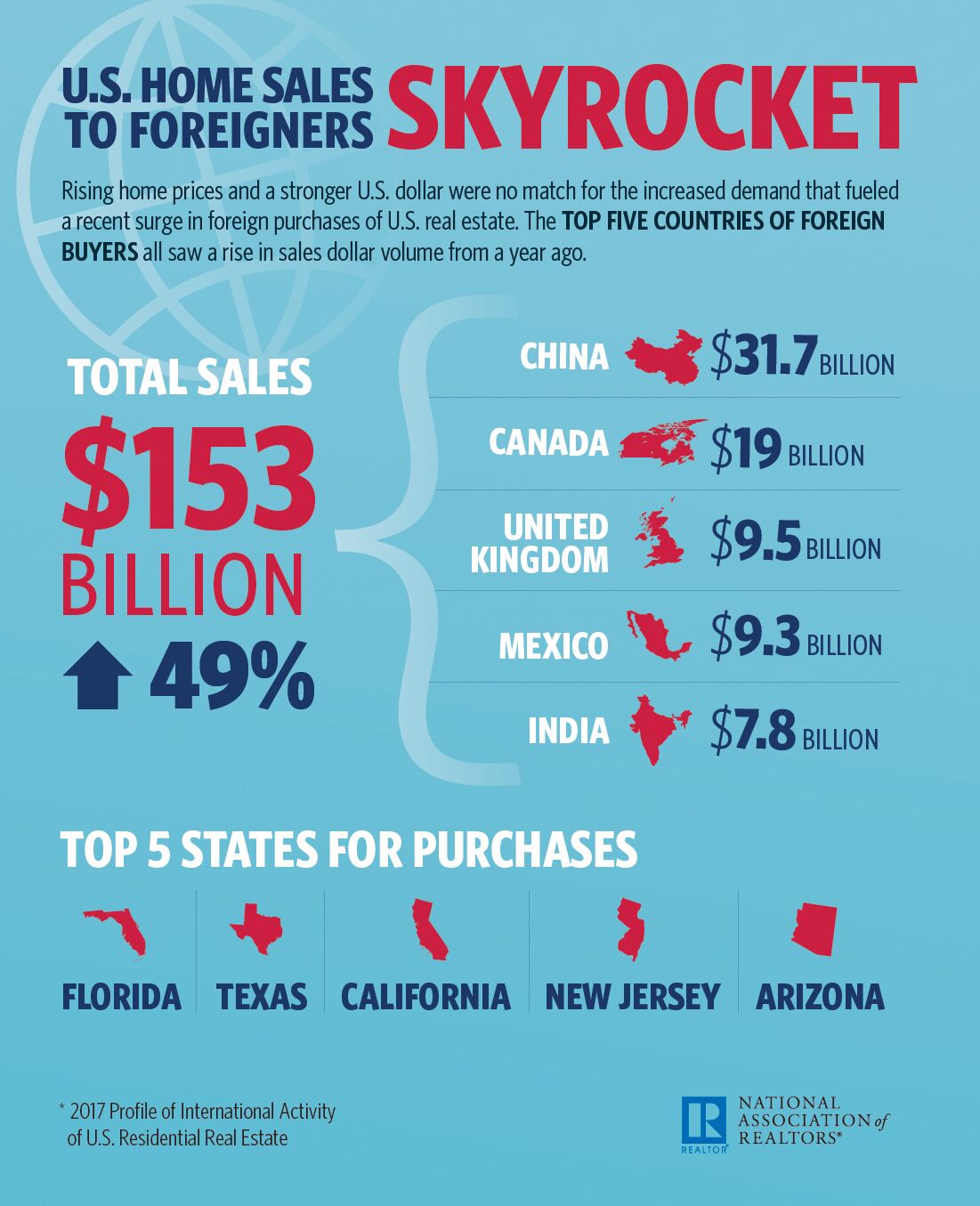

Foreign home-buying in the U.S. leaped 49 percent to $153 billion in the last year, a record high in the National Association of REALTORS® (NAR) Profile of International Activity in U.S. Residential Real Estate, recently released for 2017. The boost came as activity from Canada exploded to $19 billion, with buyers from China, India, Mexico and the UK also contributing considerable volume.

“The political and economic uncertainty both here and abroad did not deter foreigners from exponentially ramping up their purchases of U.S. property over the past year,” says Lawrence Yun, chief economist at NAR. “While the strengthening of the U.S. dollar in relation to other currencies and steadfast home price growth made buying a home more expensive in many areas, foreigners increasingly acted on their beliefs that the U.S. is a safe and secure place to live, work and invest.”

All told, foreign buyers purchased 284,455 U.S. homes from 2016 to 2017, with a sizable share of transactions taking place in California, Florida and Texas. Activity on the part of resident foreigners and non-resident foreigners both expanded—the former up 32 percent to $78.1 billion, and the latter up 72 percent to $74.9 billion.

“Although non-resident foreign purchases climbed over the past year, it appears much of the activity occurred during the second half of 2016,” Yun says. “REALTORS® in some markets are reporting that the effect of tighter regulations on capital outflows in China and weaker currencies in Canada and the UK have somewhat cooled non-resident foreign buyer interest in early 2017.”

The median sales price of homes bought by foreign buyers was $302,290, according to the Profile. Forty-four percent made all-cash purchases, and 10 percent made $1 million-plus purchases.

Buyers from China comprised $31.7 billion of the total volume between 2016 and 2017, followed by Canada, the UK at $9.5 billion, Mexico at $9.3 billion and India at $7.8 billion. Home-buying activity originating from Canada was concentrated in Florida, while activity originating from China was focused in California and activity originating from Mexico occurred in Texas.

“In 2016 Chinese investment in international and U.S. real estate hit a historic high,” says Sue Jong, chief of operations for Juwai.com. “While we think the dollar amount is likely to decline somewhat this year, investment levels are still in the foothills of this mountain range. There are higher peaks ahead. Chinese buyers trust the American market and believe it is a long-term safe bet. The U.S. is also the most popular destination for Chinese immigrants, students, and corporate investment. All of these factors drive property acquisitions.”

“Inventory shortages continue to drive up U.S. home values, but prices in five countries, including Canada, experienced even quicker appreciation,” says Yun. “Some of the acceleration in foreign purchases over the past year appears to come from the combination of more affordable property choices in the U.S. and foreigners deciding to buy now knowing that any further weakening of their local currency against the dollar will make buying more expensive in the future.”

For more information, please visit www.nar.realtor.

For the latest real estate news and trends, bookmark RISMedia.com.