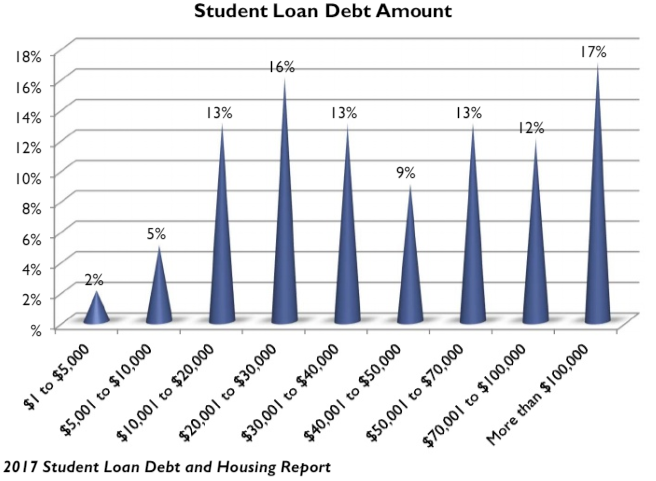

The U.S. currently has a student debt load of over $1.4 trillion, which accounts for 10 percent of all outstanding debt and 35 percent of non-housing debt. The magnitude of the debt continues to grow in size and share of the overall debt in the economy. While this amount of debt has risen, the homeownership rate has fallen, and fallen more steeply among younger generations. To evaluate those trends, SALT® and the National Association of REALTORS® (NAR) teamed up to conduct a survey of student loan borrowers who are currently in repayment in a new report entitled “Student Loan Debt and Housing Report: When Debt Holds You Back.” Notably, the median student loan debt amount is $41,200.

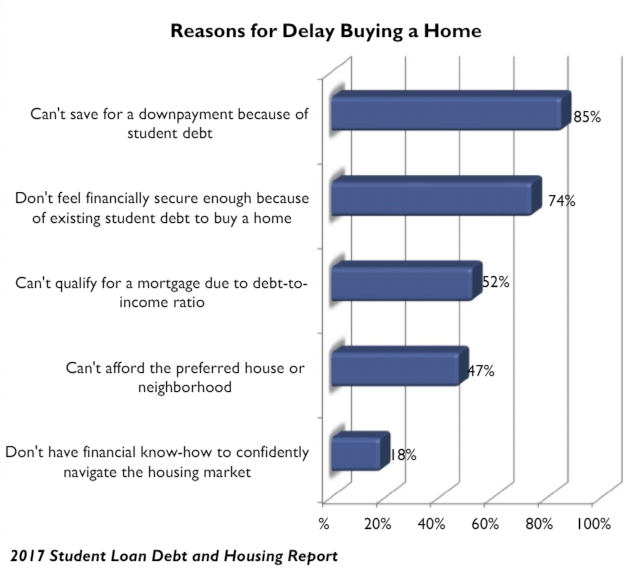

Among non-homeowners, 83 percent cite student loan debt as the factor delaying them from buying a home. This is most frequently the case due to the fact that the borrowers cannot save for a down payment because of their student debt. Seventy-four percent of those who are delayed don’t feel financially secure enough, and 52 percent can’t qualify for a mortgage due to debt-to-income ratios.

Among homeowners, 28 percent say student debt has impacted their ability to sell an existing home and move to a different home. These homeowners face a variety of problems: 21 percent believe it is too expensive to move and upgrade to a new home; 4 percent have problems with their credit caused by student loan debt; and 3 percent are underwater on their home.

The delay in buying a home among homeowners is three years. For non-homeowners, that number rises to seven years. Thirty-two percent of non-homeowners expect to be delayed more than eight years. Those with higher amounts of student loan debt and those with lower incomes expect to be delayed longer from purchasing a home than those with higher incomes and lower amounts of debt.

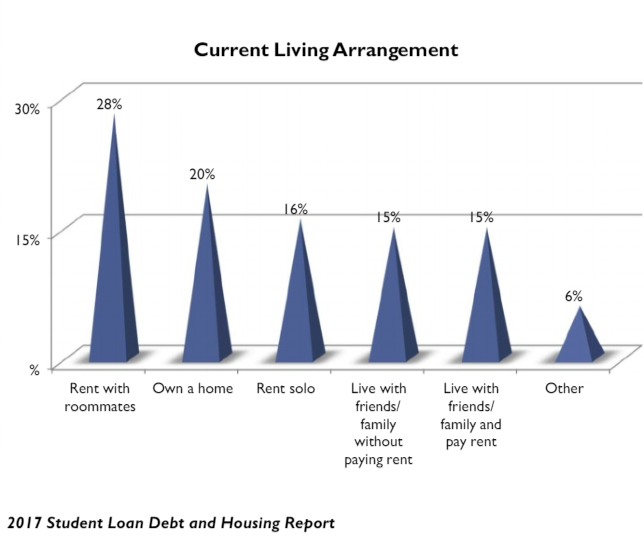

Forty-two percent were delayed moving out of their family member’s home after college, regardless of whether they were buying a home. This delay has a financial impact on both parents and the student loan borrower. Twenty percent were delayed by at least two years in moving out of a family member’s home after college due to their student loans. While 20 percent are currently homeowners, 30 percent live with friends or family, and half (15 percent) do not pay rent. Twenty-eight percent rent with roommates and 16 percent rent solo.

Among survey respondents, most are employed. Eighty-four percent are employed full-time, 6 percent are employed part-time and seeking full-time employment, and 3 percent are not employed. Seventy-nine percent received their loans from a four-year college, 19 percent from a two-year college, 29 percent from graduate/post-graduate school, and 7 percent from a technical college.

According to NAR’s Profile of Home Buyers and Sellers, among recent homebuyers, 27 percent have student loan debt and the typical amount is $25,000. The share of those with student loan debt rises to 40 percent among first-time homebuyers. Even among successful homebuyers, this amount of debt is cited as a difficulty in their home-buying process.

To find the full report, go to www.realtor.org/reports/student-loan-debt-and-housing-report.

For the latest real estate news and trends, bookmark RISMedia.com.