Supreme Court Justice Oliver Wendell Holmes Jr. once wrote, “Taxes are the price we pay for a civilized society.” As a real estate agent, though, you know to always look for possible price deductions. One of the most common taxes homeowners face is a property tax, one of many increasing carrying costs when it comes to owning a home.

The so-called Big Beautiful Bill, signed into law by President Donald Trump earlier this year, revised the State and Local Tax (SALT) deduction. True to its name, the deduction allows a taxpayer to write off the cost of state and local taxes (such as property taxes) on their federal taxes. SALT deductions had previously been capped at $10,000 in the 2017 Tax Cuts and Jobs Act, but after years of legislative debate, the cap has been raised. How much will it actually save homeowners in property tax, and how much of your client base will it actually reach?

To be simplistic about it—the cap on how much you can deduct under SALT was increased from $10,000 to $40,000, but this comes with many asterisks. For one, the raised cap is going to expire and revert back to $10,000 in 2030 unless changed by later legislation.

Also, the cap is increasing by 1% of its current number every year—i.e., in 2026 it will go up by $400 to $40,400. In 2030, it will revert back to $10,000.

Moreover, there is a threshold for modified annual gross income at which point the cap is gradually lowered. In 2025, that threshold is a $500,000 household income. The income level at which the drops begin to occur goes up by 1% each subsequent year, so $505,000 in 2026, etc.

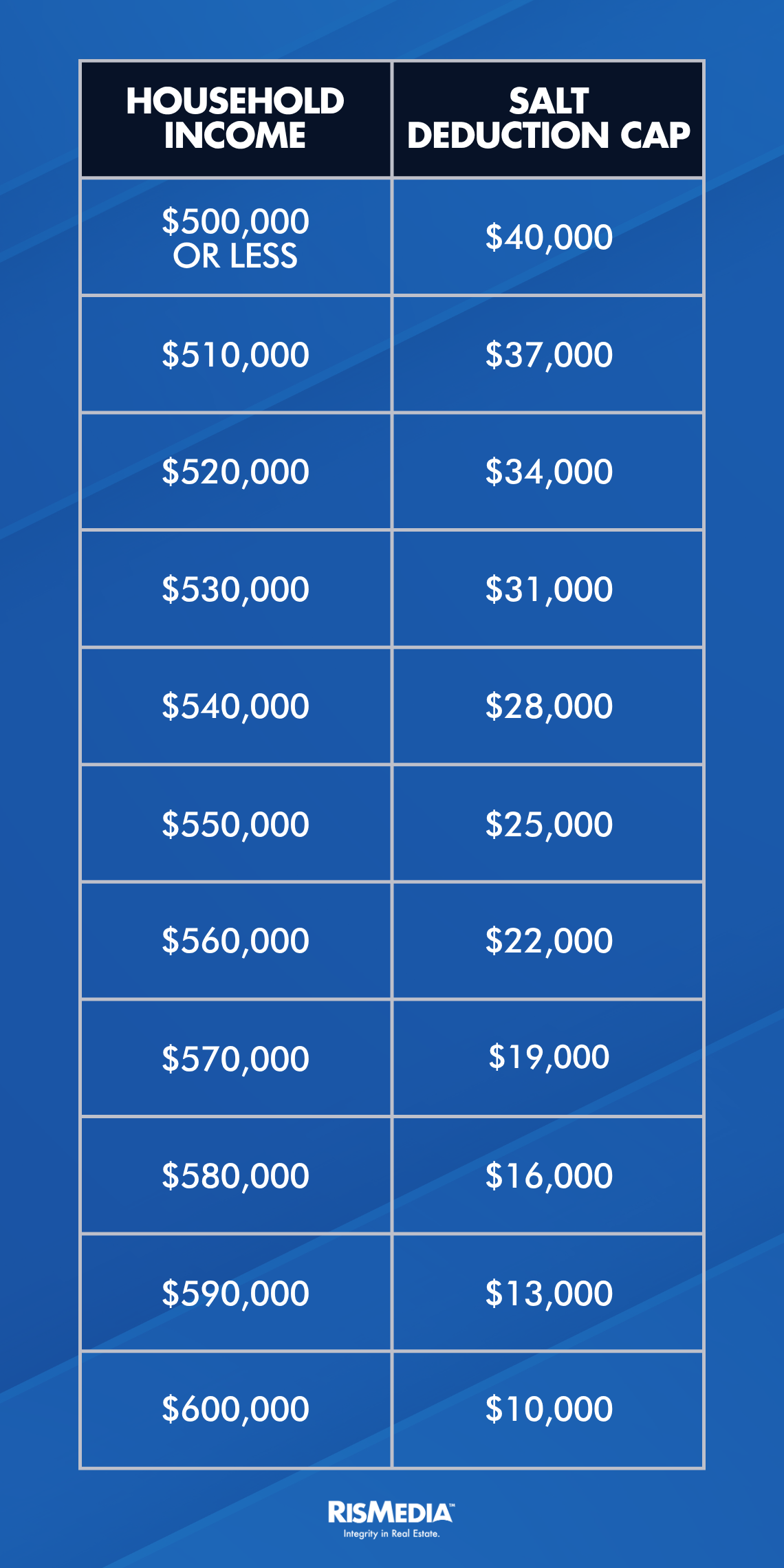

If a homeowner’s income is between $500,000 and $600,000, then the cap gradually goes down by 30% of how much they exceed the threshold. For instance, if household income is $510,000, they exceed the income threshold by $10,000. Ergo, 30% of that $10,000 ($3,000) will be shaved off their SALT Cap, bringing it down to $37,000, and so on.

If income is $600,000 or more, the SALT deduction cap is once more $10,000.

So, in 2025, benchmarks for different levels of the cap—and how much a homeowner/homeowning family making between $500,000 and $600,000 could potentially save—would be as follows:

Also important to note: owners can deduct taxes paid on multiple properties, so homeowners with vacation or rental homes are more likely to reap the benefit of the higher cap. About 4.6% of housing stock in the country was being used as a second home in 2024, according to the National Association of Homebuilders.

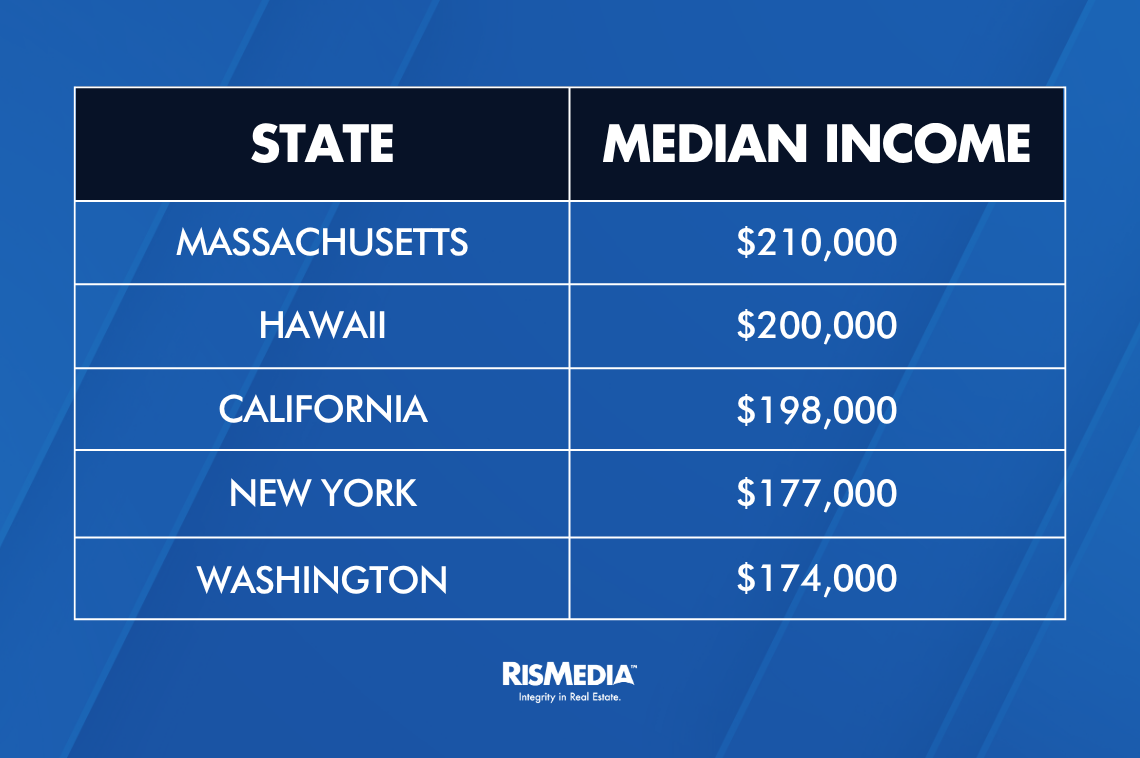

Minimum income needed to afford median home value in states is, per findings from Realtor.com®, well below $500,000 in all 50 U.S. states. For instance, the most expensive states are:

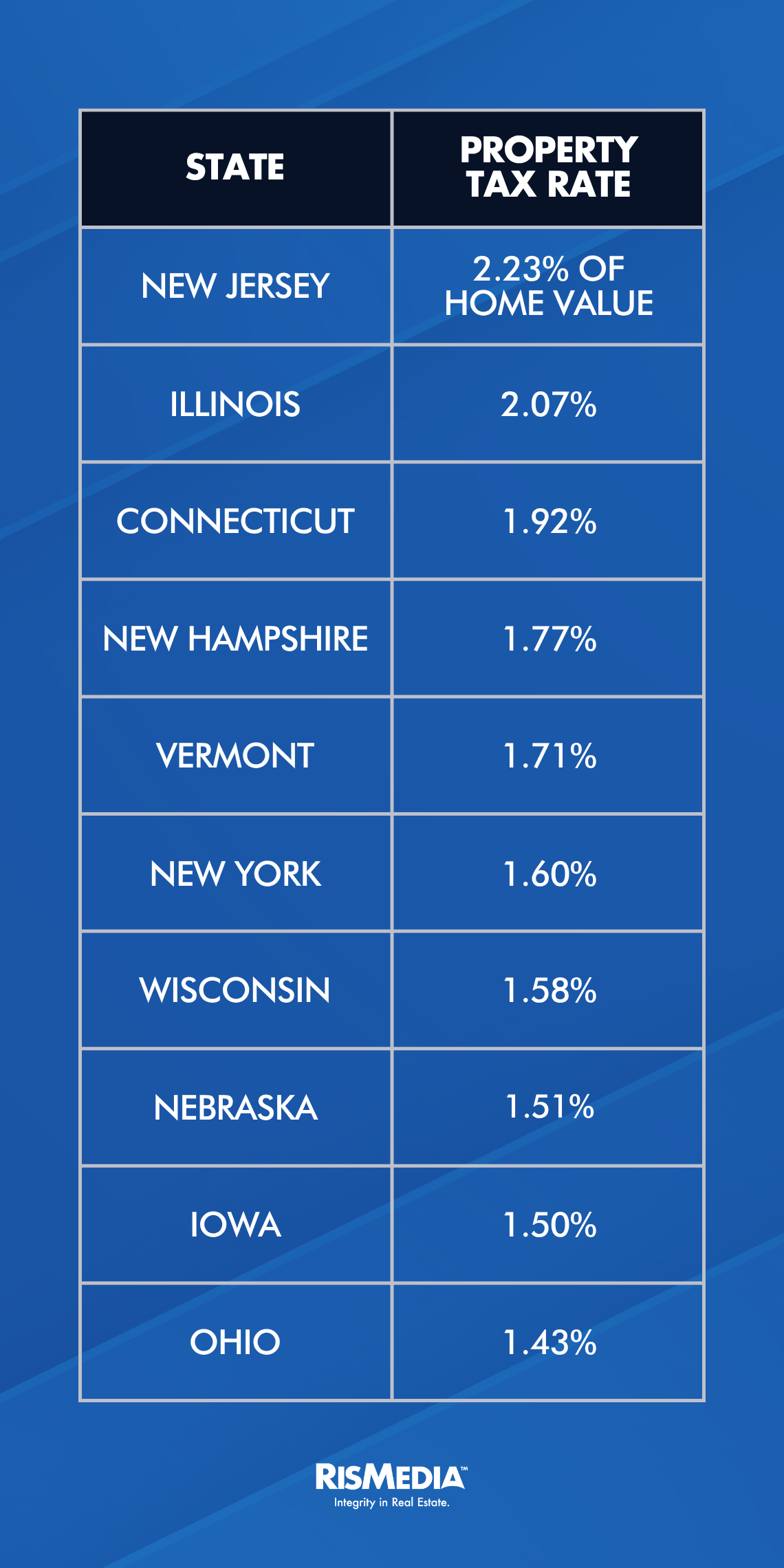

Property taxes are derived from homes’ assessed value. States with highest effective property tax rates, according to Rocket Mortgage’s survey of the latest available data (2023), are:

Here’s a hypothetical example: a married couple in Vermont with household income of $530,000 with home assessed at $800,000. They could deduct $31,000 under SALT, but their actual property tax would be about $13,860.

To get full advantage of SALT in New Jersey, your assessed value would need to be around $1.79 million. According to records by the New Jersey treasury department, none of the state’s counties have had an average assessed home value close to that in 2025; the highest, Monmouth County, has an average assessed value of $782,446. The statewide average is $404,656. A handful of districts within those counties have average assessments over $1 million, but those areas are still a clear minority. In 53 districts of the aforementioned Monmouth County, 17 showed average assessed value at $1 million or more.

Likewise, under Connecticut property tax rate, you would need an assessed value of around $2 million to be able to take advantage of the full $40,000 write-off. Assessments made from 2021 to 2023 found less than 500 residential properties valued at $2 million in the entire state of Connecticut.

At the same time, some homeowners will see modest benefits at lower assessed values. A New Jersey homeowner with a property assessed at $500,000 will be able to deduct about $1,500 more than they could before the changes. In Connecticut, a family would have to own a $600,000 property for roughly that same benefit.

SALT is also an itemized deduction, meaning to claim it, a taxpayer must forgo the standard deduction. The Big Beautiful Bill also increased the Standard Deduction to $15,750 for single taxpayers and $31,500 for married couples filing taxes jointly.

The Bipartisan Policy Center, a centrist think tank, has claimed that raising the SALT cap will encourage more taxpayers to itemize their deductions and create a more “cumbersome” process for the IRS. The incentive to itemize to get SALT benefit, though, only exists if a taxpayer has the potential to save more under SALT than by taking the standard deduction, i.e., a married household would need a property tax bill higher than $31,500, which puts them in upper income brackets.

Criticism of SALT, and the raising of the cap, is that the deduction has a narrow set of beneficiaries: homeowners in states with high local tax rates such as New York, New Jersey, etc. During the passage of the Big Beautiful Bill, other nonpartisan think tanks such as the Tax Policy Center and the Committee for a Responsible Federal Budget argued that raising the SALT cap would benefit only high earners.

In short, before you mention or cite SALT, consider if you work in the type of market where homeowners will even need to consider it when their property tax bill comes.