RealtyTrac® has released its Q1 2015 U.S. Home Purchase Down Payment Report, which shows the average down payment for single family homes, condos and townhomes purchased in the first quarter was 14.8 percent of the purchase price, down from 15.2 percent in the previous quarter and down from 15.5 percent a year ago to the lowest level since Q1 2012.

RealtyTrac® has released its Q1 2015 U.S. Home Purchase Down Payment Report, which shows the average down payment for single family homes, condos and townhomes purchased in the first quarter was 14.8 percent of the purchase price, down from 15.2 percent in the previous quarter and down from 15.5 percent a year ago to the lowest level since Q1 2012.

The report also shows that the average down payment for FHA purchase loans originated in the first quarter was 2.9 percent of the purchase price while the average down payment for conventional loans was 18.4 percent of the purchase price.

The average down payment in dollars was $57,710 in the first quarter, up slightly from $57,618 in the previous quarter and down slightly from $57,992 in the first quarter of 2014. The average down payment in dollars for FHA purchase loans originated in the first quarter was $7,609 while the average down payment for conventional loans backed by Fannie Mae and Freddie Mac was $72,590.

FHA loans as a share of loan originations increased throughout the quarter, from 21 percent in January to 22 percent in February to 25 percent in March.

“Down payment trends in the first quarter indicate that first time homebuyers are finally starting to come out of the woodwork, albeit it gradually,” says Daren Blomquist, vice president at RealtyTrac. “New low down payment loan programs recently introduced by Fannie Mae and Freddie Mac, along with the lower insurance premiums for FHA loans that took effect at the end of January are helping, given that first time homebuyers typically aren’t able to pony up large down payments. Also helping tilt the balances toward first time homebuyers in the first quarter is less competition from the large institutional investors that have been buying up starter home inventory as rentals.”

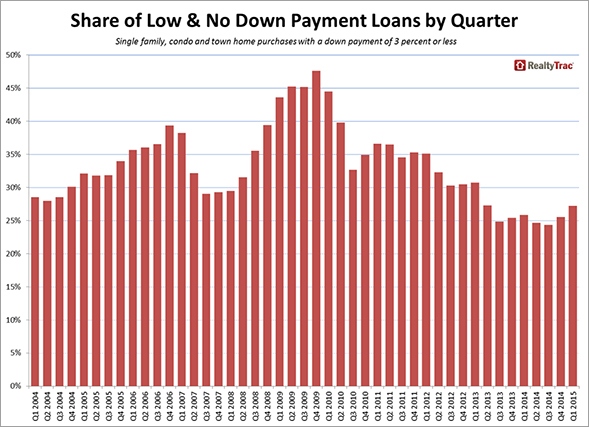

Low down payment share of purchases rises to nearly two-year high

The share of low down payment loans — defined in the report as purchase loans with a loan-to-value ratio of 97 percent or higher, which would mean a down payment of 3 percent or lower — was 27 percent of all purchase loans in the first quarter, up from 26 percent in the fourth quarter and also 26 percent a year ago to the highest share since Q2 2013. Low down payment loans accounted for 83 percent of FHA purchase loans originated in the first quarter, while 11 percent of conventional loans were low down payment loans.

“I see the rise in low down payments as a positive for our market. In Seattle, it’s primarily a function of the price growth in our region combined with buyers looking to take advantage of the new Fannie/Freddie 97 LTV programs,” says OB Jacobi, president of a Seattle-based real estate company, where low down payment loans were 13 percent of all purchase loans in King County and 31 percent of all purchase loans in Snohomish County. “As long as qualifying for mortgages remains stringent, I don’t see this as being problematic. Our region continues to expand economically and the desire to buy remains high.”

“I see the rise in low down payments as a positive for our market. In Seattle, it’s primarily a function of the price growth in our region combined with buyers looking to take advantage of the new Fannie/Freddie 97 LTV programs,” says OB Jacobi, president of a Seattle-based real estate company, where low down payment loans were 13 percent of all purchase loans in King County and 31 percent of all purchase loans in Snohomish County. “As long as qualifying for mortgages remains stringent, I don’t see this as being problematic. Our region continues to expand economically and the desire to buy remains high.”

“The growing number of low down payment loans reflects an appetite on the part of lenders and the government to provide a format to grow the number of homebuyers, particularly first time buyers. Those numbers were running near record lows over the past couple of years,” says Craig King, COO of a real estate firm covering the Lake Tahoe and Reno, Nevada housing markets. “The dangers of interest only, negative amortization, and low, low credit score loans are not a part of today’s low down loan programs. These are the components that got buyers in trouble during the severe downturn. Without those types of high risk components, low down payment loans are a sound strategy.”

Share of low down payment loans rises throughout the first quarter

The share of low down payment loans was increasing throughout the quarter, from 26 percent in January to 27 percent in February to 29 percent in March, according to the report. The overall volume of loans was also much higher in March compared to the first two months of the year.

“Low down payment loan share is going up, reflecting increased sales activity combined with more availability in and awareness in low down payment programs. We’ve seen strong activity in FHA financing in the first quarter in both LA and Orange Counties,” says Mark Hughes, chief operating officer with a real estate firm covering the Southern California market where low down payment loans were 18 percent of all purchase loans in Los Angeles County and 10 percent of all purchase loans in Orange County. “Low down payment lending is increasing as a share of an increasing total and that is a good sign. If lenders can just keep their wits about them this time it should continue to lead to a more stable, growing marketplace with limited downside distress.”

Although overall low down payment loans increased as a share of all purchase loans in the first quarter, the share of conventional loans that were low down payment loans decreased throughout the quarter, from 11 percent in January and February to 10 percent in March. Meanwhile, the share of FHA loans that were low down payment loans increased throughout the quarter, from 83 percent in both January and February to 84 percent in March

“While it’s good to see that the share of low down payment loans is gradually increasing, we’re concerned that many new buyers are unaware of options available to significantly reduce their down payment,” says Rob Chrane, president and CEO of Down Payment Resource. “Across the country, down payment program help averages almost $12,000. Even if a buyer has saved the minimum down payment, these additional benefits go a long way towards helping reduce out-of-pocket down payment and closing costs.”

“Researching available low down payment loans and programs can make a material impact on a homebuyer’s finances for years to come,” Chrane continued. “These programs can be paired with FHA or conventional first mortgages. Homebuyers can ask their Realtor and lender if they work with the state and local Housing Finance Agencies that provide these programs.”

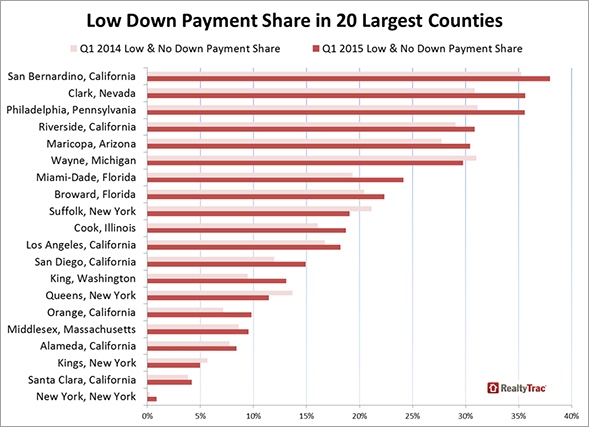

County-level down payment trends

The report also analyzed first quarter down payments for purchase loans in 367 counties nationwide with sufficient data and a population of at least 100,000.

Among the nation’s 20 largest counties with down payment data available, those with the lowest average down payment percentage were Wayne County, Michigan in Detroit (12.0 percent), Philadelphia County (12.6 percent), Clark County, Nevada in Las Vegas (13.3 percent), Riverside County, California in Inland Southern California (13.7 percent) and Maricopa County, Arizona in the Phoenix metro area (14.2 percent).

Among the nation’s 20 largest counties with down payment data available, those with the highest average down payment percent were New York, New York/Manhattan (37.2 percent), Kings County, New York/Brooklyn (29.3 percent), Queens County, New York (27.3 percent), Santa Clara County, California in the San Jose metro area (25.4 percent), and Orange County, California in the Los Angeles metro area (22.9 percent).

Markets with the highest percentage of low down payment loans in the first quarter included counties in Atlanta; Washington, D.C.; El Centro, California; Worcester, Massachusetts; and Charlotte and Greensboro in North Carolina.

Counties with lowest share of low down payment loans in the first quarter were New York County, New York (Manhattan), the Bay Area counties of San Francisco, Marin, San Mateo, and Santa Clara, and Kings County (Brooklyn), New York.

For more information, go to http://www.realtytrac.com/news/home-prices-and-sales/q1-2015-u-s-home-purchase-down-payment-report/.