The tax benefits of the mortgage interest deduction (MID) are primarily targeted to the middle class. According to 2012 Congressional estimates, 65.4 percent of the tax benefit is collected by households who have economic income of less than $200,000.

Of course, the claims for the MID are going to vary state-to-state given differences in house prices and other costs of living, household incomes, and tax items such as property taxes or state income/sales taxes, which in part determine whether a homeowner claims the standard deduction.

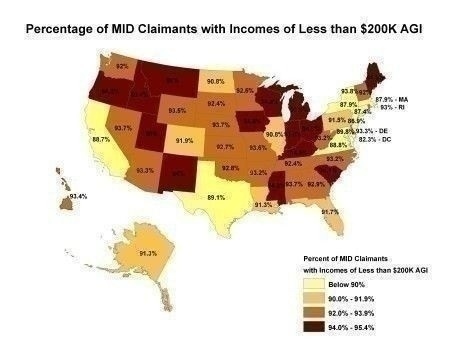

Fortunately, the Internal Revenue Service publishes state-level data of tax statistics. And these state level data, for which the income classifier is equal to adjusted gross income (AGI), illustrate the degree to which MID-benefiting taxpayers are concentrated in the middle class.

The map above reports the share of taxpayers who claimed the MID on 2010 federal income tax return (the most recent data available) and who also report less than $200,000 in adjusted gross income. Not surprisingly, the share tends to drop somewhat in high cost states, such as New York and California, for which household incomes tend to be higher. Nationally for 2010, 91 percent of taxpayers claiming the MID has an AGI of less than $200,000.

Of course, income, homeownership status, and tax characteristics are not fixed across one’s life-cycle. For example, interest payments for a fixed rate mortgage are larger in the early years of a mortgage, thus the potential deduction amount for the MID is higher for recent homebuyers.

As a result of this life-cycle effect, many homeowners benefit from the MID for a series of years and then cease claiming the deduction as their interest payments fall and the standard deduction becomes a better deal. For this reason, the often cited statistic that only a quarter of taxpayers benefit from the MID is misleading. In fact, this claim should be qualified as “in a given year,” given the life-cycle impact.

By merging IRS data with Census American Community Survey data (both for 2010), we can estimate the more useful statistic of how many homeowners with a mortgage benefit from the MID in a given year. Nationally, 73 percent of homeowners with a mortgage claimed the MID on their income tax returns for tax year 2010.

It is important to note that this number is not an accounting of the percentage of homeowners who benefit from the MID during their tenure of homeowners. That percentage would be higher given life-cycle effects, but cannot be estimated without panel data of income tax returns.

View this original post on the NAHB blog, Eye on Housing.