Nationally, the number of single-family homes for sale and their prices continue to rise—revealing a healthier real estate marketplace than a year ago and strong seller confidence, according to the April 2014 National Housing Trend Report released today by realtor.com®, a leader in providing consumers the most accurate U.S. residential listings online. Move, Inc. operates realtor.com®.

Nationally, the number of single-family homes for sale and their prices continue to rise—revealing a healthier real estate marketplace than a year ago and strong seller confidence, according to the April 2014 National Housing Trend Report released today by realtor.com®, a leader in providing consumers the most accurate U.S. residential listings online. Move, Inc. operates realtor.com®.

While last April’s list price gains were driven largely by dramatic shortages in for-sale inventory, April 2014 data shows sustained moderate home price gains in tandem with increasing inventories. The increase in inventory and asking price suggests sellers are much more optimistic than a year ago, likely the result of a strengthening national economy.

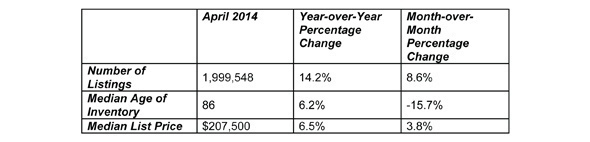

April home inventories are up a robust 14.2 percent compared with April 2013, according to realtor.com® data. Median list price rose by 6.5 percent to $207,500 compared to last year. Median age of inventory is 86 days—a 6.2 percent increase compared to a year ago.

The combination of median list price rising above $200,000 and a double-digit home inventory increase is an indication that the marketplace is becoming more balanced.

“Home prices and inventories are more in balance in most markets—a sign of improving housing health and optimism across much of the country,” said Steve Berkowitz, Move’s chief executive officer. “As sellers gain confidence, we also are watching spring sales data closely to gauge whether buying activity will be in line with these early indicators.”

Some reports showed a cooling market in the early months of 2014. Existing home sales, at 4.59 million units in March, were 7.5 percent below the pace of March 2013 according to The National Association of REALTORS® (NAR). However after nine months of stagnation, March pending home sales experienced their first gain—rising 3.4 percent, according to NAR’s Pending Home Sales Index.

While prices are rising, age of inventory is dropping faster than the previous year—by 15.7 percent in April—suggesting that properties are selling quickly in many markets and being replaced with new inventory at a quicker pace compared to last year.

National Key Market Indicators for April 2014

Key Market Highlights

10 Metropolitan Statistical Areas (MSAs) with the Greatest Median List Price Increases, Year over Year

Gains in new hot markets sprouting across the country are largely due to local economies’ increasing strength. New price leaders are Sacramento, California; Chicago; Austin and San Marcos, Texas; and Fort Pierce and Port St. Lucie, Florida. Recurring leaders are Houston; Las Vegas; Denver; Reno, Nevada; and Stockton, Lodi, Riverside, and San Bernardino, California.

While prices are continuing to rise, the pace of appreciation is slowing. This signals that housing is becoming more affordable for some, as rising equity comes more in line with asking prices.

Pumped by oil and gas economies, Texas and Colorado are exceptionally strong. Denver, Austin, Houston and Chicago are experiencing a supply-driven adjustment process similar to that which led to rapid house-price appreciation in California. These deficits aren’t as large, however, suggesting these markets are not likely to experience the kind of unsustainable appreciation California experienced during most of 2013. While sand states, such as California, Nevada and Arizona, continue to see supply-driven increases in prices in many markets, supply is beginning to catch up with demand.

How Data Is Collected

Realtor.com® regularly tracks real estate data and develops monthly reports featuring the number of listings, median age of inventory, and median list price across the U.S. and in specific markets, as well as provides year-over-year and month-over-month changes. These reports are the only ones pulled directly from the realtor.com® database, where 90 percent of listings are updated every 15 minutes from more than 800 MLSs. We regularly review and update historical data to provide the most accurate and comprehensive market-information available.

“Most accurate” claim(s) pertain to the accuracy of home listings, are based on comparison with other national listing portals, and are based on the greater frequency of listings updating on realtor.com®.

Source: realtor.com