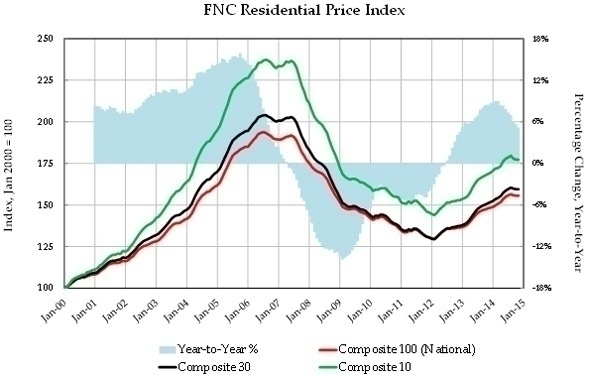

The nation’s average home prices stood stagnant this fall, largely unchanged from October to November, according to the latest FNC Residential Price Index™ (RPI). This trend occurs after prices declined for the first time in September following two-and-a-half years of modest-to-strong price increases nationwide. Weak housing activity, including sales of existing homes—even as 30-year mortgage rates are down by more than a half percentage point from a year ago—has largely contributed to continued price weakness. The retreat in the annual rate of home price appreciation continues, down to 5.2 percent in November, compared to 7.9 percent in June.

The nation’s average home prices stood stagnant this fall, largely unchanged from October to November, according to the latest FNC Residential Price Index™ (RPI). This trend occurs after prices declined for the first time in September following two-and-a-half years of modest-to-strong price increases nationwide. Weak housing activity, including sales of existing homes—even as 30-year mortgage rates are down by more than a half percentage point from a year ago—has largely contributed to continued price weakness. The retreat in the annual rate of home price appreciation continues, down to 5.2 percent in November, compared to 7.9 percent in June.

Completed foreclosures in November comprise about 15 percent of total existing home sales, up modestly from earlier months and largely reflecting increased sales of vacant REO properties during the winter months. In the for-sale market, the asking price discount and time-on-market increased modestly as a result of weak sales in recent months. As of November, the median discount is 4.3 percent while the time-on-market is 115 days, up from October’s 3.8 percent and 106 days. Preliminary December estimates show further deterioration in market liquidity.

FNC’s RPI is the mortgage industry’s first hedonic price index built on a comprehensive database that blends public records of residential sales prices with real-time appraisals of property and neighborhood attributes. As a gauge of underlying home values, the RPI excludes final sales of REO and foreclosed homes, which are frequently sold with large price discounts, likely reflecting poor property conditions.

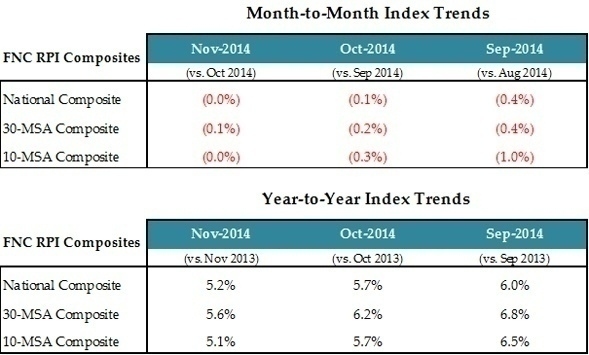

The table below shows the seasonally unadjusted rates of month-to-month and year-to-year changes in the FNC national index (a 100-MSA composite index) as well as two narrower indices, 30- and 10-MSA composites. All three indices in November are either relatively unchanged or down slightly from the previous month. The indices’ month-to-month and year-to-year trends in the last three months point to a persistent weakening in home prices. Year to year, average home price appreciation across the country has dropped below 6 percent.

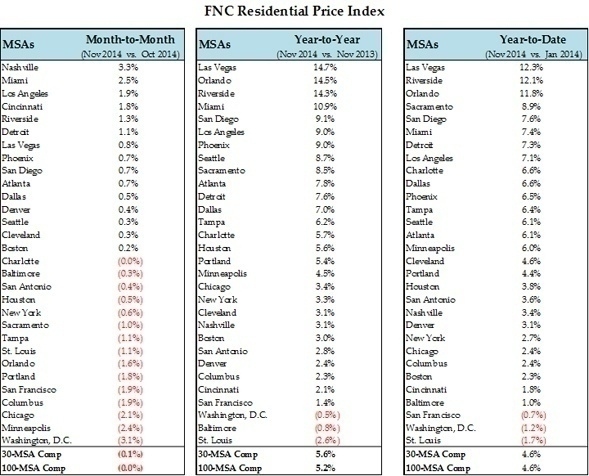

The chart below tabulates the month-to-month, year-to-year, and year-to-date changes to show the latest price trends for each MSA in the FNC Composite 30. The number of up- and down-markets are close to a 50-50 split in November, led by Nashville and Miami where home prices were up 3.3 percent and 2.5 percent respectively, followed by Los Angeles at 1.9 percent. At the bottom of the list are Washington D.C., Minneapolis, and Chicago where prices dropped 3.4 percent, 2.4 percent, and 2.1 percent, respectively. In Washington D.C.—joined by New York, San Francisco, Chicago, and Portland – home prices have notably weakened in recent months. And in San Francisco, November marks the fourth consecutive month of sharp price declines that averaged about 2.0 percent per month. As oil prices continue to be down and weak, home prices in Houston declined for the second month in November (0.5 percent) after a 2 percent drop in October.

The annual rate of home appreciation in Las Vegas (14.7 percent), Orlando (14.5 percent), Riverside (14.3 percent), and Miami (10.9 percent) continues to reach the double-digit level despite a nationwide slowdown through most of 2014. With recent market declines, Washington D.C. becomes the third city after Baltimore and St. Louis to see prices depreciating on an annual basis.

For more information, visit http://fncinc.com.