In 76 percent of the U.S. counties, the monthly house payment on a median-priced home is more affordable than the monthly fair market rent on a three-bedroom property, according to a recent RealtyTrac® analysis.

In 76 percent of the U.S. counties, the monthly house payment on a median-priced home is more affordable than the monthly fair market rent on a three-bedroom property, according to a recent RealtyTrac® analysis.

The RealtyTrac® Residential Rental Property Analysis for properties purchased in the first quarter of 2015 also ranked residential rental properties from a real estate investor perspective along with the most affordable—and least affordable—markets for renting from a renter perspective.

The analysis included 461 counties nationwide with a population of at least 100,000 and sufficient home price, income and rental data. The combined population in the 461 counties analyzed was 217 million. On average across all 461 counties, fair market rents as set by the U.S. Department of Housing and Urban Development represented 28 percent of the estimated median household income, while monthly house payments on a median-priced home—with a 10 percent down payment and including property taxes, home insurance and mortgage insurance—represented 24 percent of the estimated median income.

“From a purely affordability standpoint, renters who have saved enough to make a 10 percent down payment are better off buying in the majority of markets across the country,” says Daren Blomquist, vice president at RealtyTrac. “But factors other than affordability are keeping many renters from becoming buyers, a reality that means real estate investors buying residential properties as rentals still have the opportunity to make strong returns in many markets across the country.

“Also keep in mind that in some markets buying may be more affordable than renting, but that doesn’t mean buying is truly affordable by traditional standards,” Blomquist added. “In those markets renters are stuck behind a rock and hard place when it comes to deciding whether to try to buy or continue renting.”

56 markets with most favorable conditions for buying rather than renting

There were 351 counties out of the 461 analyzed (76 percent) where house payments on a median-priced home in the first quarter of 2015 were lower than fair market rents on three-bedroom homes.

Among these 351 counties, there were 56 counties where home prices rose at least 7 percent compared to a year ago and wages rose at least 3 percent annually—additional factors that could make owning a home more attractive than renting. Wages were from the most recent weekly wage data available from the Bureau of Labor Statistics, the third quarter of 2014.

Among the 56 counties with most favorable conditions for buying, the most affordable for buying were Bay County, Michigan in the Bay City metro area (11 percent of median income to make house payments on a median priced-home), Fayette County, Pennsylvania (11 percent) and Beaver County, Pennsylvania (14 percent), both in the Pittsburgh metro area, Tazewell County, Illinois in the Peoria metro area (14 percent), and Butler County, Ohio in the Cincinnati metro area (14 percent).

“When considering the financial aspects of renting verses owning within the majority of the Ohio markets, the better financial opportunity is in ownership,” says Michael Mahon, executive vice president at a real estate firm covering the Ohio housing markets of Cincinnati, Dayton and Columbus. “With many markets in Ohio seeing double-digit appreciation year over year, the cost of homeownership and renting will only go up in future years, while purchasing options offer attractive low interest rates for homeowners to stabilize monthly household expenses, while equally building equity within their household investments.

“As wage growth continues to stagnate, those consumers choosing to rent will see more and more of their net wages being devoted to increased housing costs in the future,” Mahon added.

Other counties among the 56 with the most favorable conditions for buying were Harris County, Texas in the Houston metro area, Tarrant County, Texas in the Dallas metro area, Fulton County, Georgia in the Atlanta metro area, Fresno County, California, and Prince George’s County, Maryland in the Washington, D.C., metro area.

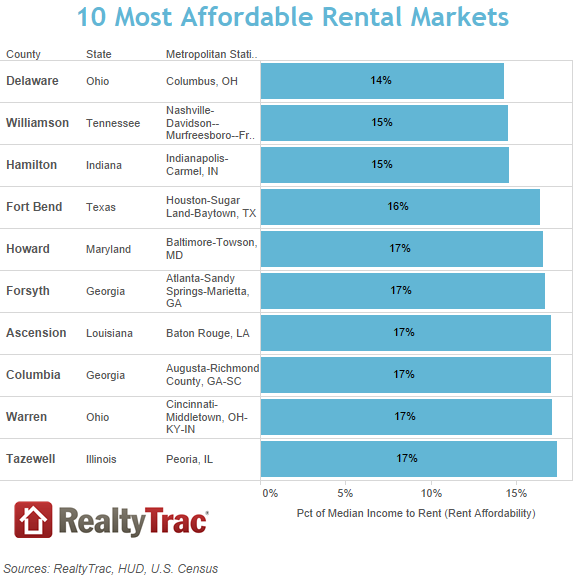

Most affordable rental markets

Markets where the fair market rent on a three-bedroom property represented the smallest share of median household income were Delaware County, Ohio in the Columbus metro area (14 percent), Williamson County, Tennessee in the Nashville metro area (14 percent), Hamilton County, Indiana in the Indianapolis metro area (15 percent), Fort Bend County, Texas in the Houston metro area (16 percent), and Howard County, Maryland, in the Baltimore metro area (17 percent).

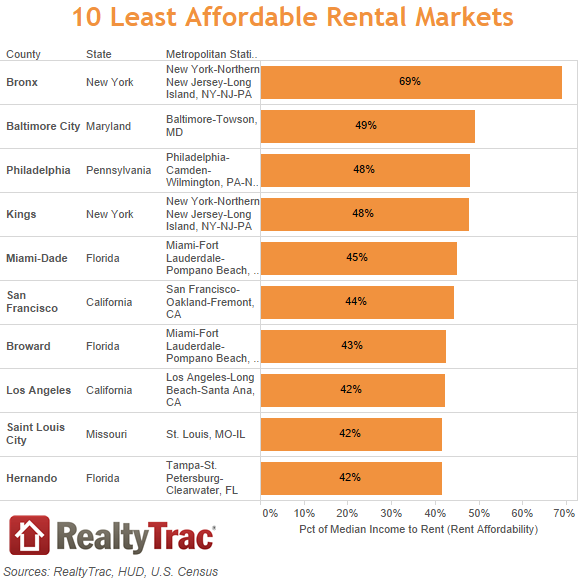

Least affordable rental markets

Markets were the fair market rent on a three-bedroom property represented the biggest share of median household income were Bronx County, New York (69 percent), Baltimore City, Maryland (49 percent), Philadelphia County, Pennsylvania (48 percent), Kings County/Brooklyn, New York (48 percent), and Miami-Dade County, Florida (45 percent).

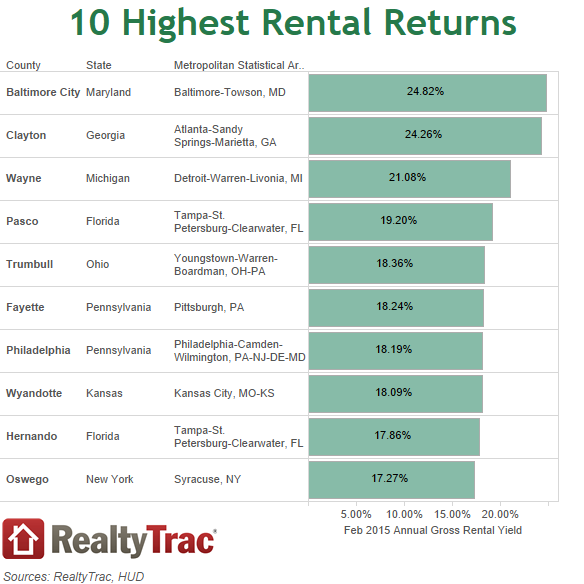

Markets with highest returns on residential rental properties

Among all 461 counties analyzed the average potential annual gross rental yield for homes purchased in February 2015 was 9.34 percent. The annual gross rental yield is calculated by annualizing the rental income and dividing that amount into the purchase price of the property.

Markets with the highest potential annual gross rental yields for homes purchased in February 2015 were Baltimore City, Maryland (24.82 percent), Clayton County, Georgia in the Atlanta metro area (24.26 percent), Wayne County, Michigan in the Detroit metro area (21.08 percent), Pasco County, Florida in the Tampa-St. Petersburg metro area (19.20 percent), and Trumbull County, Ohio in the Youngstown metro area (18.36 percent).

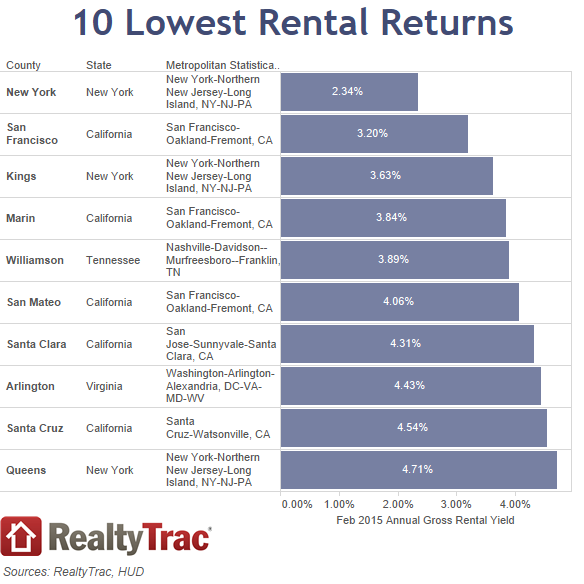

Markets with lowest returns on residential rental properties

Markets with the lowest potential annual gross rental yields for homes purchased in February 2015 were New York County/Manhattan, New York (2.34 percent), San Francisco County, California (3.20 percent), Kings County/Brooklyn, New York (3.63 percent), Marin County, California in the San Francisco metro area (3.84 percent), and Williamson County, Tennessee in the Nashville metro area (3.89 percent).

For more information, visit http://www.realtytrac.com/news/realtytrac-reports/april-2015-residential-rental-property-analysis/.