RealtyTrac® has released a joint analysis with Down Payment Resource that examined affordability, median income, median home price and homeownership program availability in 370 U.S. counties with a population of at least 100,000 and where sufficient data was available. The report then ranked each county based on its affordability and accessibility for low down payment buyers such as first-time homebuyers and boomerang buyers.

RealtyTrac® has released a joint analysis with Down Payment Resource that examined affordability, median income, median home price and homeownership program availability in 370 U.S. counties with a population of at least 100,000 and where sufficient data was available. The report then ranked each county based on its affordability and accessibility for low down payment buyers such as first-time homebuyers and boomerang buyers.

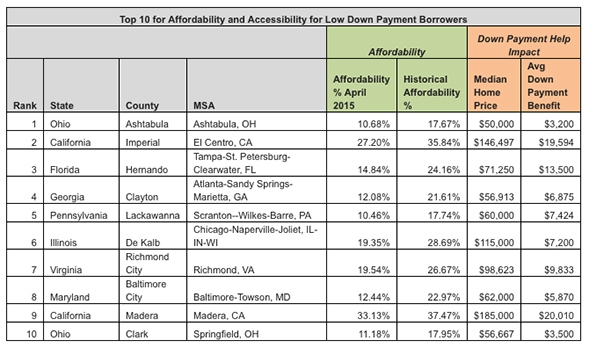

Counties ranking the highest for affordability and accessibility for low down payment borrowers

Of the counties analyzed the top five highest for affordability and accessibility for low down payment buyers included Ashtabula, Ohio, Imperial, California in the El Centro metro area, Hernando, Florida in the Tampa metro area, Clayton, Georgia in the Atlanta metro area and Lackawanna, Pennsylvania in the Scranton metro area.

Other markets within the top 25 for affordability and accessibility score for low down payment borrowers included counties in Northern New Jersey, Pittsburgh and Allentown, Pennsylvania, Dayton, Ohio and Pensacola, Florida.

“The Ohio markets continue to provide affordable housing benefits for many boomerang and first time buyers. The region’s stability in price, and growth in jobs across the state, provides greater access for buyers to take advantage of lower down payment opportunities, as well as an increasing available inventory in new and existing communities,” said Michael Mahon, president at HER Realtors, covering the Cincinnati, Dayton and Columbus markets in Ohio. “Unlike many market across the country, Ohio has remained at an affordable median housing price that enables many first time buyers and boomerang buyers to realize their dreams of homeownership.”

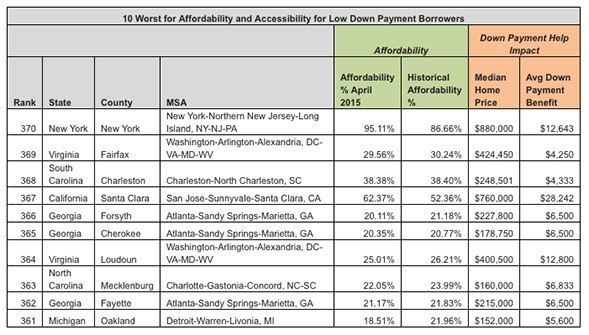

Counties ranking the worst for affordability and accessibility for low down payment buyers

County housing markets ranking in the top five lowest for affordability and accessibility for low down payment buyers were in New York, New York, Fairfax, Virginia in the D.C. metro area, Charleston, South Carolina, Santa Clara, California in the San Jose metro area and Forsyth, Georgia in the Atlanta metro area.

Other markets in the bottom 25 score for affordability and accessibility for low down payment buyers included counties in Seattle, Washington, San Francisco, California, Chicago, Illinois, Philadelphia, Pennsylvania, Des Moines, Iowa, Minneapolis, Minnesota and Reno, Nevada.

90 percent of U.S. markets analyzed still more affordable than historic averages

Of the 370 counties analyzed, 334 (90 percent) were more affordable for low down payment buyers in April 2015 than their historic averages.

Major counties still more affordable than their historic averages included Cook County, Illinois (Chicago), Maricopa County, Arizona (Phoenix), San Diego County, California, Miami-Dade County, Florida, and Riverside County in Southern California.

“Even with all our sizzle and glitz—Miami is still an affordable bargain compared to other major U.S. cities and globally. Our average income household earner can buy almost two times the average priced house in South Florida,” says Mike Pappas, CEO and president of the Keyes Company, covering the South Florida market. “There are a plethora of loan options that help the first-time buyer purchase with only a 3 percent down payment. Many will look back at this opportunistic time as one of the best times to purchase a home in the area.”

There were 36 counties of the 370 analyzed (10 percent) that were less affordable for low down payment buyers in April 2015 than their historic averages.

Counties least affordable relative to their historic averages were San Francisco and San Mateo counties in the San Francisco metro area, Kings County (Brooklyn), New York, Santa Clara County, California in the San Jose metro area, and Denver County, Colorado.

“Our market is so tight, that anytime a broker receives several offers, they first look at price, the probability of that price appraising, and then they look at form of financing,” says Wesley Hardin, broker/owner of RE/MAX Alliance, covering the Denver market. “If it’s close on price, then they take the cash offer as that price is usually far higher than what they thought they would ever get. This pinches any opportunity for low money down buyers to successfully secure and close on a piece of real estate in the Denver metro area.”

Average down payment program benefit $10,443 for all U.S. markets analyzed

On average, across all 370 counties analyzed the average amount of down payment help was $10,443 and that was on average 6.84 percent of the median home sales price in April.

Counties with the highest average down payment program benefit as a percentage of the median home sales price in April 2015 were Volusia County, Florida in the Deltona-Daytona Beach-Ormond Beach metro area (24.73 percent), Pasco County, Florida in the Tampa metro area (24.16 percent), Kern County, California in the Bakersfield metro area (21.62 percent), Sullivan County, Tennessee in the Kingsport-Bristol metro area, and Broward County, Florida in the Miami metro area.

Counties with the highest average down payment assistance in dollars were San Francisco, California ($51,713), Orange County, California ($43,121), Los Angeles County, California ($40,004), Placer County, California in the Sacramento metro area ($35,475) and King County, Washington in the Seattle metro area ($33,735).

“Low down payment programs are plentiful but awareness about these programs by agents and buyers is not. Down Payment Resource provides an amazing service in aggregating available down payment resources available by home and area, we are integrating the resource into our new website,” says Mark Hughes, chief operating officer with First Team Real Estate, covering the Southern California market. “Historically down payment resources have been disparate, misunderstood and somewhat fluid in nature, which has led to agents tuning them out. Even in our area where affordability is much higher on average than most places Southern California is still among the highest average down payment assistance in dollars. As in all real estate dynamics knowledge is the key to success.”

“This analysis demonstrates that low down payment borrowers can find affordable housing and good accessibility to down payment help in a wide variety of markets nationwide,” says Daren Blomquist, vice president at RealtyTrac. “However, within many major metro areas the most affordable and accessible markets for low down payment buyers are often those furthest from jobs and other amenities that many buyers want.”

“Housing affordability is a critical issue for all buyers today. This report underscores the fact that there are significant missed opportunities for down payment help, even in the areas ranked worst in affordability. There are programs in every community that could increase housing affordability for buyers, especially first-time and boomerang buyers,” says Rob Chrane, CEO of Down Payment Resource. “The entry cost for homeownership is the greatest challenge for all buyers. This report highlights how homebuyers can save on their home loan when they access available programs.”

View the full report here.