Teachers budgeting the historical norm for housing will have an easier time finding a home in some parts of California than in Salt Lake City or Portland, Ore., according to new Zillow research.

Teachers budgeting the historical norm for housing will have an easier time finding a home in some parts of California than in Salt Lake City or Portland, Ore., according to new Zillow research.

Homes are cheaper in the middle of the country, but wages are lower, too, and people who live there are accustomed to putting a smaller percentage of their monthly income toward housing. That means the markets with the cheapest homes aren’t necessarily the most affordable for every worker.

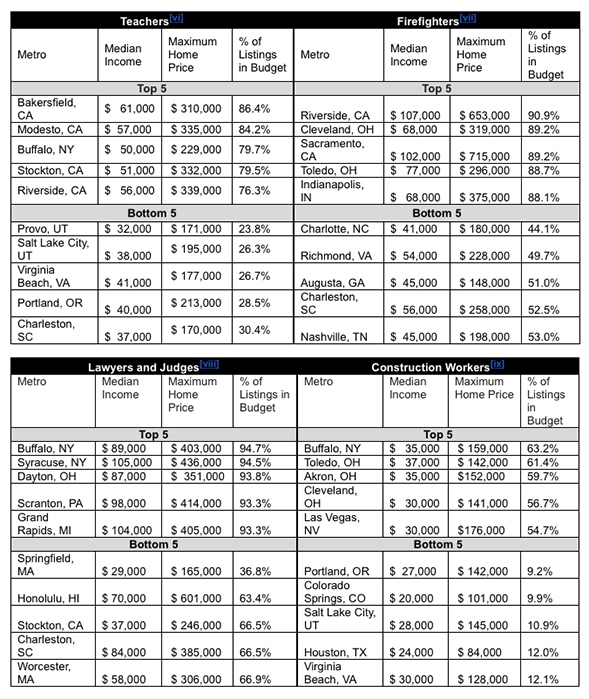

In Bakersfield, Calif., the median home value is $166,300, and the average annual teacher salary is $61,000 a year. Since people in Bakersfield are accustomed to spending 22 percent of their income on a house payment, a Bakersfield teacher could afford a $310,000 home. In today’s market, that includes about 86 percent of the homes on the market—more than anywhere else in the country.

Contrast that with a teacher in Salt Lake City, Utah, where teachers make $38,000 a year and people historically spend the same share—22 percent—of their incomes on a mortgage payment. There, teachers could buy a $195,000 home—meaning only about a quarter of the homes on the Salt Lake City market would fall within their budget.

“There’s a lot more to home buying affordability than just the cost of the home. Incomes vary a lot across the country—even within the same occupation,” says Zillow Chief Economist Dr. Svenja Gudell. “There’s also the question of how much of your paycheck you’re willing to put toward a house payment, and finally, whether you can find a home in your price range. Many potential buyers are checking all the right boxes prior to buying a home—saving a healthy down payment, organizing finances and qualifying for a loan—only to find there are few homes available within their budget and close to their job.”

Zillow’s analysis of affordability by occupation found that lawyers and judges could affordably buy almost every home on the market in Buffalo and Syracuse, N.Y., but could afford only about 66 percent of the homes for sale in Stockton, Calif.

Firefighters, whose average salaries range wildly depending on geography, could afford a $583,000 home in Seattle—or a $167,000 home in Little Rock, Ark. Part of the reason for the big difference is that people in Little Rock have historically spent a smaller share of their income on their house payment.

In the notoriously expensive San Francisco metro area, food-service workerscould afford less than 10 percent of the homes on the market, even if they spend the market-norm of 37 percent of their income on the monthly payment. Teachers could afford about a third of the listings, while firefighters—who make almost as much as the average lawyer there—could afford three-quarters of the homes for sale in the area.

For more information, visit www.zillow.com.