This Could Take a While

With inventory low and prices rebounding, affordability has become one of the foremost housing issues—both for buyers entering the market, and homeowners looking for a new, but practically priced property after selling. According to new research, accumulating enough for a down payment can take over seven years—and even longer in pricey spots.

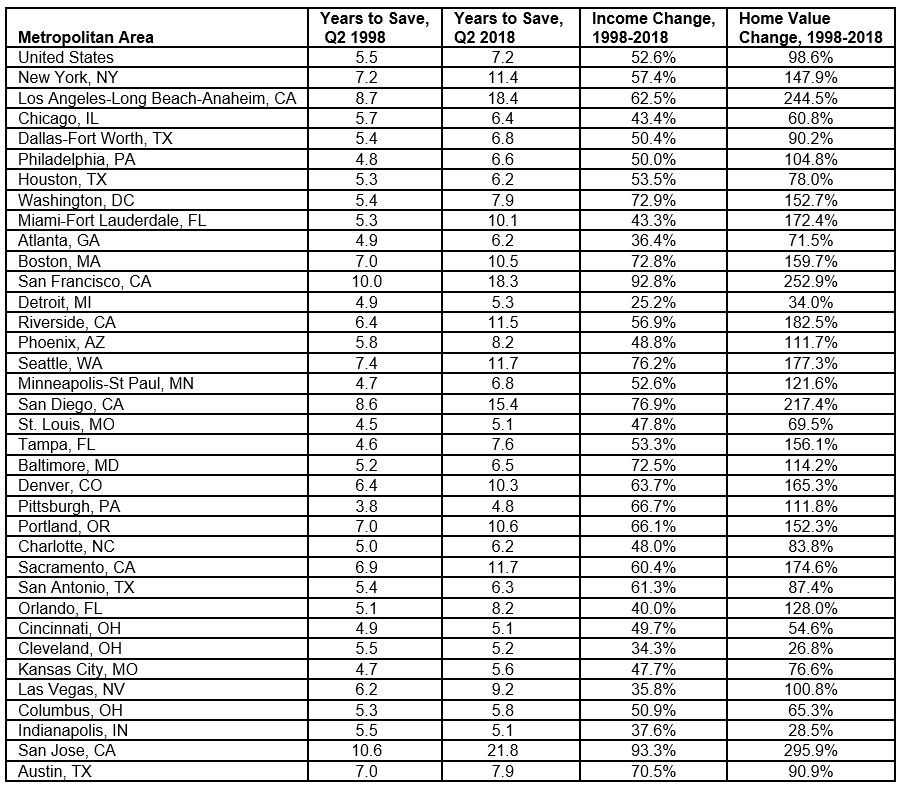

If the average buyer earning the median national income saved 10 percent of it per month, it would take 7.2 years to amass a 20 percent down payment on the average home in the U.S., according to an analysis recently released by Zillow. Buyers in California are in for the longest savings stretch: 18.4 years in Los Angeles; 18.3 years in San Francisco; and 21.8 years in San Jose—the longest of the markets in the report. Buyers have an easier path in Pittsburgh, where it takes 4.8 years, and in Cincinnati, Indianapolis and St. Louis, where it takes 5.1 years.

The disparity between earnings growth and home prices is substantial, the analysis shows. Incomes have increased 52.6 percent in the past 20 years, while appreciation has hit 98.6 percent.

“The simple fact that home values have far outpaced income growth, lengthening the time needed to save for a down payment, contributes to millennials’ struggles to enter homeownership,” says Skylar Olsen, director of Economic Research at Zillow. “Saving up for a down payment can be tough, especially when the cost of everyday life outpaces the money you put into the bank. It requires good budgeting and long-term planning. It’s one reason why more and more first-time home buyers are looking to family and friends for financial help when coming up with their down payment.”

While 20 percent down is ideal by many measures, it’s not a requirement; in fact, borrowers can be eligible for as low as 3 percent, depending on the loan and their situation. For guidance, contact your REALTOR®.

“Even if you don’t have plans to buy a home in the next year or two, it’s not a bad idea to start setting aside savings for a future home purchase,” Olsen says. “It’s also important to remember that there are many options for mortgages requiring less than 20 percent down.”

For more information, please visit www.zillow.com.

Suzanne De Vita is RISMedia’s online news editor. Email her your real estate news ideas at sdevita@rismedia.com. For the latest real estate news and trends, bookmark RISMedia.com.

Suzanne De Vita is RISMedia’s online news editor. Email her your real estate news ideas at sdevita@rismedia.com. For the latest real estate news and trends, bookmark RISMedia.com.