CoreLogic® recently released its latest Single-Family Rent Index (SFRI), which analyzes single-family rent price changes nationally and across more than 80 metropolitan areas. Data collected for July 2020 shows a national rent increase of 1.7 percent year over year, down from a 2.9 percent year-over-year increase in July 2019.

In February, the coronavirus (COVID-19) pandemic set off a chain reaction in the rental market. Unemployment rates skyrocketed, leaving cash-strapped renters struggling to make ends meet and landlords lowering rates in the hopes of keeping their tenants, and local economies, afloat. Rent increases slowed sharply from an average of 2.9 percent in the first quarter of 2020 to 1.7 percent in May and 1.4 percent in June. However, in July, the national rent price growth rate stabilized for the first time since February, posting a 1.7 percent gain as local economies continued to reopen. Still, despite the positive signal on the national level, renters and landlords continued to work to accommodate shelter-in-place orders and added safety measures, which likely slowed rent price growth.

“Increases in single-family rent prices slowed dramatically this spring as the nation began to face the economic impact of the pandemic. As job losses slowed in July, rent growth steadied,” said Molly Boesel, principal economist at CoreLogic. “However, increases in rents should remain sluggish until the economy starts to experience employment gains.”

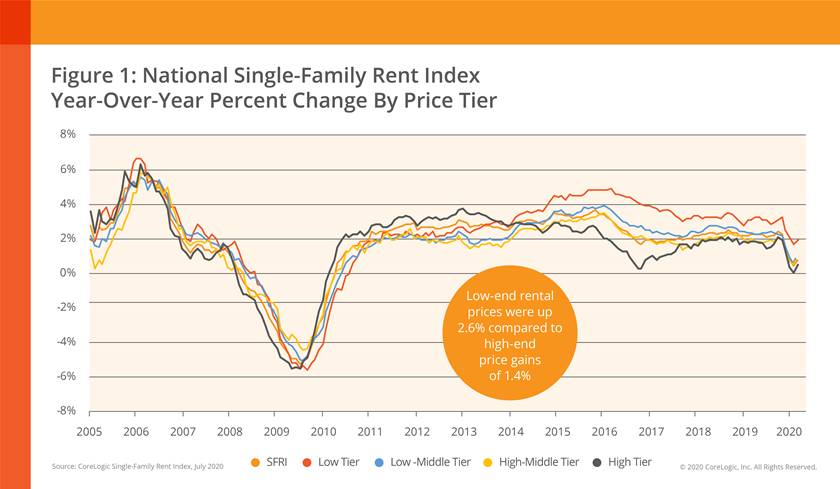

To gain an accurate view of single-family rental prices, CoreLogic examines four tiers of rental prices. On an annual basis, rent prices slowed across all tiers in July. However, mirroring the national trend, all tiers showed a slight uptick in rent growth month over month, with the high-end price tier experiencing the largest increase. In July 2020, the national single-family rent growth across the four tiers, and the year-over-year changes, were as follows:

– Lower-priced (75 percent or less than the regional median): 2.6 percent, down from 3.7 percent in July 2019

– Lower-middle priced (75 percent to 100 percent of the regional median): 1.8 percent, down from 3.1 percent in July 2019

– Higher-middle priced (100 percent to 125 percent of the regional median): 1.7 percent, down from 2.8 percent in July 2019

– Higher-priced (125 percent or more than the regional median): 1.4 percent, down from 2.5 percent in July 2019

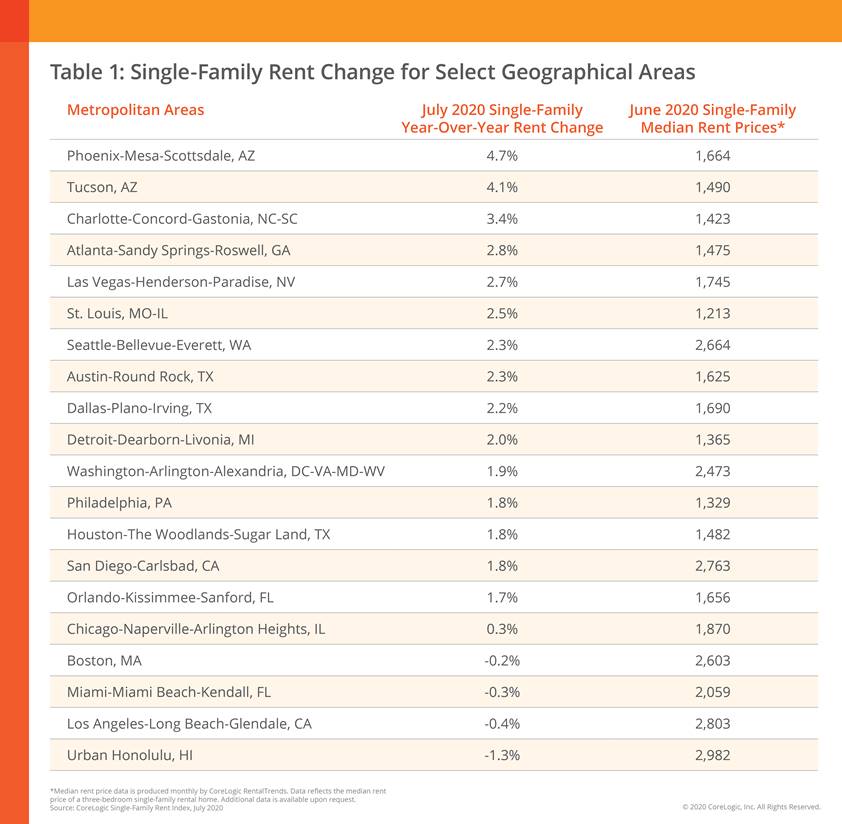

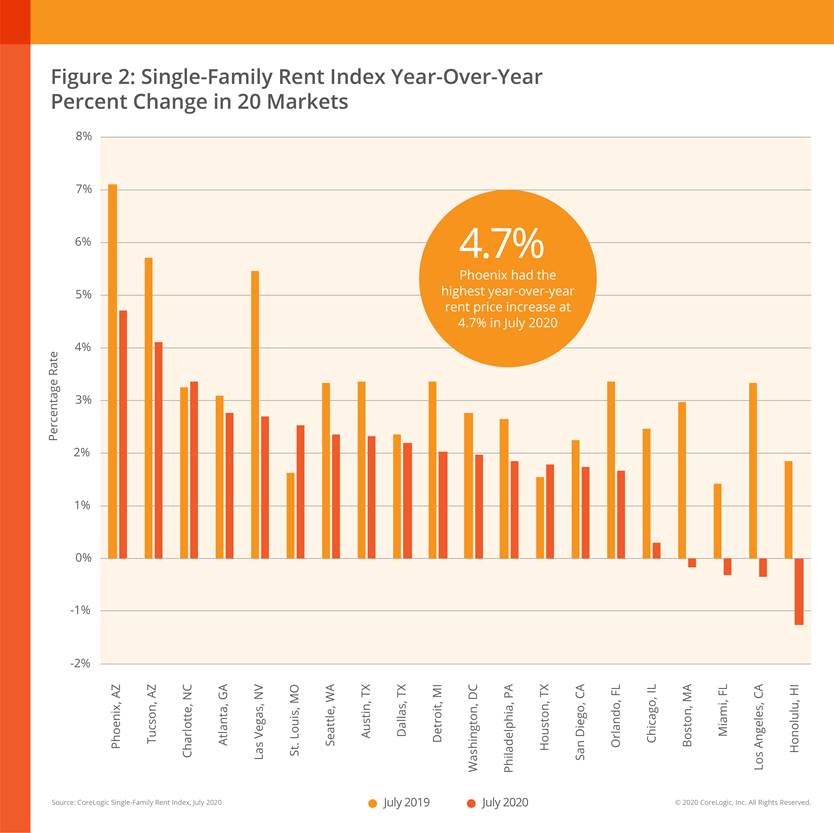

Among the 20 metro areas shown in Table 1, and for the 20th consecutive month, Phoenix had the highest year-over-year increase in single-family rents in July 2020 at 4.7 percent. However, rent growth in Phoenix has also begun to slow in comparison to its average growth rate of 6.5 percent in the first quarter of 2020. Tucson, Ariz., had the second-highest rent price growth in July 2020 with a gain of 4.1 percent, followed by Charlotte, N.C., at 3.4 percent. Conversely, typical tourist destinations like Honolulu, Los Angeles, Miami and Boston all logged an annual decline in rent prices. Honolulu—which continues to adhere to stricter lockdowns and shelter-in-place ordinances—had the most significant decline at -1.3 percent.

While July’s unemployment rates remained elevated across the country, some areas are continuing to experience higher rates of job loss, which is driving downward pressure on rent prices. For example, employment decreased by just 3.5 percent in Phoenix where rent prices have remained comparatively strong. Meanwhile, Honolulu’s employment decreased by 13.8 percent compared to a year ago, which likely contributed to its significant rent price decline. Given the slow economic recovery from the initial impact of COVID-19, as well as the resurgence of the virus in many metro areas, we may expect to see further disruption of local rental markets.

For more information, please visit www.corelogic.com.