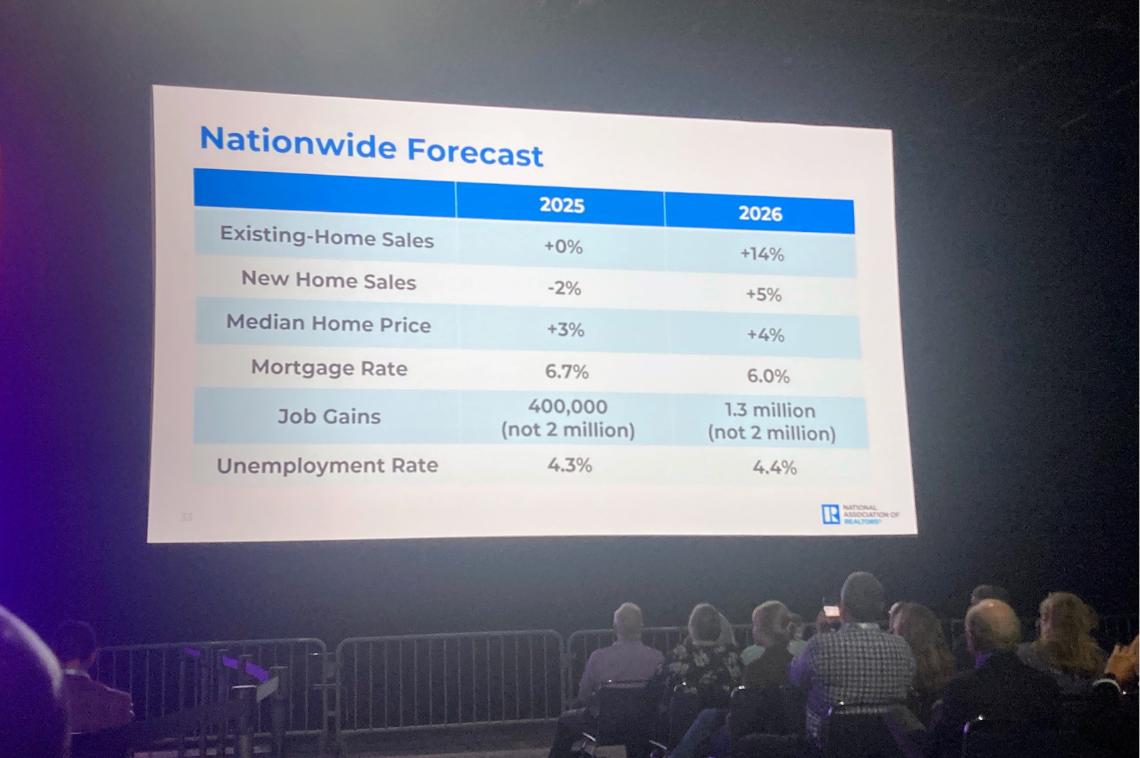

Buoyed by the reopening of the government on Thursday, a bit of optimism was in the air at NAR NXT, where Chief Economist Dr. Lawrence Yun predicted a 14% increase in existing-home sales in 2026, along with a 5% increase in new-home sales, a 4% increase in the median home price, and mortgage rates settling in at 6%.

Yun opened his presentation during the Residential Economic Issues and Trends Forum on Nov. 14 by celebrating the fact that “America is now open for business.”

“The government shutdown is over, and you should expect some of the deals that did not go through during the shutdown to slowly catch up,” he explained to the crowd gathered in Houston.

Drawing upon trends from the last government shutdown in 2018 – 2019, Yun said agents can expect to see more activity now that the government has reopened. He stressed, however, that the degree of the pick-up will be influenced by other market factors, such as interest rates.

“We were almost at a 6% mortgage rate just a few weeks ago,” said Yun. “Then it got bounced up and I think, today, it is around 6.3%. I think as we go into next year, the mortgage rate will be even a little bit better.

“And I definitely am using the adjective ‘a little bit’,” he added. “It’s not going to be a big decline, but there will still be some modest decline that will help improve affordability.”

Improvement, but lingering concerns

While home sales are still roughly 30% lower than pre-Covid data, Yun pointed to some improvement in year-over-year sales this past September. However, there are important details within that data to take into consideration.

“We are essentially finding that the upper-end market has been doing much better than the lower-end market,” said Yun.

According to NAR research, while home sales in the $250K – $500K price range increased by just under 10% from September 2024 to September 2025, home sales in the $1M-plus range increased by some 20% in the same time period.

“First, inventory is more readily available in the upper-end market,” he explained. “And the stock market—some days it appears to swing, but it’s essentially at a record high, and therefore, the wealthy are in more comfortable financial situations to make this transaction.”

While the September uptick in home sales and expectations for decreasing mortgage rates are positive signals, Yun explained that trends in consumer sentiment—this year hitting its lowest point in 25 years—still pose an obstacle to a full market rebound.

“Do you remember the great recession of 2008, 2009? The foreclosure crisis? Consumers are saying things are even worse today,” said Yun. “Will this impact home sales? It’s not only about the financial resources; people need to have confidence in order to purchase.”

Yun pointed to a potentially concerning sub-text in the consumer confidence data, which measures not only sentiment about the present, but the future as well. Normally, when consumer confidence about current conditions is low, their sentiment about the future is markedly higher.

“I think maybe that’s part of human nature,” said Yun. “You always want to say things will be a little better tomorrow. But look at what has been happening in recent years. Either future or present, people are not happy. Previously, Americans always had a little better hope for the future, but that is no longer the case.”

Wounded confidence combined with heading into real estate’s traditionally slower winter season will lead to an increasing number of days on market along with price reductions in the coming months, said Yun. For homesellers who list their home at an unrealistically high price, these trends will be more pronounced.

“If you misprice the home from the very beginning and it sits on the market for a very long time (91 – 120 days), you may have an almost 11% price reduction in order to get the closing done,” said Yun. For homes on the market longer than 120 days, the price reduction from list to closing rises to almost 14%.

What will influence mortgage rates

With a rate cut in both September and October, Yun believes there is a 50/50 chance of another cut in December.

“In my view, if I have to make a bet, I would say (the Federal Reserve) will make a cut in December, probably two more next year,” he said.

Yun stressed, however, that mortgage rates are not solely determined by the Federal Reserve. Rather, they are influenced by several factors, such as the federal budget deficit and tariff uncertainty.

“The mortgage rate almost reached 6% a couple of weeks ago, then suddenly bounced up about 30 basis points,” he explained. “The Supreme Court began to ask President Trump’s lawyer about the legality of tariffs. Over a 10-year cycle, it looks like Trump’s tariffs could bring in $3 trillion in revenue, which will lessen some of the budget deficit pressures. But it looks like the market is essentially saying that the Supreme Court will rule the Trump tariff as being unconstitutional.”

Other factors influencing mortgage rates include inflation, quantitative tightening and the stock market. Fed Chair Jerome Powell’s infamous delay in reducing interest rates, for example, was largely due to lingering concerns over inflation.

“Inflation is not under control and (the Fed’s) job is to control inflation,” said Yun. “(Inflation) is still running at 3%, and the preferred rate is 2% or below.”

Two fall rate cuts, however, came to pass despite the desired reduction in inflation. While pressure from President Trump may have played a role, Yun believes the primary deciding factor was a weakening job market.

“Why is the Federal Reserve cutting interest rates when the labor market does not appear to be weak?” asked Yun. “Because if you look at the data carefully, the monthly job additions, at least through August, is close to zero. And maybe in September and October it is already negative, yet we are in a blackout period, so we don’t have the data. That is why the Federal Reserve is cutting interest rates—to make sure we don’t go into an economic recession. Once fresh data comes out, we will see how it goes. But this is a five-year timespan, which is not going to change all that much with one or two more additional months of data.”

A better year on the horizon

Looking at positive signs in the market, Yun highlighted unprecedented homeowner equity.

Pointing to research that showed significant home price increases in virtually every state over the past five years, Yun noted that, “because of that price increase, we are at a record high in terms of real estate worth.”

And, according to Yun, this record level of equity is on solid footing.

“First, real estate is an inflation hedge,” he explained. “But here’s the second reason: Mortgage delinquency and foreclosures are still at historically low levels. Now some people will say, well, mortgage delinquencies are rising by 20%—but they’re rising to 20% from super low levels. Home prices are essentially on solid ground.”

When it comes to 2026, Yun said, “The light is flashing at the end of the tunnel.”

“Mortgage applications, even though some are not mortgage approvals, have been consistently above last year, implying that people’s desire to enter the market has been consistently positive,” he explained. “They just want a little lower mortgage rate and more inventory to get the deals done.

“It looks like this year, to be a bummer, there will be no increase in unit sales overall,” said Yun.

“Next year is really the year where you see some measurable increase in sales,” he said, adding that even though there may be temporary declines in certain cities, “home prices nationwide are in no danger of declining.”