Another year is almost in the books, and with it, a cavalcade of economists and experts seeking to peer into the future and predict the subsequent year’s housing market. As brokers and agents parse out their path forward, these big national trends are not always the most useful guidance—even when they are accurate.

After many major forecasts missed with overly optimistic predictions for this year (particularly for sales, which are on track to come in essentially flat from 2024), RISMedia asked leading brokers what their expectations are for sales, revenue and agent churn in 2026, with a focus on the local elements that are most relevant to a real estate business.

“There are still many areas in our region that have limited inventory and pent-up buyer demand. We also have areas with increasing inventory, moderating prices and lending availability,” said one broker, who requested anonymity.

With RISMedia’s Broker Confidence Index (BCI) dropping from 7 to 6.5—still above historic levels for this time of year—brokers largely said their expectations are in-line with what economists predict, looking toward a somewhat significant rebound in housing next year.

Scott Myers, CEO of CENTURY 21 Scott Myers REALTORS®, said the probability of the Federal Reserve further lowering interest rates is buoying overall expectations for a healthy market right now.

“Lots of pent-up demand waiting for this type of good news,” he claimed.

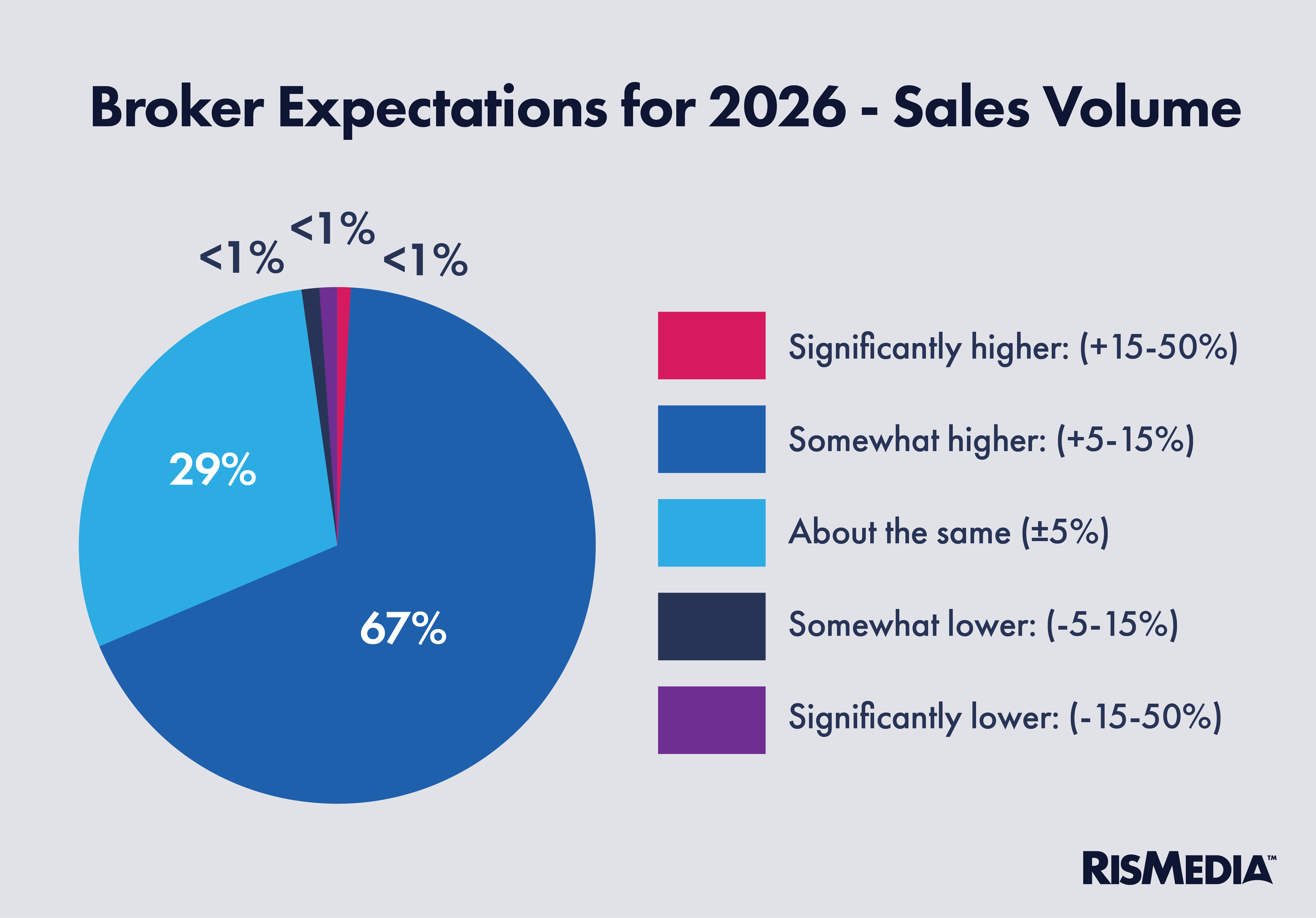

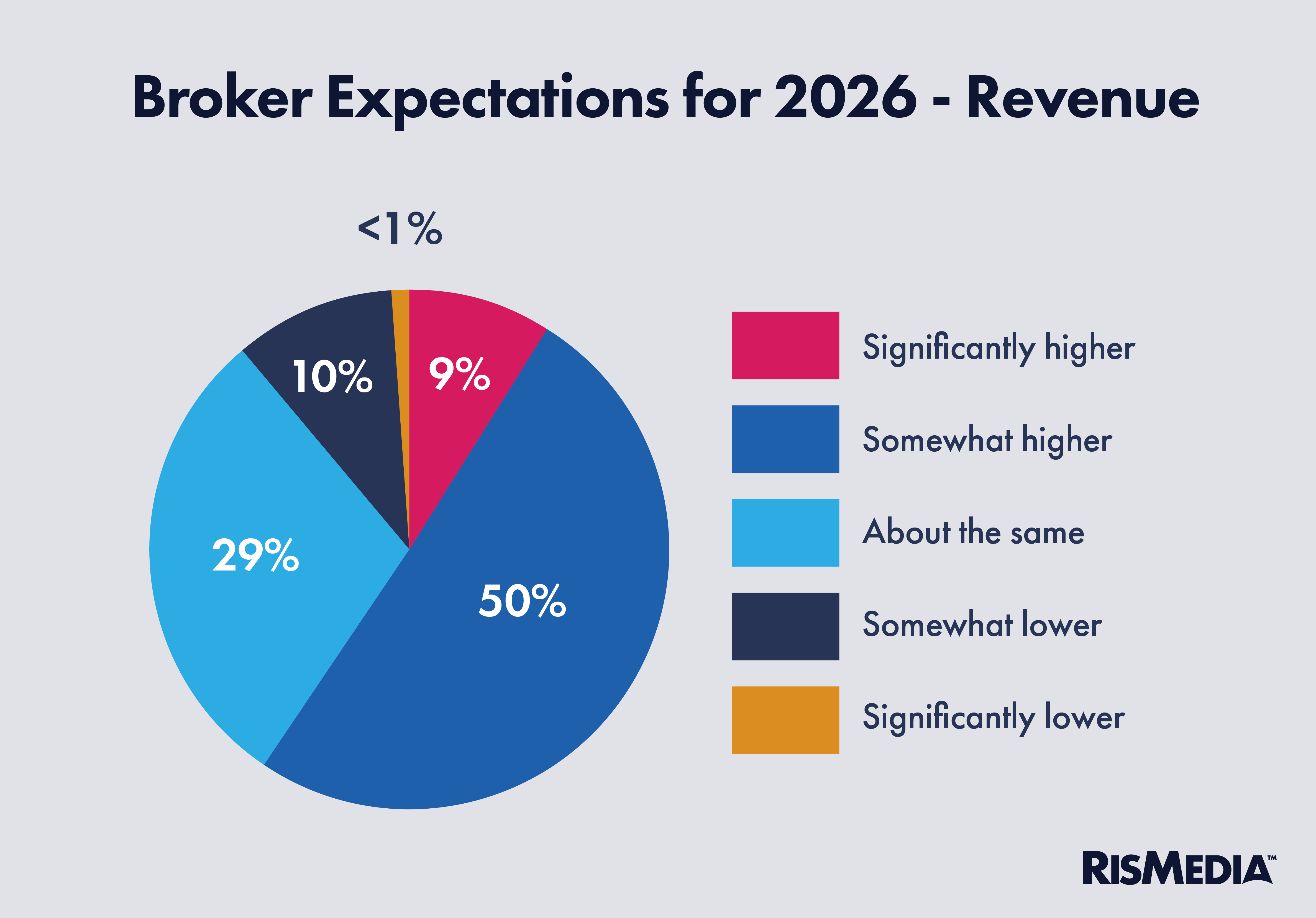

Quantitatively, the vast majority of brokers said they are looking forward to a slight increase in sales volume in 2026, with less certainty regarding revenue amid broader economic uncertainty.

That range, of 5%-15%, reflects what most housing forecasters are predicting for overall sales, with the National Association of Realtors® (NAR) on the high end while economists at the portals, MLSs and big brokerages call for a single-digit uptick in transactions.

Early this year, brokers responding to RISMedia were more reserved, with less than half saying they expected high sales volume in 2025 compared to 2024. What are brokers seeing that gives them increased confidence in real estate right now?

“Overall economic optimism, a positive political environment and consumer confidence,” wrote Steve Roney, CEO and owner of Berkshire Hathaway HomeServices Utah Properties.

That all represents reversals in those factors from the spring, when worries about tariffs and federal policies appeared to leave consumers hesitant and worried. Surveys continued to show weak levels of consumer confidence in the economy, though up slightly from recent lows.

That general uncertainty about the economy appeared to affect brokers as well, with less optimism about their business revenue next year despite expectations for increased sales.

The local factors

As most real estate professionals know, the national housing picture is generally unhelpful for understanding a local market—and can even be a barrier as consumers are bombarded with inaccurate narratives from mainstream news.

Jim Fite, CEO of CENTURY 21 Judge Fite Company based in Texas and Oklahoma, pointed to “buyer apathy” as a factor in the market but also noted that his region is well positioned from a foundational standpoint.

“Local economic conditions are among the best in the country. My comments are primarily based on the number of real estate companies opening up, more business models,” he said. “The vast majority are not business-minded people.”

Many other brokers with a positive outlook noted their regions have momentum from relocations or a better balance of inventory and demand—something economists predict will characterize more markets in 2026.

“We are in a four-season vacation area that serves the greater Boston market,” wrote Andy Smith, broker/owner of Badger Peabody & Smith Realty in New Hampshire. “Strong economy in (New Hampshire), and a flight to safety of all kinds environmental, civil, economic.”

That “flight to safety” though, means that consumer and economic concerns are still a factor. Other brokers reported that political or economic worries in their region continue to impact housing decisions.

“Political chaos in the United States make(s) consumers scared/nervous and makes people want to wait before making huge financial decisions. Potential for local layoffs and affordability are regional factors,” said another broker who requested anonymity.

Housing affordability remains a primary barrier to the overall market, with President Donald Trump and his administration promising to address the issue (largely focusing on deregulation and pointing to mortgage rates “trending in the right direction”). More recently, though, the federal government has made significant cuts to affordable housing subsidies as the administration has publicly mulled 50-year or portable mortgages.

NAR’s affordability index has shown homes becoming less affordable this year overall, even as mortgage rates have fallen. At the same time, price appreciation and supply-demand dynamics have demonstrated that demand is still strong in more affordable areas.

“I believe overall there is buyer confidence and more availability, but there is a lot of concern over federal policies,” said another broker who requested anonymity.

Confidence dip

Historically, the BCI has followed seasonal patterns, falling but at least one full point between August and January.

This year, the index actually saw a significant jump in September, which held through October as mortgage rates fell, and sales saw a corresponding bump.

But last month, as the holidays loomed and rates held essentially steady, the BCI fell, with brokers noting a significant—but not unexpected—dip in activity.

“Buyers and sellers are getting mixed signals affecting their confidence in the economy and their future,” said another broker who asked to remain anonymous.

The current reading of 6.5 is still higher than any other November BCI survey in the last four years. November of 2023 saw the lowest reading of existing-home sales since 2010, with a corresponding low for the BCI. Conversely, winter of last year was characterized by an unexpected surge, with the seasonally adjusted rate of sales peaking in November and December as the BCI rose to 6.4. This year, sales have ticked up slightly since a slower-than-expected summer, with data for November not yet released.