Over the past 12 months, single women made up 17 percent of all homebuyers, purchasing at twice the rate of their single male counterparts, according to a new annual report from the National Association of REALTORS®.

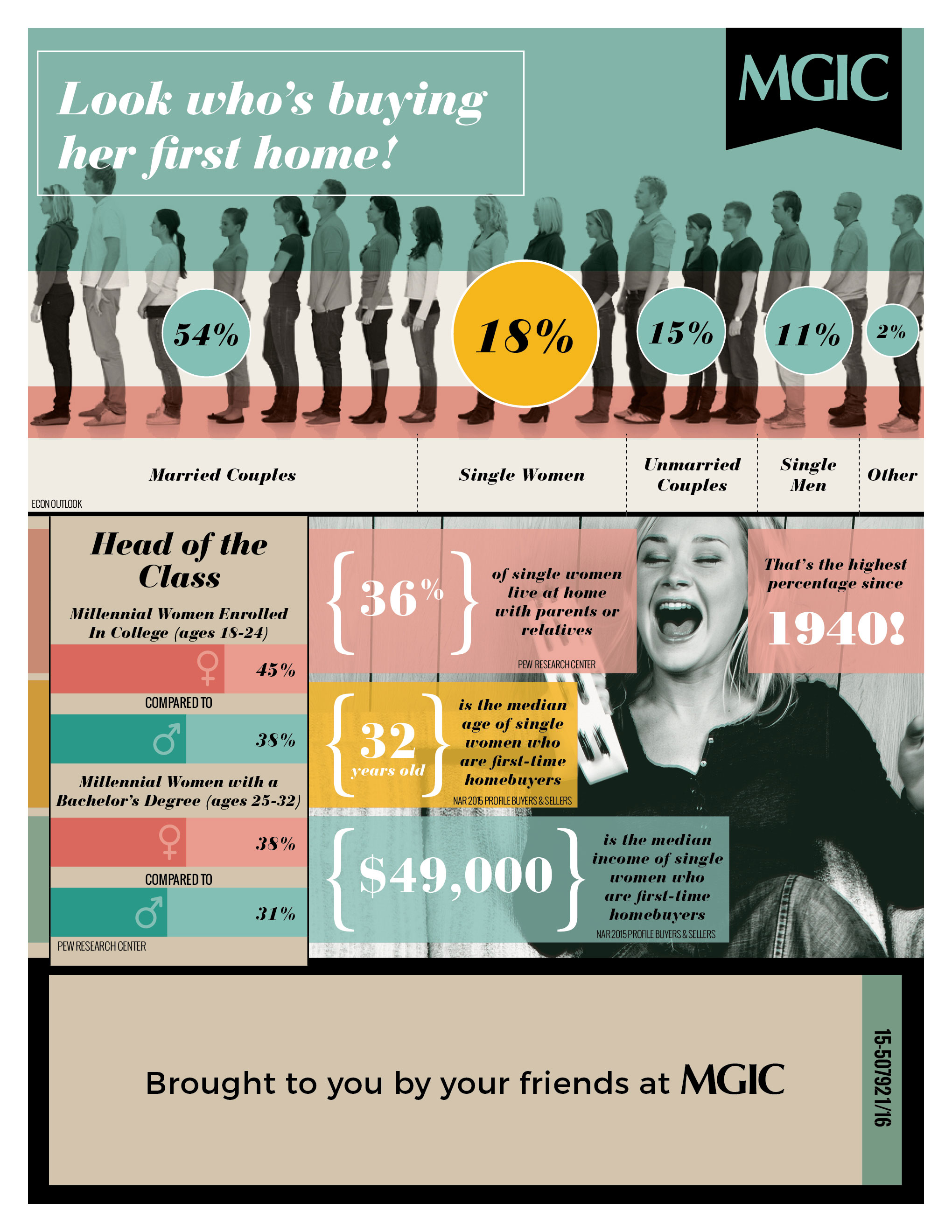

Furthermore, 2016 research from MGIC Connects shows single women representing the second-largest home-buying group, right behind married couples. This is even more impressive when you consider wage inequality, which is still a country-wide issue. In 2015, women made only 80 cents for every dollar earned by men working a comparable job—a gender wage gap of a shocking 20 percent.

So, women are kicking butt in the housing market. But who are these ladies? According to NAR’s 2015 Profile of Buyers and Sellers report, the median age of the single female buyer is 32 years old, and their median income is $49,000. But it’s not just 30-something ladies purchasing their homes solo, but baby boomers, divorced and out on their own, or downsizing from a family home they no longer need.

Unfortunately, all this forward movement for female homebuyers doesn’t come without the occasional stigma. A 2016 RealtyTrac study found that homes owned by single men are valued 10 percent higher, on average, than homes owned by single women. At the time of the study, the value of homes owned by single men averaged $255,226—10 percent above the $229,094 average of homes owned by single women. Womp womp.

According to the RealtyTrac study, the following markets have the largest percentage of housing inequality, with homes owned by men trumping value of those owned by women:

- District of Columbia: 14% higher

- Florida: 12% higher

- West Virginia: 12% higher

- Wisconsin: 12% higher

- Texas: 10% higher

- Alabama: 10% higher

Despite this, three states kick the gender gap in its numerical butt, with the average value of homes owned by single women ranking higher than those owned by single men. These gems are:

- Massachusetts: 11% higher

- Kentucky: 2% higher

- Kansas: 1% higher

What’s in store for the future of female-owned housing? When you consider the consistent rise in the educated woman (meaning higher-paying jobs and more opportunities), well, things are looking pretty peachy. Check out the following infographic, courtesy of MGIC.

This was originally published on RISMedia’s blog, Housecall. Visit the blog daily for housing and real estate tips and trends.