RISMEDIA, June, 2009-During its midyear meetings, the National Association of REALTORS® (NAR) research division, led by Chief Economist Lawrence Yun, released a study on the jumbo mortgage market and its impact on the housing market overall. The jumbo mortgage market faces significant challenges. Securitization has come to a standstill, spreads have sky-rocketed, and banks’ ability and willingness to hold loans in portfolio has been curtailed by mounting losses and capital shortfalls. While there has been resistance to efforts designed to assist a segment of the market largely seen as serving the rich, the continued lack of jumbo financing is impeding the housing market recovery.

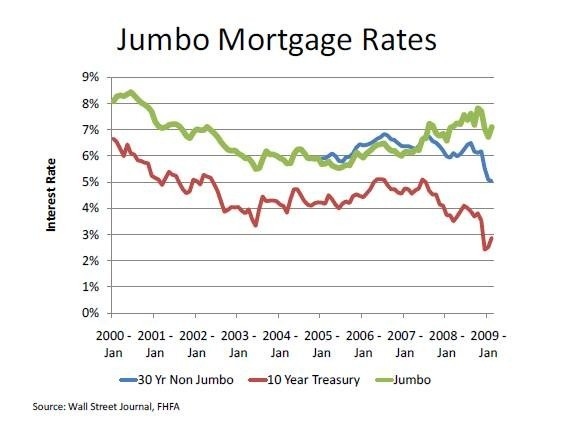

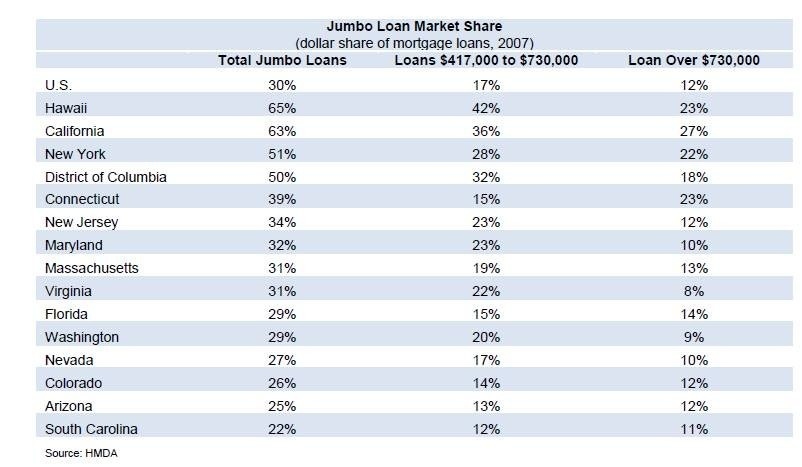

Congress recently increased the conforming loan limit to as much as $729,750 in a few high-cost areas. Now the mortgage market has three primary types of loans: loans up to $417,000 are considered “conforming;” loans between $417,000 and $729,500 are “conforming jumbo;” and loans over $729,500 are “super-jumbo.” Though conforming mortgage rates are at 50-year lows, jumbo loans are dramatically more costly. Essentially, any loan above $417,000 will have a higher rate than a conforming loan, even those eligible for Fannie Mae and Freddie Mac securitization. While the spreads vary depending on the loan, it is quite common to see a spread in the 2% range. This is leaving many higher end buyers saying “why me?” as they face 20% or more downpayments and mortgage rates closer to 7% than to 5% regardless of a good credit and other measures of their ability to repay.

The impact of higher jumbo rates affects markets across the country and it is showing up in sales numbers. Even though limits in high cost areas have increased, a significant portion of those markets are outside the conforming limit. Likewise, in other areas, where the limit is $417,000, sales of higher-end homes are lagging. Nationally, home sales above $750,000 have dropped nearly 50% since 2007, a steep decline even when compared to declines in overall sales.

Fourteen states have jumbo market shares above 25% in dollar volume. While the unit share may be proportionally smaller, the higher-end market is important to the housing economy overall. When one segment of the market experiences friction, the effect ripples through the market. Reduced sales on the high end negatively impact data on home prices which has a negative effect on buyer sentiment. It causes a misperception of broadly falling prices that keeps many people “on the fence.” The lack of reasonably priced loans is also an impediment to those wishing to move up to a larger home or a location closer to work.

What Can be Done?

There are a number of ways that high-end lending can be improved. NAR has advocated that Term Asset-backed Loan Facility (TALF) and Public-Private Investment Program (PPIP) funds be used to purchase jumbo MBS to help restart a securitization market. Another option is lifting the Fannie and Freddie loan limits further and more broadly. The political sentiment for doing this is not presently strong. A third option is promoting new (at least for the U.S.) financing vehicles such as Covered Bonds. While a different mechanism, the covered bond model could be a way to raise jumbo capital more efficiently. It may not have the effect of bringing jumbo rates in line with conventional rates, but could have the effect of reducing spreads to more reasonable levels. Whatever the policy response, it is clear from the NAR study that something needs to be done or we will not see as broad a recovery in the housing market.

Ken Trepeta is the director of Real Estate Services for NAR. For more information on the National Association of REALTORS® Real Estate Services program, please visit www.realtor.org/res.