RISMEDIA, April 13, 2011—In one of the first articles I wrote for this column, I said that the majority of home buyers today without 20% to put down on a new home are getting an FHA loan. I also said that many of those home buyers—in particular, those with a 720 or better FICO score—could have saved money on a conventional loan with private mortgage insurance (MI). And now that the FHA is increasing their pricing for the second time in less than six months, this message is even truer today.

RISMEDIA, April 13, 2011—In one of the first articles I wrote for this column, I said that the majority of home buyers today without 20% to put down on a new home are getting an FHA loan. I also said that many of those home buyers—in particular, those with a 720 or better FICO score—could have saved money on a conventional loan with private mortgage insurance (MI). And now that the FHA is increasing their pricing for the second time in less than six months, this message is even truer today.

While it’s typically the loan officer’s responsibility to know the ins and outs involved in mortgage lending, with the current market changing and the FHA taking further steps to reduce the number of loans they insure, it’s important for you to also understand these two simple points about private MI from companies like Radian. For example, come April 18th, Radian can:

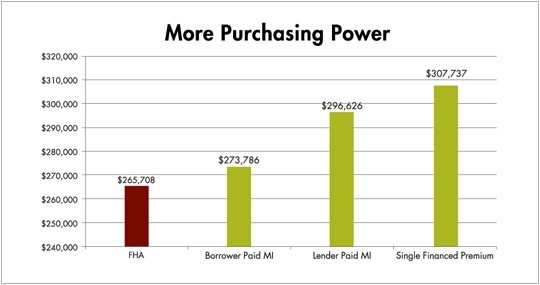

1. Give your buyer 18% more purchasing power over the FHA.

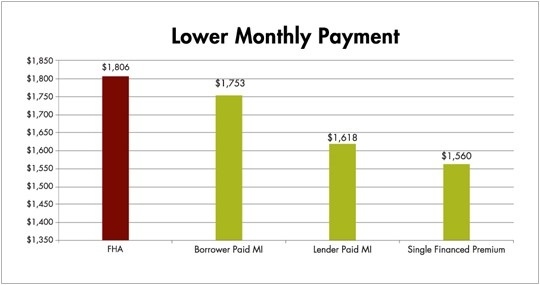

2. Help you to qualify more home buyers and increase your sales by lowering a buyer’s monthly payment by up to 15% over the FHA.

Even in the healthiest housing market, it’d be hard to argue with numbers like this. Check out the comparisons below to see how the FHA increase stacks up in some real-life examples.

Based on a 30-year 95% LTV loan, a monthly payment of $1,600 and a FICO of 760; interest rate is 5% for all with the exception of LPMI which has a 5.5% rate.

Based on a 30-year 95% LTV loan, a base loan amount of $285,000 and a FICO of 760; interest rate is 5% for all with the exception of LPMI which has a 5.5% rate.

While there may be uncertainty about pending changes to home finance rules, there are two things that are certain. FHA prices are going up and, in many cases, conventional financing with MI will be the best option for you and your buyers. Secondly, with the Administration’s recommendation that Congress allow the FHA conforming loan limit increase to expire as scheduled on October 1, 2011, it’s clear that this change won’t be the last to ensure the FHA returns to its traditional, smaller role in the housing market.Now that I’ve had a chance to look at MI from a new perspective, and when you consider what numbers like these could mean for your bottom line—not to mention referral and repeat business from the home buyers you helped—I’m simply asking that you consider the options. Or better yet, ask your lending partner to compare the FHA’s new rates to a conventional loan with private MI. You (and your buyers) won’t be sorry you did.

Brien McMahon is chief franchise officer of Radian Guaranty Inc. More information may be found at www.radian.biz.