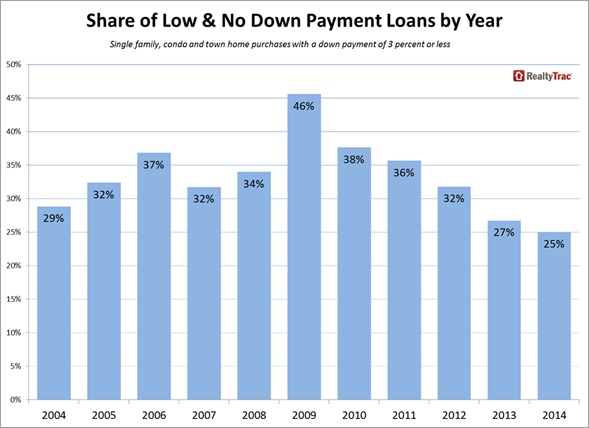

Those using low down payment plans dropped last year, according to recently released news from RealtyTrac, who analyzed the size of down payments on nearly 20 million purchase loans for single family homes and condos nationwide from 2004 through 2014. Results show that in 2014 the share of buyers putting down 3 percent or less dropped to its lowest level during the last decade.

Those using low down payment plans dropped last year, according to recently released news from RealtyTrac, who analyzed the size of down payments on nearly 20 million purchase loans for single family homes and condos nationwide from 2004 through 2014. Results show that in 2014 the share of buyers putting down 3 percent or less dropped to its lowest level during the last decade.

Share of Buyers Using Low Down Payment Loans Drops to 11-Year Low in 2014

In 2014, 25 percent of buyers using conventional or FHA loans put less than 3 percent down when purchasing a home, down from 27 percent in 2013 and down from a peak of 46 percent in 2009, when a first-time homebuyer tax credit stimulated purchases by first-time homebuyers, who are more likely to utilize low down payment loans.

The share of low down payment loans was at 37 percent in 2006 before the housing price bubble burst, dropping in 2007 and 2008 before jumping again in 2009. Since 2009 the share of buyers using low down payments has dropped every year compared to the previous year.

Average down payment hit high of 15.6 percent ($58,900) in 2013

The weighted average down payment percentage has held fairly steady between about 13 and 16 percent over the past decade. The average down payment percentage reached an 11-year high of 15.6 percent in 2013, falling to 15.4 percent in 2014, while the average down payment percentage was at its 11-year low in 2009, when it was 12.9 percent.

An average purchase price of $291,428 and an average loan amount of $232,527 in 2013 translated into an un-weighted average down payment of $58,900, also the highest in terms of dollar amount of any year since 2004. The un-weighted average down payment in dollars dropped slightly to $58,496 in 2014.

Lowest average sales prices on low down payment purchases

The lower the down payment, the lower the average price, according to the analysis. For purchases where there was no down payment (the combined loan amount was actually more than the purchase price, typically indicating a down payment assistance program or purchase-rehab loan was involved) the average sales price was $154,214, while for purchases with a down payment of less than 3 percent but more than 0 percent, the average sales price was $190,304.

For every down payment percentage range higher, the average purchase price was also higher except for between the 10 to 15 percent and 15 to 20 percent range. On the other end of the spectrum, the average purchase price in 2014 was $502,213 for purchases when the borrower put down 50 percent or more.

View the full report here.