RealtyTrac® recently released an analysis of wage growth and home price appreciation during the U.S. housing recovery of the past two years that found home price appreciation has outpaced wage growth in 76 percent of U.S. housing markets during that time period. The report also found home price appreciation nationwide has outpaced wage growth by a 13:1 ratio.

RealtyTrac® recently released an analysis of wage growth and home price appreciation during the U.S. housing recovery of the past two years that found home price appreciation has outpaced wage growth in 76 percent of U.S. housing markets during that time period. The report also found home price appreciation nationwide has outpaced wage growth by a 13:1 ratio.

For the report RealtyTrac analyzed growth in average weekly wages from the Bureau of Labor Statistics and median home prices derived from sales deed data in 184 metropolitan statistical areas nationwide with a combined population of nearly 228 million, comparing 2014 to 2012 numbers (see full methodology below).

“Home prices in many housing markets across the country found a floor in 2012 and since then have rapidly appreciated, particularly in markets attracting institutional investors, international buyers or some other flavor of cash buyer not constrained by income as much as traditional buyers,” says Daren Blomquist, vice president at RealtyTrac. “Eventually, however, those traditional buyers will need to play a bigger role in the housing market for the recovery to maintain its momentum.

“Those markets with the biggest disconnect between price growth and wage growth during the last two years are most likely to see plateauing home prices in 2015 until wages catch up,” Blomquist continued. “Meanwhile, markets where wage growth has outpaced home price appreciation during the last two years are poised to see at least steady growth in home prices 2015 in most cases.”

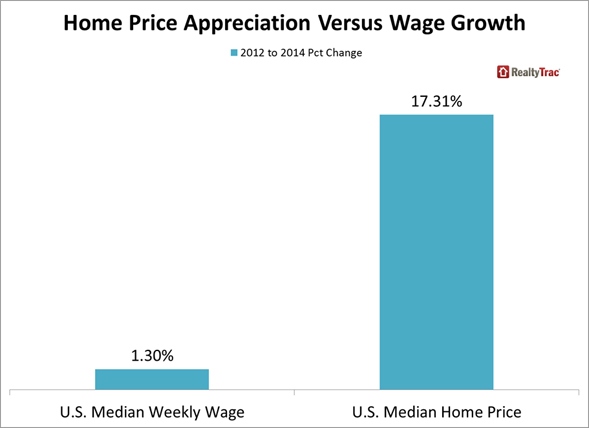

Wages up 1.3 percent, home prices up 17 percent during housing recovery

Nationwide, median wages have increased 1.3 percent between the second quarter of 2012 —when home prices bottomed out and started rising again — and the second quarter of 2014. Meanwhile home prices have increased 17 percent in the two years ending in December 2014, outpacing wage growth by a 13:1 ratio.

Among the 184 metro areas analyzed, the average wage growth over the two years ending Q2 2014 was 3.7 percent while the average home price appreciation in the two years ending in December 2014 was 13.4 percent.

Despite the rapid increase in home prices, most markets are still affordable by traditional standards. Of the total 184 markets analyzed, 135 (73 percent) with a combined population of 143 million had a median home sales price in December that required less than 28 percent of median income for monthly mortgage payments, including property taxes and insurance.

“South Florida is still an affordable market and a bargain when compared to other major cities. Low interest rates and prices moderating at historical single-digit levels bodes well for all as our economy is diversifying and gaining momentum,” says Mike Pappas, CEO and president of a South Florida real estate company, where home price appreciation outpaced wage growth by a ratio of 7:1 during the housing recovery but where mortgage payments on a median-priced home represent 27 percent of the median household income. “Construction and hospitality are booming but we are also seeing strong gains in the financial, tech, and health industries.”

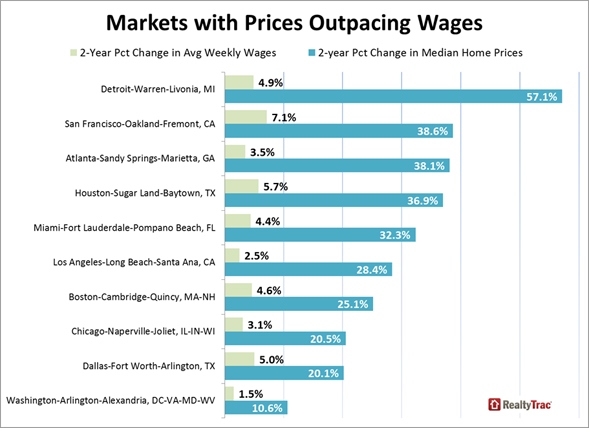

Home price appreciation outpaces wage growth in 76 percent of markets

Home price appreciation outpaced wage growth in 140 of the 184 metro areas (76 percent) with a combined population of 176 million. Metropolitan statistical areas with the highest ratio of price appreciation to wage growth included Merced, California (141:1), Memphis, Tennessee (99:1), Santa Cruz, California (94:1), Augusta, Georgia (78:1), and Palm Bay-Melbourne-Titusville, Florida (62:1).

Other metro areas where home price appreciation has outpaced wage growth by a wide margin during the housing recovery included Sacramento, California (17:1 ratio), Riverside-San Bernardino, California (15:1 ratio), Las Vegas, Nevada (14:1 ratio), and Detroit (12:1 ratio).

“As wage growth remains fairly flat across the Ohio markets, the effects of low available inventory continue to escalate prices, creating a negative effect on home affordability for many first time, and move up home buyers,” says Michael Mahon, executive vice president of a real estate firm covering the Ohio markets of Cincinnati, Dayton and Columbus, the latter of which has seen home price appreciation outpace wage growth by a ratio of 9:1 during the housing recovery. “While the time to purchase is now, for home buyers to take advantage of all time low interest rates, continued stress on home affordability and credit repair shall leave many missing this prime time opportunity of home ownership.”

Among the 140 markets where home price appreciation has outpaced wage growth during the housing recovery, 45 metro areas (32 percent) with a combined population of 63 million had a median home price in December that required more than 28 percent of the median income for monthly mortgage payments — unaffordable by traditional standards.

These 45 markets traditionally unaffordable markets with price appreciation outpacing wage growth included Los Angeles, San Francisco, San Jose and San Diego in California, Seattle, Portland, Boston and Denver.

“Marketing homes in areas that have home ownership costs continually outpacing wage growth means that you run into more people leaving areas for their next move, up or down,” says Mark Hughes, chief operating officer at a real estate company covering the Southern California market. “The dynamics driving the affordability, or lack of affordability, have as much to do with the new global nature of real estate as much as they have to do with the speed of local wage acceleration. Southern California will remain increasingly unaffordable from within, but a hot commodity world-wide.”

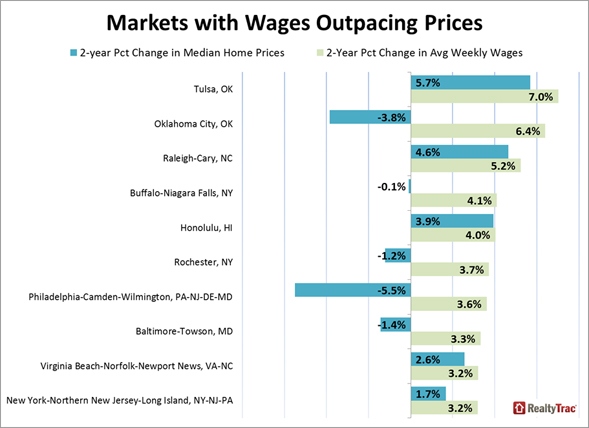

Wage growth outpaces home price appreciation in 24 percent of markets

Wage growth outpaced home price appreciation in 44 of the 184 metro areas (24 percent) analyzed with a combined population of 51 million. Metropolitan statistical areas with the lowest ratio of home price appreciation to wage growth were Hagerstown-Martinsburg, Maryland-West Virginia, Wichita, Kansas, Des Moines, Iowa, Gulfport-Biloxi, Mississippi, and Harrisburg, Pennsylvania.

Other metro areas where wage growth outpaced home price appreciation during the housing recovery included New York, New Haven, Connecticut, Virginia Beach, Tulsa, Oklahoma, and Raleigh, North Carolina.

Top 25 metros with highest rate of home price appreciation

Metropolitan statistical areas with the highest rate of home price appreciation during the two years ending in December were Detroit (up 57 percent), Salinas, California (up 49 percent), Myrtle Beach, South Carolina (up 47 percent), Houma-Bayou Cane-Thibodaux, Louisiana (up 45 percent), and Modesto, California (up 44 percent).

Other metro areas among the top 25 for highest rate of home price appreciation in the two years ending in December 2014 included San Francisco, California (up 39 percent), Atlanta (up 38 percent), Houston (up 37 percent), Sacramento, California (up 37 percent), San Jose, California (up 33 percent), and Memphis (up 33 percent).

Top 25 metros with highest rate of wage growth

Metropolitan statistical areas with the highest rate of wage growth in the two years ending in the second quarter of 2014 were Gulfport-Biloxi, Mississippi (up 13.2 percent), Naples-Marco Island, Florida (up 9.2 percent), Houma-Bayou Cane-Thibodaux, Louisiana (8.9 percent), Manchester, New Hampshire (8.4 percent), and San Jose, California (8.3 percent).

Other metro areas among the top 25 for highest rate of home price appreciation in the two years ending in December 2014 included Madison, Wisconsin (up 8.1 percent), San Francisco (up 7.1 percent), Tulsa, Oklahoma (up 7.0 percent), Provo, Utah (up 7.0 percent), and Albany, New York (up 6.4 percent).

For more information, visit www.realtytrac.com.

For more information, visit www.realtytrac.com.