As the cost of homeownership increases and options remain thin, family is stepping in.

Among first-time homebuyers this year, 32 percent depended on family or friends for financial help purchasing, commonly in the form of gifts or loans, according to the 2019 Profile of Home Buyers and Sellers, the annual National Association of REALTORS® report, newly released.

Buyers depended on family or friends for help saving, too. Before buying their home, 23 percent cohabitated with family or friends, accumulating down payment savings without the additional burden of market-rate rent. Furthermore, in a growing trend, 4 percent of first-time homebuyers purchased as roommates. The average first-time homebuyer put 6 percent down, according to the report, and 25 percent financed through an FHA loan, which has a more affordable down payment threshold.

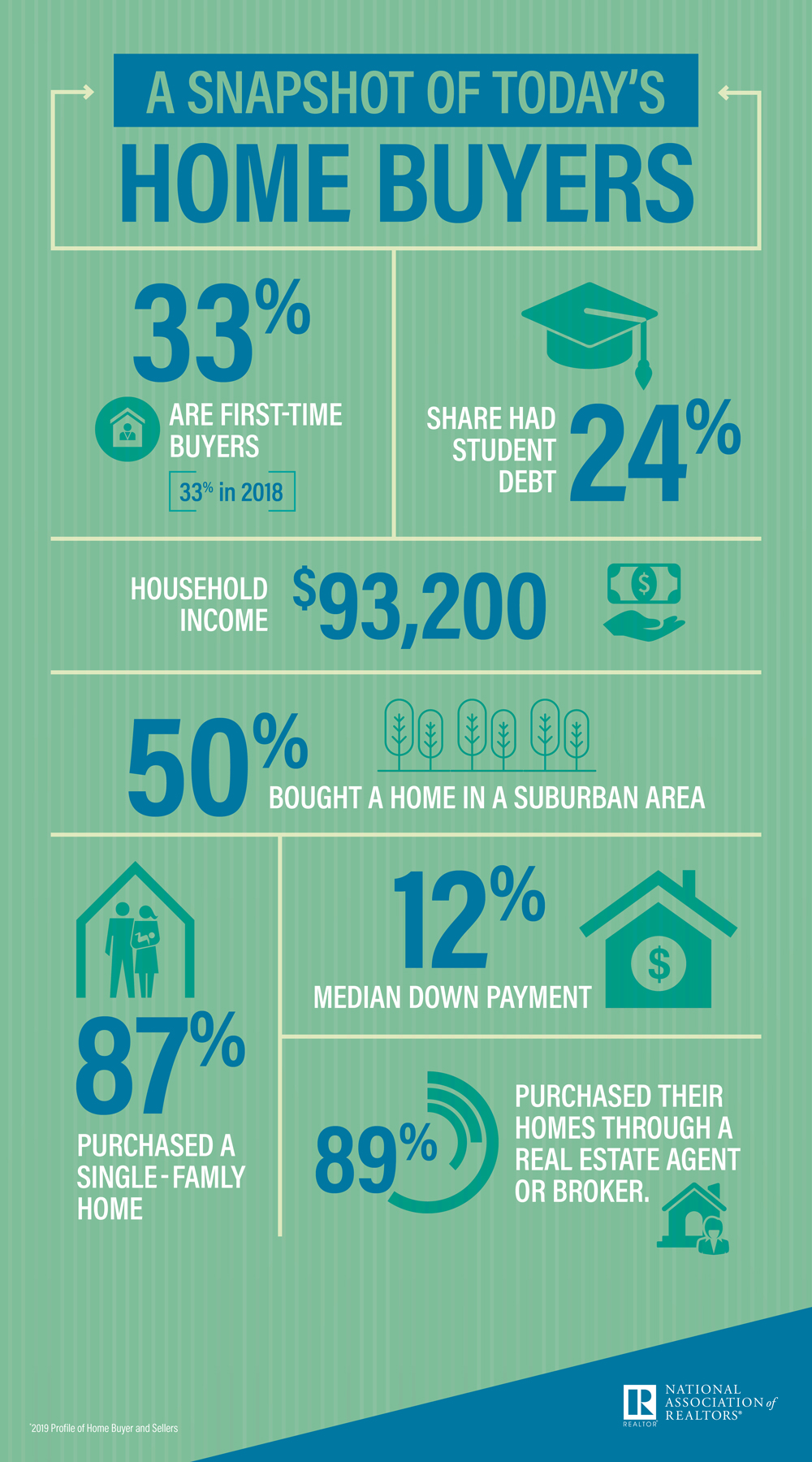

Despite the financial lift, 33 percent of buyers were first-timers—below the historic 40 percent. According to John Smaby, NAR president, a critical factor is supply, which is exceedingly limited in the starter tier, where first-timers search.

“Prerecession, the number of first-time buyers was higher in part because buyers had more options,” says Smaby. “However, over the past few years, we have unfortunately experienced a scarcity in housing inventory, especially at the middle- and lower-end of the market.”

“Low inventory conditions hurt would-be first-time buyers most,” explains Lawrence Yun, chief economist at NAR. “Their homeownership dream and the opportunity to build wealth gets delayed until more inventory choices reach the market.”

Because of the inventory shortage, buyers depend heavily on their REALTOR®, according to the report. Still, 52 percent found their home online—the majority. In the buyer-REALTOR® relationship, they appreciate experience, honesty and negotiation and pricing skills.

On the home-selling side, the average seller was 57 years old this year, and profited $60,000 at sale, the report shows. Typically, they garnered 99 percent of the price, and their home sold in three weeks. The average seller’s tenure was 10 years—considerably longer than six, the historic norm—and, when they moved, they bought newer and pricier compared to their previous property. Eighty-nine percent listed with a REALTOR®, and 66 percent were “very satisfied” with the process.

“Today, repeat buyer behavior is more similar to first-time buyer behavior as tenure in home has increased,” Jessica Lautz, vice president of Demographics and Behavioral insights at NAR, says, adding, “All buyers are doing their homework—going to open houses, following housing news—and are more reliant than ever on the expert advice of real estate agents and brokers.”

A Record Year

Within the report, there were many records set this year—a marked sign of the times.

- Of all homes purchased, just 13 percent were new—an all-time low.

- Of all homes sold, just 8 percent were FSBOs, closing in on the lowest on record.

- The average first-time homebuyer is 33 years old—the oldest on record.

- Of first-time homebuyers, 17 percent were couples that were unmarried—a high rate, compared to the historic trend.

- The average non-first-time homebuyer is 55 years old—a high hit in 2018, and repeated this year.

- Of home sellers, 16 percent bought closer to family and friends—the most common motivation in the report, and a first as the most popular reason.

For more information, please visit www.nar.realtor.

Suzanne De Vita is RISMedia’s online news editor. Email her your real estate news ideas at sdevita@rismedia.com.

Suzanne De Vita is RISMedia’s online news editor. Email her your real estate news ideas at sdevita@rismedia.com.

Thanks for the infographics

very informative. nice visuals

The first time home buyers I work with are not generally coming to the table with family money. Instead, we’re using seller contributed closing cost help, and first time buyer mortgage programs available in the Baltimore County MD area.

Hi Suzanne,

Very well researched article. I think for Millenials the challenge is still the low inventory in relation to the job growth stagnation from the 2008 housing crisis. Plus, with the 24% student debt, you mention in your infographic. With that said, it’s no wonder folks trying to buy homes are exploring alternative ways to finance their first home than the traditional route.

Plus, having living arrangements that allow for an opportunity to finance. I think that it’s risky to read in your article that roommates are purchasing homes together, but maybe it works out in the long run. I am curious about what the Covid-19 situation will bring in the next couple of years for first-time homebuyers?

Keep up the good work.

-Matthew