Amassing more than $2.4T in collective sales volume for 2021, RISMedia’s Top 1,000 Power Brokers reflect the outcome of one of the hottest real estate markets in decades. The detailed results are now available in RISMedia’s 2022 Power Broker Report, ranking real estate firms by both sales volume and transactions in 2021.

See RISMedia’s 2022 Power Broker Directory

The production results for 2021 reflect the unprecedented nature of last year’s market. The Top 1,000 respondents to this year’s Power Broker Survey report a collective $2,468,407,918,793 in sales volume for 2021, representing 5,008,011 transactions. Not only does this mark a significant increase over 2020’s numbers, it clearly depicts the inventory strain on last year’s market. While total sales volume increased by nearly $800B YoY, transactions only increased by about 750,000. The cause of the discrepancy is obvious when comparing the YoY average sales price for the Top 1,000: $394,043 in 2020 vs. $492,857 in 2021. With not enough supply to meet demand, home-sale prices—and brokerage sales volume—rose to new heights.

The Inventory Shortage: Problem or Semantics?

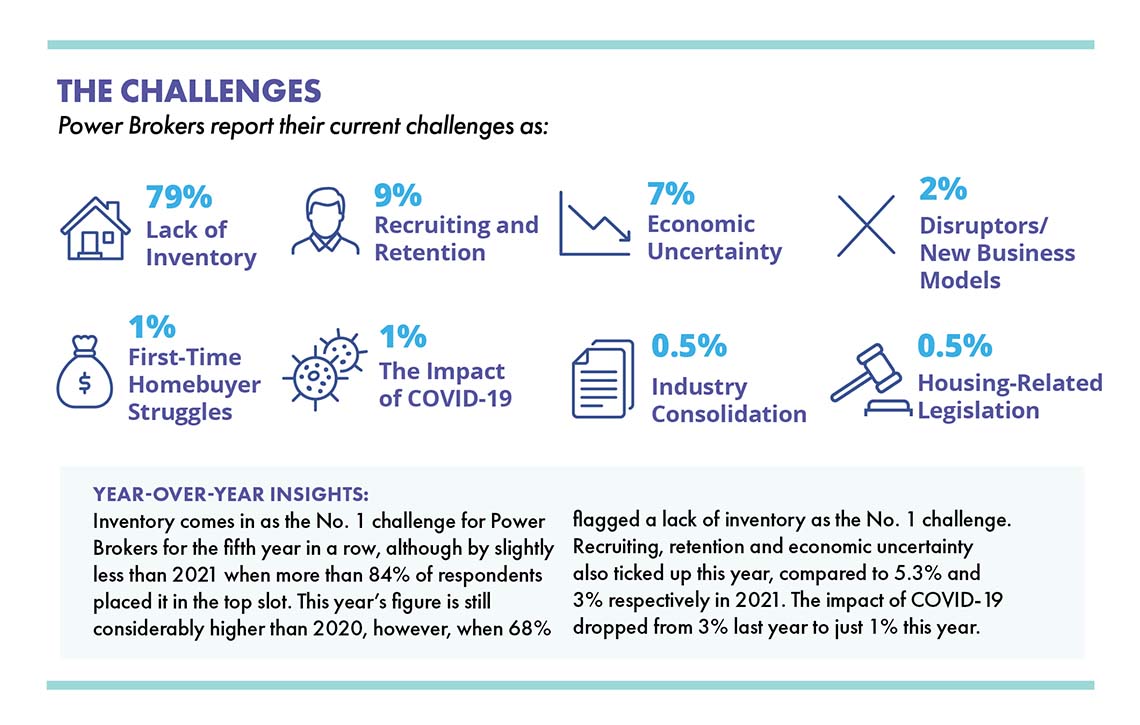

If there’s one thing Power Brokers continue to agree upon it’s that there simply aren’t enough homes to go around. For the fifth year in a row, respondents flagged a lack of inventory as their top challenge, chosen by 79% of Power Brokers in this year’s report—less than the 84% in 2021, but notably higher than 2020’s 68%.

“Continued delays in the natural progression of sellers to the market, along with decade-long underbuilding, leaves our markets struggling to meet the demands of population growth and economic developments,” says Dereck Fritz, vice president of Berkshire Hathaway HomeServices Homesale Realty in Pennsylvania.

Yet with more than 6 million home sales in 2021, it’s still hard to say there’s a shortage. As RE/MAX CEO Nick Bailey said during the RE/MAX R4 Conference in March, it’s not a question of too little inventory, but rather, who has it.

“If we had an inventory problem, you wouldn’t have been able to sell 6.12 million homes,” Bailey told attendees at the event’s opening session. “The inventory was there—the problem was it flew off the shelves in record time. Inventory’s not the problem, it’s who gets it and the timeline in getting it off the shelf. Inventory is only low when it’s not yours.”

With that in mind, Power Brokers are becoming more competitive and creative in their strategies to secure listings. “The average amount of equity currently in the hands of each homeowner is at an all-time high,” says Jake Piller, broker/owner of Weichert REALTORSⓇ Heartland in Minnesota. “We are striving to focus on this number and get the word out to each potential seller or those on the fence so they know the reality of the market right now. It is a great time to cash in on the equity and take advantage of what are still low interest rates.”

Power Brokers don’t expect the supply and demand imbalance to correct itself anytime soon. “Buyer demand remains high, however, very low inventory across all price points is expected to continue,” says Shawn Schmidt, vice president of Park Co. REALTORSⓇ in North Dakota. “Affordability is a concern as inflation outpaces individual earnings and mortgage rates increase while home prices remain high due to demand. Supply chain issues continue to add to new-home prices.”

Moving Past the Pandemic, But Dealing With the Aftermath

Along with most of the world, Power Brokers seem to have put COVID-19 and its effects on the housing market behind them, with just 1% reporting pandemic concerns as a challenge to current business. That said, the ripple effect of the pandemic will continue to be felt for some time.

“I believe the impact of the pandemic and the isolation of agents will have a negative impact on the traditional brokerages,” says Michael Killmer, broker/owner of CENTURY 21 North Homes Realty, Inc. in Washington state. “The economic concerns about inflation could stall the real estate market and make affordability out of reach with a rise in interest rates.”

For many Power Brokers, such challenges are a call to arms. As Trent Barney, CEO of Keller Williams Signature Partners in Kansas, explains, “The economy will continue to see the effects of the pandemic, political policy and cultural unrest for many years. Every business will have to lean into its systems and culture to bring in positive growth. There will be a shift in marketshare negatively impacting the average agent across the country. Every market has an opportunity. It will be our opportunity to shift our business model to adapt to the ever-changing industry and current environment. By focusing on relationships with our people, education, training, lead flow to agents and providing additional services, we will be able to enhance the agent experience and grow through 2022.”

Barney echoes the sentiment of most Power Brokers—to get innovative and take a hands-on approach to the challenges at hand. Jemila Winsey, broker/owner of ERA Legacy Living in Texas, exemplifies that spirit.

“The continued pandemic, economic concerns, social unrest, etc., present an unprecedented set of challenges to all industries no doubt; however, from my purview, I see an opportunity to grow and reinvent ourselves as brokers and owners,” she says. “We have had to roll our sleeves up to provide new tools and support that make our agents stand out as subject-matter experts. The glass is half-full from where we sit.”

A Positive—But Murky—Outlook

With so many variables affecting the current market—from economic concerns to geopolitical issues—the outlook for the remainder of 2022 remains murky, despite continued healthy demand from buyers. Like most Power Brokers in this year’s survey, Patrick Conner, president of California’s London Properties, is grappling with a double-edged sword.

“Inflation, we believe, will push people—homeowners, investors and businesses—into hard assets like real estate,” he says. “This is a positive, but leads to other issues like inventory crisis and rising sales prices. Inventory is a major concern—we see this continuing, especially as interest rates move up and the ‘golden cuffs’ of ‘rate-lock’ tighten. Interest rates are a moving target that will, at a minimum, cause our market to pause by the third quarter.”

Power Brokers see much opportunity in the year ahead, especially from consumers who put off their home-buying and -selling plans among the uncertainties of the past two years. This group represents the No. 1 opportunity for growth in 2022, according to 30% of respondents.

“Price appreciation, lack of inventory and rising interest rates have caused some local buyers to put their purchase on hold for now so that they don’t have to compete with other buyers,” says Suzanne Lail, relocation director for Cottingham Chalk & Associates, Inc. in North Carolina. “However, Charlotte is thriving with relocating individuals and families, which is good for real estate and the overall economy.”

But many Power Brokers fear that inflation’s impact on consumer confidence will keep them on the sidelines of the real estate market. “Inflation coupled with unpredictable interest rates will create hesitancy among buyers and sellers,” says Grattan Donahoe, broker/owner of ERA Donahoe Realty in California.

Power Brokers are also concerned about the challenging conditions for another critical consumer group: first-time homebuyers.

“Institutional buyers are beating out all first-time homebuyers,” says Ric Devore, broker/owner of Ohio’s e-Merge Real Estate. “This is a trend that started in late 2010 but took off in the pandemic. This will hurt the housing market for years to come if not solved.”

Other Power Brokers feel that the various pressures in today’s market will be a boon for real estate in 2022.

“While we are always cognizant of external social, political and economic events that may affect the markets in which we operate, we are bullish on the 2022 real estate market, even after the remarkable sales records we achieved in 2021,” says Salvatore Troia, CFO of New York City-based Douglas Elliman Realty. “Douglas Elliman is experiencing incredibly high demand coupled with low inventory, pushing prices northward. In addition, increased mortgage rates are driving buyers into the market before they go up again, making the start of 2022 a robust sales season with no signs of slowing.”

Succeeding in the year ahead will involve a creative mindset, a renewed focus on agents and increased emotional intelligence, explains Andrea Larson, brand manager for Arizona’s North&Co.

“Over the last year, our brokerage faced immense change and disruption; through it all, we found success in evolving, staying agile and strategically pivoting each step of the way,” she says. “Our core focus on our people and professionals is the constant that gives us a hopeful outlook on 2022. As the market shifts and inventory levels remain low, IQ/EQ and creative tactics to find inventory and help clients win are at the forefront of our real estate coaching. With the concerns and variability that the national economy experienced in 2021, we are committed to the financial wellness and literacy of our agents so that they and their businesses can withstand any economic outcome.”

To see the Top 1,000 real estate firms ranked by both sales volume and transactions, see RISMedia’s 2022 Power Broker Report.

Maria Patterson is RISMedia’s executive editor. Email her your real estate news ideas to maria@rismedia.com.

Maria Patterson is RISMedia’s executive editor. Email her your real estate news ideas to maria@rismedia.com.