Despite the demand for homes significantly outweighing a razor-thin supply, rising prices and mortgage rates have stifled contract signings, as March marked the fifth consecutive month of declines, according to recent data from the National Association of REALTORS® (NAR).

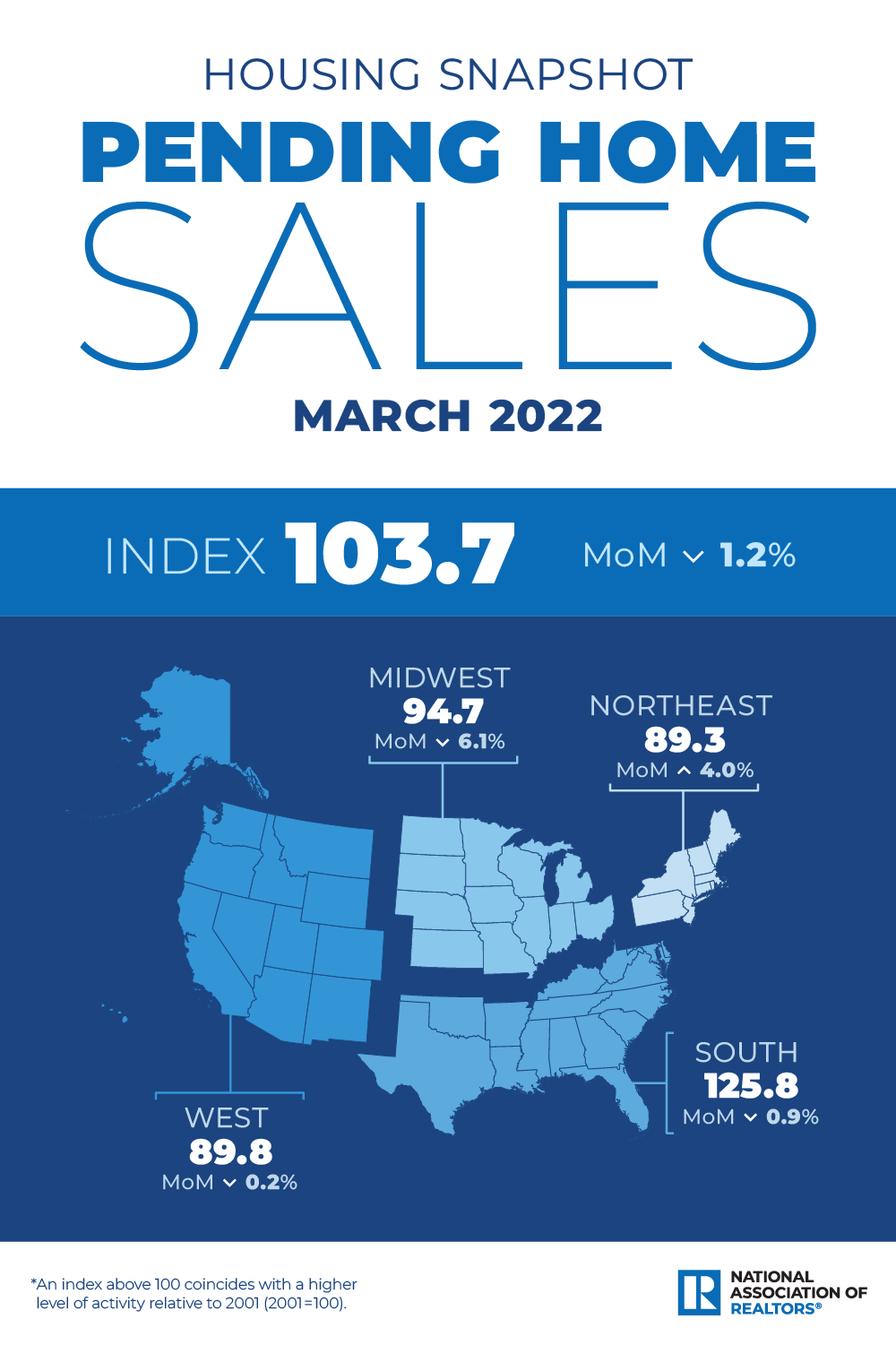

NAR’s Pending Home Sales Index (PHSI), a forward-looking indicator of home sales based on contract signings, fell by 1.2% last month—dipping to 103.7—down 8.2% year-over-year.

Despite the Northeast seeing the only monthly increase in pending sales, the remaining regions saw a decline. Each region also experienced a decline in annual contract signings, dipping 8.2% nationally.

The widening affordability gap influenced by the persisting inventory shortage and strong demand has continued to weigh down activity in the market as experts signal that the days of multi-bid competitions could diminish as activity cools down.

That’s primarily due to price appreciation, rising mortgage rates and sustained elevated inflation, which are squeezing buyers out of the market. Experts predict that the 30-year fixed mortgage rate will reach 5.3% by the end of the year and 5.4% by 2023.

NAR also expects inflation to average 8.2% in 2022, although it could start to moderate to 5.5% in the second half of this year.

Regional Breakdown:

Northeast

+4.0% MoM — Now 89.3 PHSI

-9.2% YoY

Midwest

-6.1% MoM — 94.7 PHSI

-4.8% YoY

South

-0.9% MoM — 125.8 PHSI

-9.5% YoY

West

-0.2% MoM — 89.8 PHSI

-8.4% YoY

The takeaway:

“The falling contract signings are implying that multiple offers will soon dissipate and be replaced by much calmer and normalized market conditions,” said Lawrence Yun, NAR’s chief economist. “As it stands, the sudden large gains in mortgage rates have reduced the pool of eligible homebuyers, and that has consequently lowered buying activity.”

“The aspiration to purchase a home remains, but the financial capacity has become a major limiting factor. Overall existing-home sales this year look to be down 9% from the heated pace of last year.”

“Home prices are in no danger of decline on a nationwide basis, but the price gains will steadily decelerate such that the median home price in 2022 will likely be up 8% from last year.”

“Fast-rising rents will encourage renters to consider buying a home, though higher mortgage rates will present challenges. Strong rent growth nonetheless will lead to a boom in multifamily housing starts, with more than 20% growth this year,” Yun concluded.

“The spring housing market is off to an unpredictable start, mirroring weather patterns in much of the country, which have alternated between heat waves and ice storms,” said George Ratiu, manager of economic research for realtor.com®. “Markets remain clearly tilted in sellers’ favor due to the shortage of homes and the sheer number of buyers still determined to lock in predictable monthly payments as an inflation hedge. However, the economic climate is changing as the Fed moves to stem runaway prices by pulling back on credit availability through higher interest rates

“For consumers, the increases in credit card, auto and mortgage rates are compounding the much higher prices they are paying for gasoline, cars, clothing, food and services. At the end of every month, Americans are finding that there is less money left out of each paycheck. We can expect these factors to lead to fewer transactions in the months ahead, as many first-time buyers find themselves priced out of the market.”

For more information, visit www.nar.realtor.

Jordan Grice is RISMedia’s associate online editor. Email him your real estate news ideas to jgrice@rismedia.com.

Jordan Grice is RISMedia’s associate online editor. Email him your real estate news ideas to jgrice@rismedia.com.