Among the many forward-looking real estate indicators that have flashed warning signs (or at least wobbled) in recent months, deals falling through might be one of the most alarming. As sales remain depressed and buyer interest flags, reports of delistings or terminations offer an even stronger indicator of market instability amid tariff pressures and job-market jitters.

As RISMedia’s Broker Confidence Index (BCI) fell to 5.3 last month—tied for the lowest in history—brokers reported an elevated number of contract terminations, though the specific reasons and levels remain murky.

“Interest rates are not dropping, so buyers are still on the fence,” said Scott Myers, broker/owner of CENTURY 21 Scott Myers REALTORS® in Texas. “Owners are not selling because of having a low interest rate.”

Broadly, brokers surveyed by RISMedia cited general worries about the economy, including affordability, rates, “world affairs,” immigration and “what could happen next” as most affecting their confidence, painting a picture of disquiet that pervades, but also extends beyond, housing markets.

Many also cited expectations from buyers that they would have an easier home search now that the market has shifted.

“We are in a transition market, yet agents are telling buyers we are in a buyers market,” said Todd Menard, CEO of West USA Realty in Arizona. “Buyers want a discount off list price, plus concessions, plus they expect the resale to be free of defects during the inspection.”

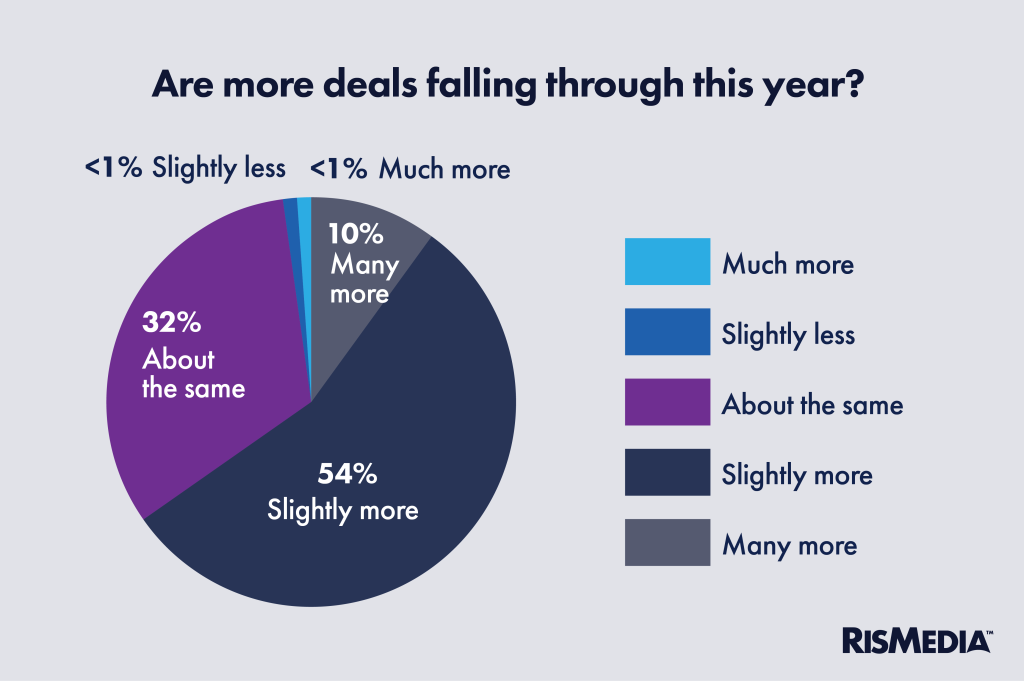

All this has seemingly contributed to more deals falling apart. Almost two-thirds (64%) of brokers said they have seen more transactions fail to close this year compared to the same time period (January to July) in previous years—though reasons for contract terminations vary.

That is supported by other studies of limited cohorts, including Bright MLS, which also found more buyers and sellers dropping out of the market entirely. Separately, in an analysis of MLS data, Redfin revealed that collapses of pending deals reached a historic high in June.

Cause and effect

The question of why deals are falling through might be the most important one. Redfin analysts noted that this metric is seasonal (although terminated pendings usually peak in the winter), positing like Menard that the transition from seller’s to buyer’s markets is causing upheaval.

At the same time, though, consumer confidence remains sharply down, and economists continue to warn of near-term economic woes. When considering a home transaction, how much are these things affecting consumers’ decisions?

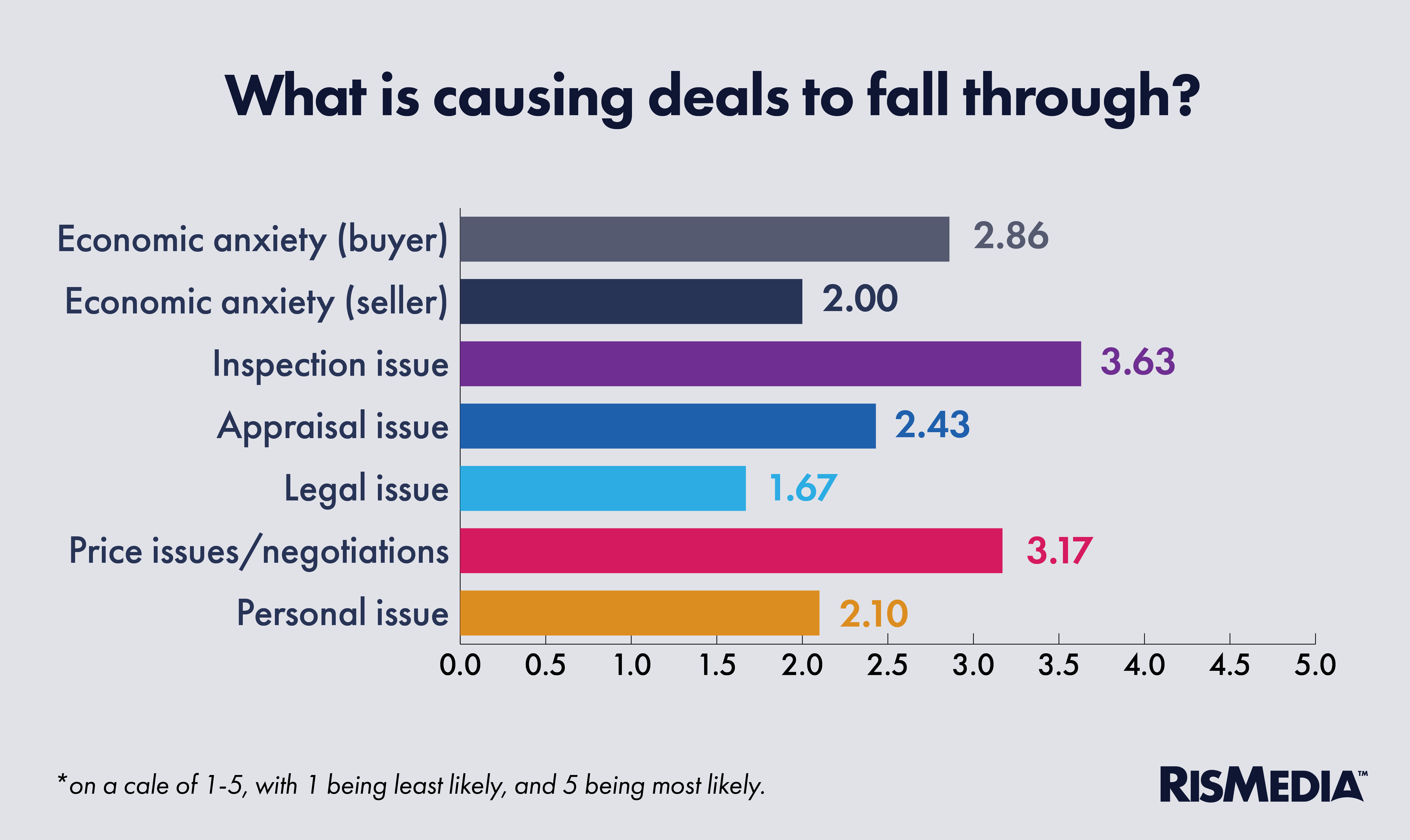

RISMedia asked brokers what was most likely to upend a deal in 2025. There was no clear theme or trend, with brokers citing many of the usual contingencies or issues that come up as part of a home sale.

But based on the qualitative responses, the significant number of brokers pointing to economic anxiety is notable. Buyer anxiety was rated as the overall most likely reason for a deal to fall apart by 9% of brokers, compared to 36% who said inspections are the most likely point for deals to collapse.

One broker, who requested anonymity, said that “inexperienced” agents are struggling with inspection negotiations and “not setting proper expectations,” causing deals to crumble. Another broker who asked for anonymity said that issues with lenders were actually due to unqualified buyers.

Big homebuilders revealed recently that they are encountering more issues with buyers holding significant debt, and also detailed issues with overall consumer confidence.

This spotlight on buyer struggles could speak to a more endemic issue, as macro signs point to a broader economic downturn. A recent regional study by Bright MLS found that buyers (and sellers to some degree) are now more driven by economic factors than rates.

But economists have also noted that with recent increases in inventory, any short-term surge in buyer demand would likely result in a large jump in transactions. National Association of Realtors® Chief Economist Lawrence Yun said recently that a drop in mortgage rates to 6% would result in more than half a million more sales.