Federal Reserve Chair Jerome Powell previously predicted that inflation effects from tariffs would begin showing up in summer readings. The latest Consumer Price Index (CPI) from the Bureau of Labor Statistics (BLS) showed some inflation, but was about in line with expectations.

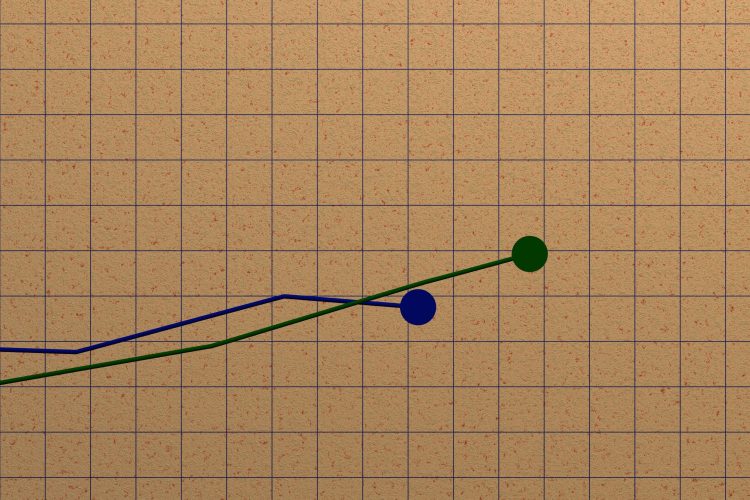

Annual inflation was 2.7% in July 2025. The CPI also ticked up 0.2% month-over-month on a seasonally adjusted basis; in June, the index had ticked up by 0.3%. These July numbers are largely aligned with the latest findings from another primary inflation gauge favored by the Fed, the Personal Consumption Expenditures (PCE) index.

Following the CPI’s publication, the stock market jumped with investors seemingly more confident that the Fed will bring interest rates down at its September Federal Open Market Committee (FOMC) meeting. At the previous FOMC meeting, two members of the Federal Reserve board dissented from the majority voting to hold rates and voted to cut interest rates.

Core inflation, which excludes food and energy costs, was where the signs of higher inflation could be found. The core CPI posted a 0.3% monthly increase, or an annual rate of 3.1%. This is the highest annual rate for the index since January 2025 and the highest month-over-month increase since February. Core inflation was slightly higher than economists’ projected rate of 3%.

“The tariffs are in the numbers, but they’re certainly not jumping out hair on fire at this point,” former White House Economist Jared Bernstein told CNBC about the CPI.

Shelter costs were once more a key driver of inflation in the CPI, increasing by 0.2% month-over-month; the BLS reported shelter costs as the “primary factor” in monthly price increases across all items. Tariffs on key building materials such as lumber and aluminum have been a key concern for homebuilders.

President Donald Trump fired the head of BLS after a poor jobs report earlier this month, yesterday naming a replacement (who must still be confirmed by the Senate).

Realtor.com® Senior Economist Jake Krimmel said in a press release that amidst signs of “tariff-driven pressure” in construction, the CPI showing price increases for home furnishing and used cars also suggests tariffs are having an impact on consumers.

Lisa Sturtevant, chief economist of Bright MLS, noted in emailed remarks that the weak July jobs report is another key incentive for the Fed to cut rates.

“But inflation will still be a concern for the Fed,” noted Sturtevant, specifically citing the 3.1% core inflation number. “The members of the FOMC will be considering both labor market conditions and inflation in their decision-making process. Even with core inflation at 3.1%, the fact that overall inflation did not increase in July suggests that the Fed will cut rates in September, probably by a quarter of a percentage point.”

However, Sturtevant also noted that if inflation is “sticky,” that might keep mortgage rates (which recently hit a four-month low point) higher and disincentivize home-buying even with an interest rate cut.

“Prospective homebuyers who have been waiting for mortgage rates to come down may continue to be disappointed,” Sturtevant forecasted. “After years of higher prices for a range of goods and services and rising consumer debt, individuals and families are watching their finances more closely. As a result, as we head into fall, more and more would-be buyers are going to decide to hold off and push their home-buying out to 2026.”

Krimmel also noted in his remarks that higher readings on the CPI and PCE will “be key for the future path of mortgage rates.”

“Recently, borrowing costs have ticked down but affordability is still stretched,” Krimmel continued. “Importantly, a Fed cut doesn’t guarantee relief, as 10-year Treasury yields, inflation expectations and other market reactions all factor in. If inflation runs hotter, the path for mortgage rates gets cloudier, with markets likely keeping borrowing costs higher for longer.”

For the full index, click here.