Winter continues to slow growth in housing price appreciation across the nation, but according to Clear Capital, distressed saturation levels – the percentage of real estate owned and short sales to all sales – could point to a strong market return come spring.

Winter continues to slow growth in housing price appreciation across the nation, but according to Clear Capital, distressed saturation levels – the percentage of real estate owned and short sales to all sales – could point to a strong market return come spring.

According to the Home Data Index™ (HDI) Market Report, regions across the nation continue to wane in quarter-over-quarter (QoQ) growth in home prices during the slow winter real estate season. Since last month, the West has downticked 0.1 percent to 0.9 percent quarter-over-quarter, though still the highest regional growth figure in the nation, while the Northeast and Midwest have each fallen 0.2 percent to 0.3 percent QoQ growth. The downward trend continues nationally, as well, with the national quarter-over-quarter growth rate falling 0.1 percent to 0.6 percent during the lows of winter. The South appears to be the only region in the nation that has not lost ground in the last month, as it holds steady at relatively decent 0.6 percent quarterly gains.

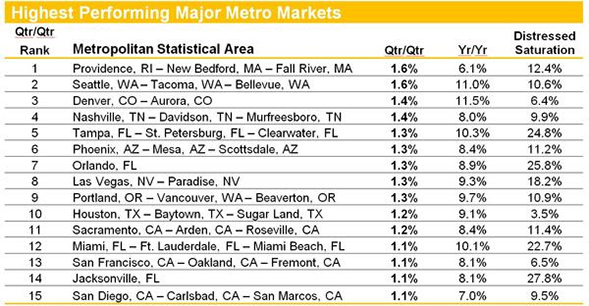

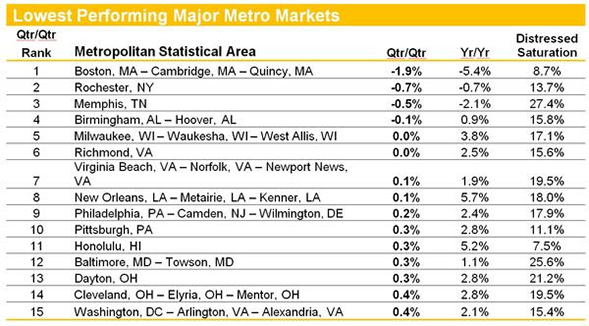

On the MSA market level, there are several markets that are reporting increasing QoQ growth in home prices since last month, an uncharacteristic upward move during the winter season. Nashville, Tenn. is up 0.3 percent since last month to 1.3 percent QoQ growth, while Seattle has increased 0.2 percent to 1.6 percent quarterly price change, tied with Providence, R.I. for the top spot on the performing market chart.

It’s been a hard winter for Boston, Mass., which is reporting the lowest QoQ growth in home prices of any major metro area at -1.9 percent quarterly price change. While the bottom performing markets do not appear to be dominated by any single region, western presence is noticeably lacking. Apart from Honolulu, HI, which is reporting positive 0.3 percent QoQ growth, there are no MSAs from the West in this month’s lowest performing markets, a sign that the region is proving to be more resilient to the troughs of winter growth.

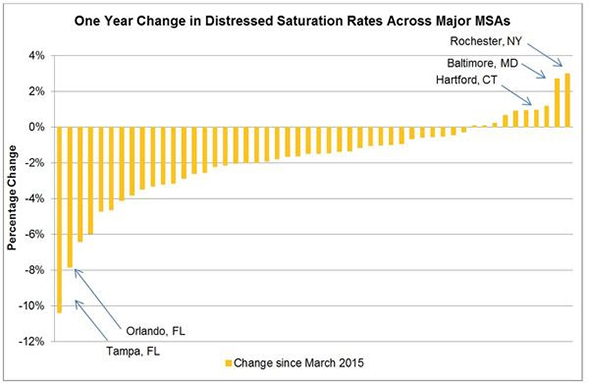

There are signs that this spring is shaping up to be a healthier one than spring of 2015, when considering the overall levels of distressed saturation across the nation’s largest markets. For 80 percent of the nation’s top 50 markets, the percentage of distressed properties on the market is down from March 2015, with Tampa and Orlando having the best improvements—down 7.8 percent and 10.4 percent respectively. Most markets are down between 1-4 percent, and only three markets, Baltimore, Hartford, and Rochester, have higher distressed saturation levels at an increase of 2.0 percent or more.

“As winter continues to slow quarterly growth across most areas of the nation, there are several MSAs that are showing resistance to the usually lethargic season,” says Alex Villacorta, Ph.D., vice president of research and analytics at Clear Capital. “This is a good sign that the current economic and financial market instabilities are not greatly affecting all corners of the real estate industry, yet shows that there is still volatility in the market across various factors. At the end of the day, however, the decline in the number of distressed properties from March 2015 to March 2016 is promising. As the legacy of the housing crash continues to subside, markets become healthier and more stable in the long run.

“Conversely, lower levels of distressed saturation will also mean fewer opportunities for investment buyers, potentially leading to lower demand in certain areas of these markets. As the slow season thaws and the spring kickstart of the real estate season nears, we’ll get a better idea of how consumer confidence and economic uncertainty, along with the distressed saturation levels, will ultimately affect the nation’s housing industry.”

For more information, visit www.clearcapital.com.