Existing-homes sales backtracked in June, posting higher than one year prior but lower than in May, the National Association of REALTORS® (NAR) reports.

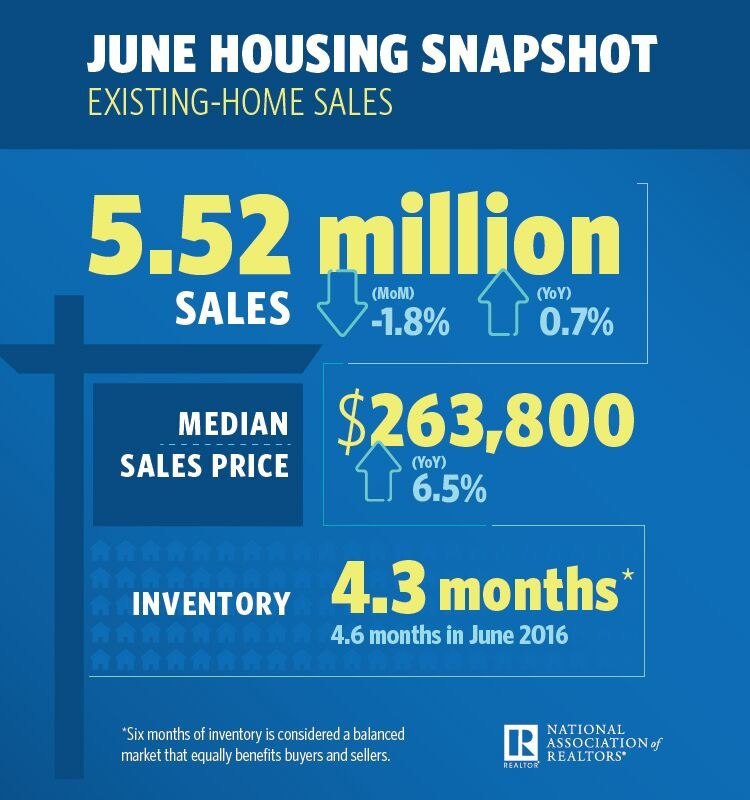

Existing-home sales totaled 5.52 million, a 1.8 percent decrease from May but a 0.7 percent increase from one year prior. Inventory decreased 0.5 percent to 1.96 million, 7.1 percent below one year prior.

“Closings were down in most of the country last month because interested buyers are being tripped up by supply that remains stuck at a meager level and price growth that’s straining their budget,” says Lawrence Yun, chief economist at NAR. “The demand for buying a home is as strong as it has been since before the Great Recession. Listings in the affordable price range continue to be scooped up rapidly, but the severe housing shortages inflicting many markets are keeping a large segment of would-be buyers on the sidelines. The good news is that sales are still running slightly above last year’s pace despite these persistent market challenges.”

Inventory is currently at a 4.3-month supply. Existing homes averaged 28 days on market in June, one more day than in May but six less days than one year prior. Non-distressed homes took 27 days to sell. All told, 54 percent of homes sold in June were on the market for less than one month.

The metropolitan areas with the fewest days on market in June, according to data from realtor.com®, were Seattle-Tacoma-Bellevue, Wash. (23 days); Salt Lake City, Utah (26 days); San Jose-Sunnyvale-Santa Clara, Calif. (27 days); San Francisco-Oakland-Hayward, Calif. (29 days); and Denver-Aurora-Lakewood, Colo. (30 days).

The median existing-home price for all types of houses (single-family, condo, co-op and townhome) was $263,800, a 6.5 percent increase from one year prior. The median price for a single-family existing home was $266,200, while the median price for an existing condo was $245,900.

Single-family existing-home sales came in at 4.88 million in June, a 2.0 percent decrease from 4.98 million in May, but a 0.6 percent increase from 4.85 million one year prior. Existing-condo and -co-op sales came in at 640,000, unchanged from May, but a 1.6 percent increase from one year prior.

Eighteen percent of existing-home sales in June were all-cash, with 13 percent by individual investors. Four percent were distressed.

The Midwest was the only region to see positive activity in June, with existing-home sales rising 3.1 percent to 1.32 million, with a median price of $213,000. Existing-home sales in the South fell 4.7 percent to 2.23 million, with a median price of $231,300. Existing-home sales in the Northeast also fell, 2.6 percent to 760,000, with a median price of $296,300. Existing-home sales in the West were down only slightly, 0.8 percent to 1.21 million, with a median price of $378,100.

First-time homebuyers comprised 32 percent of existing-home sales in June, a decrease from 33 percent in May and one year prior.

“It’s shaping up to be another year of below-average sales to first-time buyers despite a healthy economy that continues to create jobs,” Yun says. “Worsening supply and affordability conditions in many markets have unfortunately put a temporary hold on many aspiring buyers’ dreams of owning a home this year.”

“Prospective buyers who postponed their home search this spring because of limited inventory may have better luck as the summer winds down,” says NAR President Bill Brown. “The pool of buyers this time of year typically begins to shrink as households with children have likely closed on a home before school starts. Inventory remains extremely tight, but patience may pay off in coming months for those looking to buy.”

In a statement, realtor.com Senior Economist Joseph Kirchner said, “Lack of inventory, largely caused by weak growth in home-building since the recession, is the culprit responsible for the 1.8 percent decline in existing-home sales in June compared to May. Though we continue to see record-high demand, sales of existing homes are up by only 0.7 percent compared to last year.

“This situation primarily affects low- to moderate-priced homebuyers, including millennials, first-time buyers and people of modest means,” he continued. “These groups have had extreme difficulty finding homes and the plummeting sales we have seen for months isn’t showing signs of slowing soon.”

For more information, please visit www.nar.realtor.

For the latest real estate news and trends, bookmark RISMedia.com.