The red-hot housing market showed signs of cooling last month as price surges persisted, according to the latest report from the National Association of REALTORS® (NAR), which showed contracted signings are down.

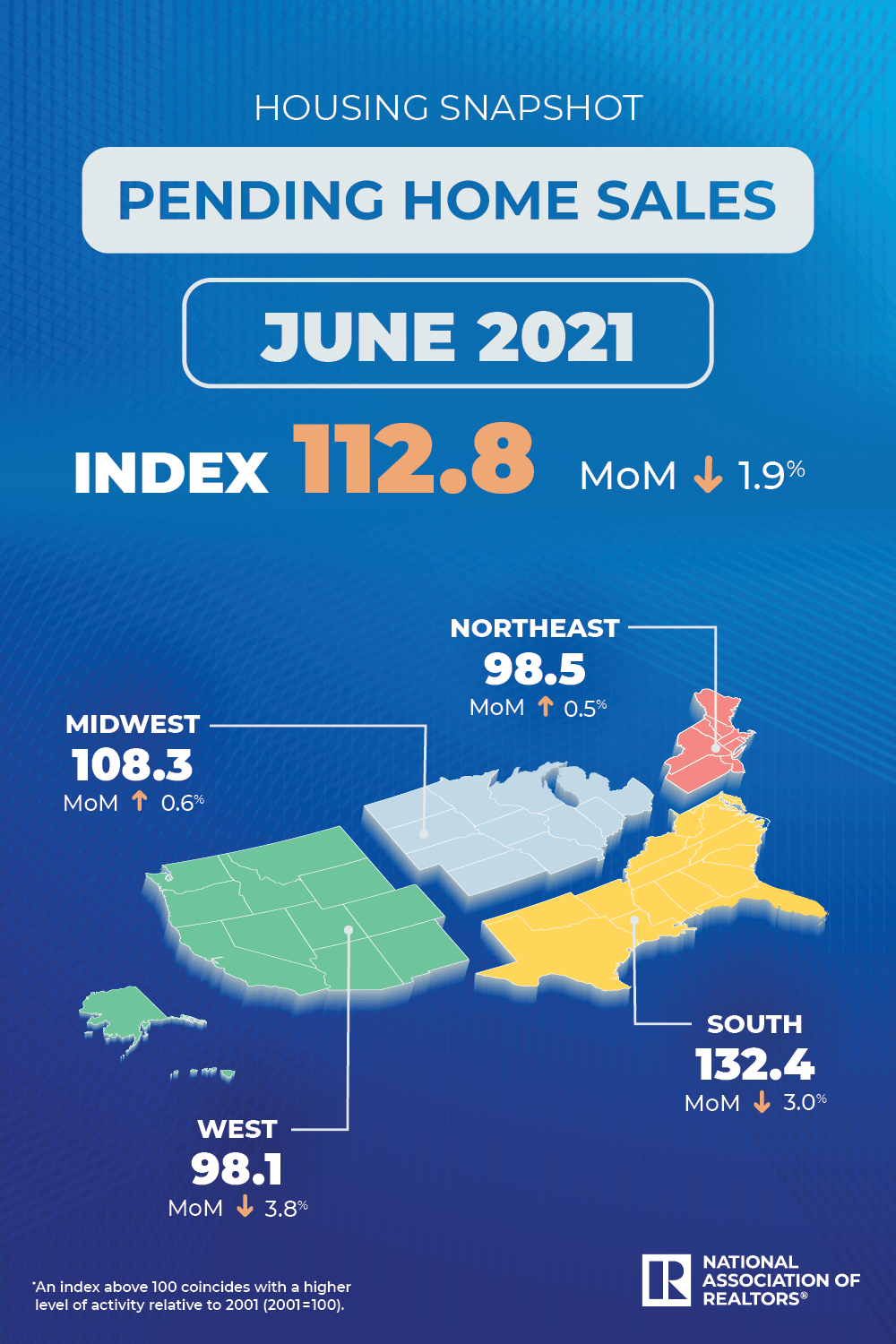

NAR’s Pending Home Sales Index (PHSI), a forward-looking indicator of home sales based on contract signings, showed a 1.9% decline last month, falling to 112.8. An index of 100 is equal to the level of contract activity in 2001.

Year-over-year contract signings followed suit with 1.9% dip as well.

Experts at NAR expect mortgage rates to start creeping up, hitting 3.3% toward the end of the year and averaging 3.6% in 2022. The increase in rates could put a damper on demand and price appreciation in the market

Regional Breakdown:

Northeast

+0.5% MoM — Now 98.5 PHSI

+ 8.7% YoY

Midwest

+0.5% MoM — 108.3 PHSI

-2.4% YoY

South

-3.0% MoM — 132.4 PHSI

-4.7% YoY

West

-3.8% MoM — 98.1 PHSI

-2.6% YoY

What the Industry Is Saying:

“Pending sales have seesawed since January, indicating a turning point for the market. Buyers are still interested and want to own a home, but record-high home prices are causing some to retreat.

“The moderate slowdown in sales is largely due to the huge spike in home prices. The Midwest region offers the most affordable costs for a home, and hence that region has seen better sales activity compared to other areas in recent months.”

“In just the last year, increasing home prices have translated into a substantial wealth gain of $45,000 for a typical homeowner. These gains are expected to moderate to around $10,000 to $20,000 over the next year.” — Lawrence Yun, NAR Chief Economist

“We think interest rates and the economic recovery continue to support strong housing demand, but affordability is becoming a serious concern. Currently, the absorption rate for new listings remains high; however, this may start to slow in the coming months and allow inventory to slowly begin accumulating toward more normal levels, as well as slow price growth.

“Price-growth levels are beginning to raise concern, and we’ve seen the housing market move back onto the radar of the Federal Reserve board in recent meetings. If appreciation continues at levels that suggest market distortions, we could see Federal Reserve moves that aim to have some cooling effect on housing.” — Ruben Gonzalez, Keller Williams Chief Economist

“Contract signings declined in June, reversing the strong advance from May. For many Americans, the end of pandemic restrictions at the beginning of summer led to a shift in focus toward vacations, travel and family reunions, which took attention away from real estate markets.

“As Americans embrace the return to a new normal, many are ready to move on to the next chapter of life and are listing their homes for sale. With prices at record highs and mortgage rates still hovering near record lows, sellers are recognizing the favorable conditions. In June, the number of newly-listed homes was 5.5% higher than a year ago.

“Just as importantly, today’s realtor.com® Weekly Housing Report shows that the number of sellers bringing properties to market continues to grow in July, signaling a boost in available housing options. The influx of new supply is keeping price growth in check and offering much-needed relief for buyers who have been frustrated by the very tight inventory and highly competitive market conditions of the past six months.”

— George Ratiu, realtor.com® Chief Economist

For more information, please visit www.nar.realtor.

Jordan Grice is RISMedia’s associate online editor. Email him your real estate news ideas to jgrice@rismedia.com.

Jordan Grice is RISMedia’s associate online editor. Email him your real estate news ideas to jgrice@rismedia.com.