Approximately nine out of 10 metro markets registered home price gains in Q4 2022 despite mortgage rates eclipsing 7%, according to a new report from the National Association of Realtors® (NAR).

NAR’s latest metro area index found that 18% of the 186 tracked metro areas registered double-digit price increases over the same time period, down from 46% in Q3 2022. Compared to a year ago, the report found that the national median single-family existing-home price rose 4.0% to $378,700. Year-over-year price appreciation decelerated when compared to the previous quarter’s 8.6%.

In addition, the report found that among the major regions, the South saw the largest share of single-family existing-home sales (45%) in Q3, with YoY price appreciation of 4.9%. Prices grew 5.3% in the Northeast, 4% in the Midwest, and 2.6% in the West.

Key highlights:

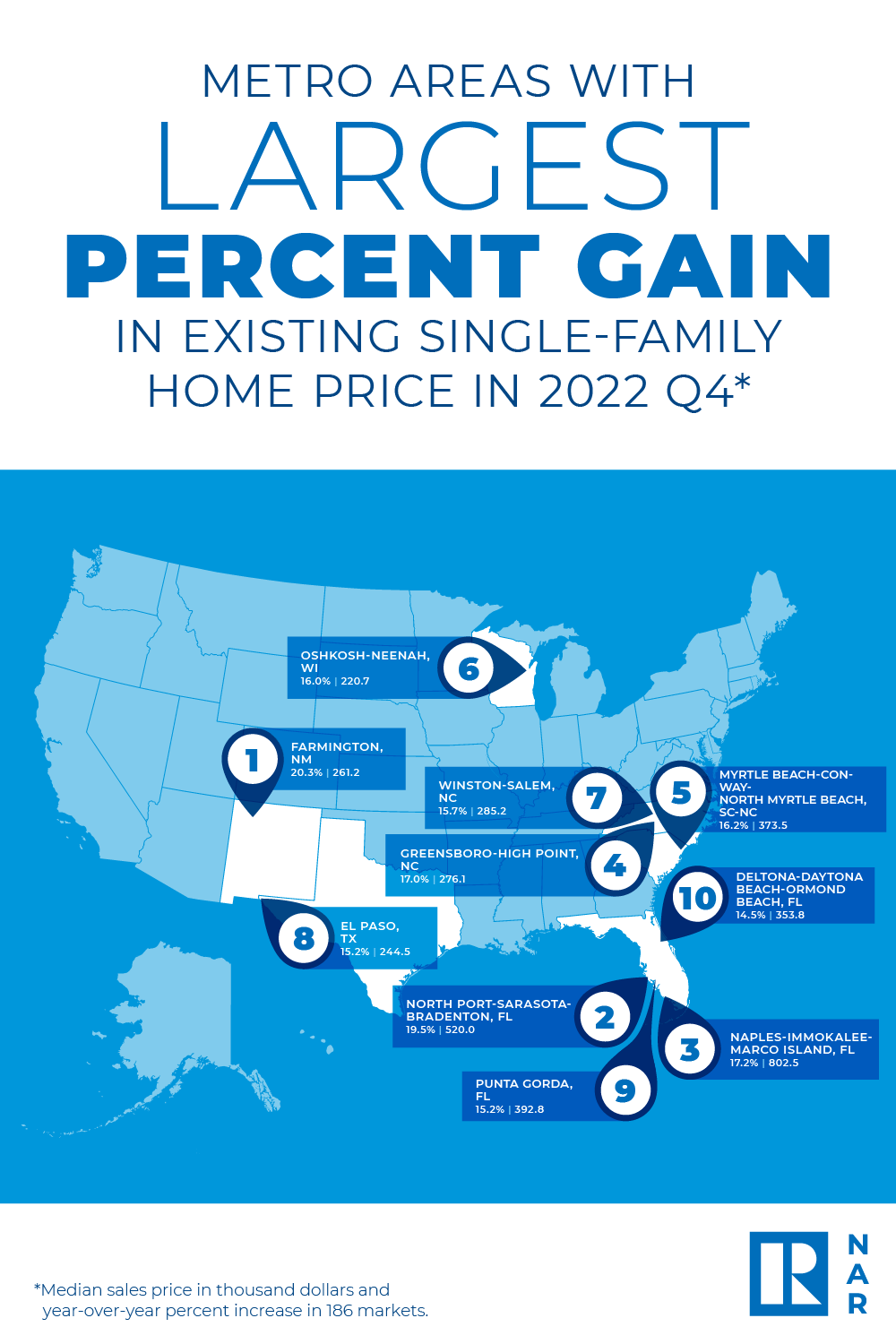

- The top 10 metro areas with the largest year-over-year price increases all recorded gains of at least 14.5%, with seven of those markets in Florida and the Carolinas.

- Those include Farmington, New Mexico (20.3%); North Port-Sarasota-Bradenton, Florida (19.5%); Naples-Immokalee-Marco Island, Florida (17.2%); Greensboro-High Point, North Carolina (17.0%); Myrtle Beach-Conway-North Myrtle Beach, South Carolina-North Carolina (16.2%); Oshkosh-Neenah, Wisconsin (16.0%); Winston-Salem, North Carolina (15.7%); El Paso, Texas (15.2%); Punta Gorda, Florida (15.2%); and Deltona-Daytona Beach-Ormond Beach, Florida (14.5%).

- Half of the top 10 most expensive markets were in California, including San Jose-Sunnyvale-Santa Clara, California ($1,577,500; -5.8%); San Francisco-Oakland-Hayward, California ($1,230,000; -6.1%); Anaheim-Santa Ana-Irvine, California ($1,132,000; -1.6%); Urban Honolulu, Hawaii ($1,090,200; 3.4%); San Diego-Carlsbad, California ($857,000; 1.4%); Los Angeles-Long Beach-Glendale, California ($829,100; -1.3%); Naples-Immokalee-Marco Island, Florida ($802,500; 17.2%); Boulder, Colorado ($759,500; -2.0%); Seattle-Tacoma-Bellevue, Washington ($708,900; 1.3%); and Barnstable Town, Massachusetts ($668,100; 4.0%).

- Roughly one in 10 markets (11%; 20 of 186) experienced home price declines in the Q4 2022.

- Housing affordability was exacerbated by elevated home prices and mortgage rates which roughly doubled from the beginning of the year. The monthly mortgage payment on a typical existing single-family home with a 20% down payment was $1,969. This represents a 7% increase from Q3 2021 ($1,838), but a major surge of 58%–or $720–from last year.

- Families typically spent 26.2% of their income on mortgage payments, up from 25% in the prior quarter and 17.5% one year ago.

- Once again, first-time buyers looking to purchase a typical home encountered challenges related to housing’s growing unaffordability. For a typical starter home valued at $321,900 with a 10% down payment loan, the monthly mortgage payment rose to $1,931, about 7% more than the previous quarter ($1,806) and an increase of almost $700, or 57%, from one year ago ($1,233).

- First-time buyers typically spent 39.5% of their family income on mortgage payments, up from 37.8% in the previous quarter. A mortgage is considered unaffordable if the monthly payment (principal and interest) amounts to more than 25% of the family’s income.

- A family needed a qualifying income of at least $100,000 to afford a 10% down payment mortgage in 71 markets, up from 59 in the prior quarter. Yet, a family needed a qualifying income of less than $50,000 to afford a home in 16 markets, down from 17 in the previous quarter.

Major takeaway:

“A slowdown in home prices is underway and welcomed, particularly as the typical home price has risen 42% in the past three years,” NAR Chief Economist Lawrence Yun said, noting these costs increases have far surpassed wage increases and consumer price inflation of 15% and 14%, respectively, since 2019. “Far fewer metro markets experienced double-digit price gains in the latest quarter.”

“Even with a projected reduction in home sales this year, prices are expected to remain stable in the vast majority of the markets due to extremely limited supply. Moreover, there are signs that buyers are returning as mortgage rates decline, even with inventory levels near historic lows,” Yun continued, “A few markets may see double-digit price drops, especially some of the more expensive parts of the country which have also seen weaker employment and higher instances of residents moving to other areas.”

For the full report, click here.

For the full report, click here.