The post-settlement period in real estate might be remembered as the era of consolidation, at least based on 2025’s headlines. Along with many smaller buyouts, the purchase of consumer portal and discount brokerage Redfin by mortgage giant Rocket, and Compass’s (still pending) deal to take over Anywhere are somewhat unprecedented, at least since the post-Great Recession shakeups.

As this evolution takes hold, though, with some companies reaping major financial benefits, does the average broker see any change at all? And are the long-term impacts positive or negative in terms of tech, resources or legal challenges facing real estate?

“Monopolies seem to be coming to the real estate business,” said one broker, who requested anonymity.

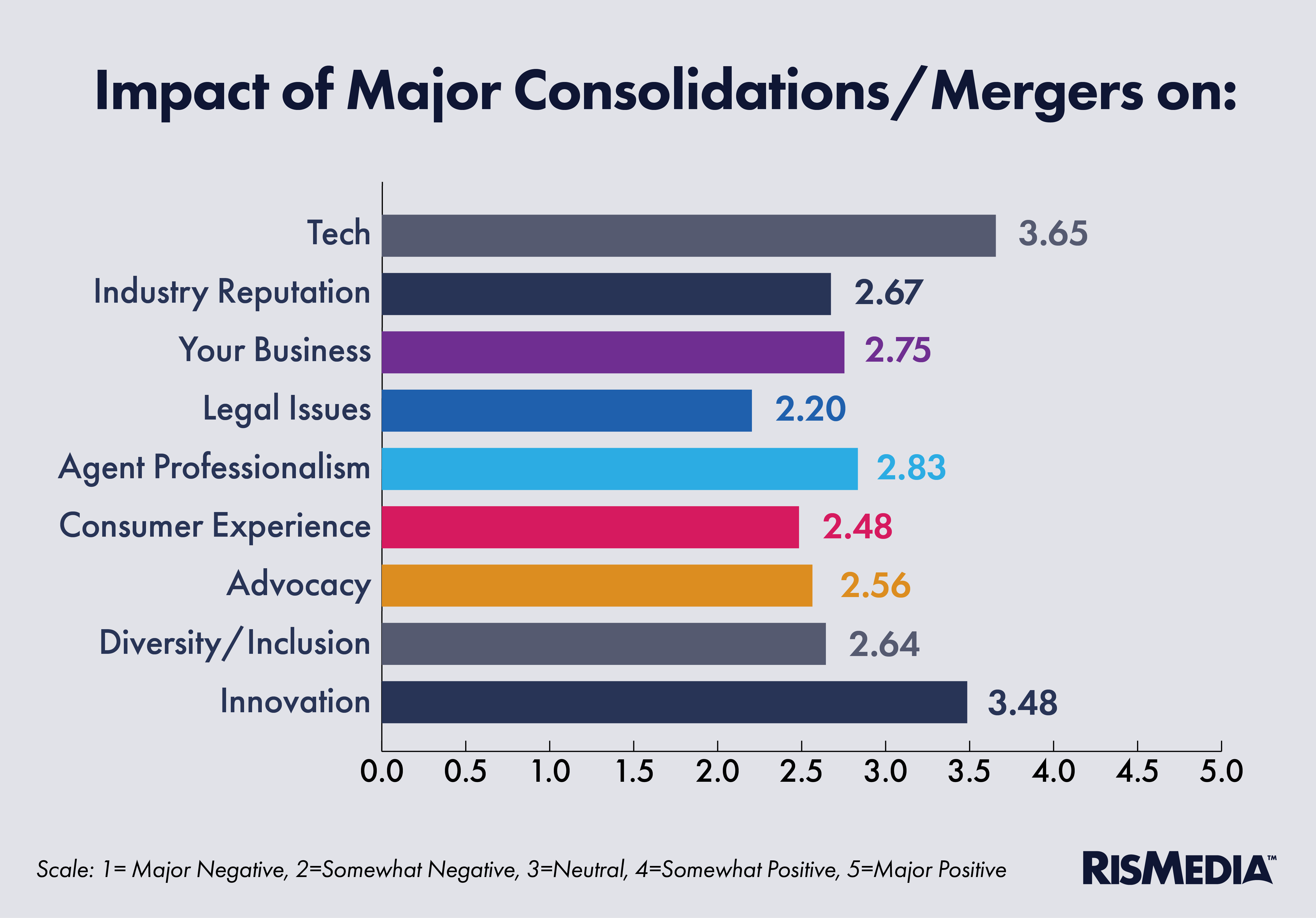

RISMedia’s latest Broker Confidence Index (BCI) found that brokers largely had a negative view of ongoing consolidation and how it will impact the industry—with some nuance—though qualitatively, there was relatively little worry these deals would immediately disrupt day-to-day-business.

While this might not be surprising, the details are important, especially since the impact of these deals are only just starting to be felt. By a small margin, brokers saw tech advancement and innovation increasing, but said they expected more legal challenges, worse consumer experience and harm to the industry’s reputation.

“Transparency to the customers—who is working for them? How do you explain to the customers that one company owns all the companies they interview, and why are all of their fees different?” said another broker who also asked to remain anonymous.

Anywhere and Compass’s proposed merger, which must still pass the scrutiny of regulators, would create the largest real estate brokerage in the country by far. Rocket’s deal for Redfin, along with its purchase of mortgage service giant Mr. Cooper, forms a powerful vertical pipeline from consumer to homeownership—not unprecedented, but scaled tremendously.

While every company involved in these deals claims they are pursuing efficiencies, synergies and pro-consumer policies, brokers were much more skeptical—particularly regarding Compass’s plans as it grows marketshare.

Sandy Olson, broker/owner of REMAX Results in Maryland, said she was most concerned about “less competition and larger companies making policy decisions, such as exclusive listings.”

“Exclusive listings are not in the best interest of the consumer,” she added. “Many state laws require cooperation of listings when it’s in the best interest of the consumer. Having listings that are only shared by a select group is a recipe for future lawsuits and potential discrimination.”

“I disagree with so many of the things Compass stands for,” said another anonymous broker. “I believe the more power they gain, the worse our industry will be.”

The big picture

While other consolidations are still happening—or being challenged—the Compass-Anywhere deal clearly was on the mind of broker respondents, with many calling out Compass and its private listing-focused business model by name.

Notably, as part of Compass’s lawsuit against Zillow, a federal judge just ruled that Zillow can review certain documents and communications related to the Anywhere deal, seeking to determine just how fundamental private listings are to Compass’s business.

At the same time, though, some brokers offered a more positive assessment of a consolidated real estate landscape, and many said they had no real concerns about large-scale negative impacts.

“There’s great opportunity to drive significant changes to the way our industry has operated for decades,“ said Rick Davidson, CEO of Cairn Real Estate Holdings based in Utah. “Agents are the assets, and they vote with their feet. If larger enterprises can align with their agents on needed changes within the industry, they potentially will be able to drive massive shifts across multiple industry segments.”

Brokers were mixed on how the consolidation would affect independents, with some arguing smaller companies will have a chance to differentiate, while others predicted many would be absorbed or pushed out of business.

Asked what they believe is driving this year’s major consolidation spree, brokers were also split, but honed in on another Compass-related force: Wall Street money. While between 20% and 30% of brokers saw real estate policy changes, tech or the regulatory landscape as contributing to the merger spree, 60% blamed Wall Street or private equity dollars.

Compass, founded in 2012, grew very quickly in part due to significant venture capital backing that allowed it to acquire smaller companies and recruit top agents. Proptech investment from venture capitalists reached an all-time high of around $10 billion in 2021, and although that appears to have shrunk significantly as the market cooled, brokers continue to feel Wall Street’s influence on the industry.

“Brands beholden to Wall Street (might be) leaving agents and consumers in the dust,” said another broker, who asked to remain anonymous.

Market optimism

Perhaps unrelated to news of consolidation, market optimism surged last month, as a disappointing summer seems to have transitioned to a much more productive fall.

This jump, from 5.6 in August, is one of the largest single-month increases in the history of the BCI, and reveres a trend of slow declines in confidence from summer to fall in the post-pandemic era.

As far as what was affecting their confidence, brokers continued to single out many of the same issues that suppressed demand and slowed the market through the summer months. Buyers are still on the sidelines, most brokers agreed, waiting out high rates or concerned about the economy.

But strong positives from inventory, and at least a few regions where sellers are listing at prices closer to what buyers are looking for has accelerated the market, the BCI found.

“There is more inventory for buyers to choose from. The drop in rates has brought more buyers to the market,” Olson said.

“Pending sales are tracking up, listings are coming in at the right price,” said Andrew Smith, broker/owner of Badger Peabody & Smith Realty based in New Hampshire.

Many brokers also cited instability in the political sphere as a continued worry. Though the BCI survey was conducted ahead of a government shutdown, just under 20% of brokers mentioned government dysfunction or political uncertainty as impacting their market.

“The international and our national scene in leadership is definitely concerning me,” said another broker who requested anonymity.