RealtyTrac®recently released its Q2 2015 U.S. Home Flipping Report, which shows that 30,013 single family homes were flipped—sold as part of an arms-length sale for the second time within a 12-month period—in the second quarter, 4.5 percent of all single family home sales during the quarter.

The 4.5 percent share of second quarter home sales that were flips was down from 5.5 percent in the previous quarter and down from 4.9 percent a year ago. Going back to the first quarter of 2000, the peak in flipping was in the first quarter of 2006, when 8.0 percent of all single family home sales were flips.

The average gross profit—the difference between the purchase price and the flipped price (not including rehab costs and other expenses incurred, which flipping experts estimate typically run between 20 percent and 33 percent of the property’s after repair value)—for completed flips in the second quarter was $70,696, up from $67,753 in the previous quarter and up from $49,842 a year ago.

The average gross return on investment (ROI)—the average gross profit as a percentage of the average original purchase price—was 35.9 percent for completed flips in the second quarter, up slightly from 35.6 percent in the first quarter and up from 23.4 percent a year ago. The average gross ROI on flips reached a 10-year peak of 44.9 percent in Q2 2013.

“Despite the rise in flipping returns in the second quarter, home flippers should proceed with caution in the next six to 12 months as home price appreciation slows and a possible interest rate increase could shrink the pool of prospective buyers for fix-and-flip homes,” says Daren Blomquist, vice president at RealtyTrac. “While average flipping returns are up substantially from a year ago at the national level and in moderately-priced markets such as Miami, Atlanta, Phoenix and Minneapolis, flipping returns are softening in some of the higher-priced markets such as San Francisco, Seattle, Denver and Los Angeles,”

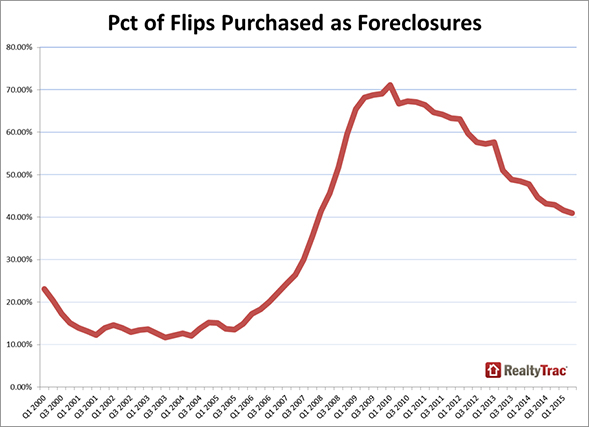

“The fewer foreclosure deals and longer flipping timelines that we see in the data demonstrate that flippers are getting squeezed on both sides of the profit equation,” Blomquist continues. “Experienced flippers will often need to enter into higher-risk markets with less solid economic fundamentals to chase better yields. Flipping is not always profitable, as evidenced by the fact that flips on low-end homes priced below $50,000 actually yielded negative returns in the second quarter.”

Markets with highest share of flipped homes

Among metropolitan statistical areas with at least 50 completed single family home flips in the second quarter, those where flips accounted for the highest percentage of all home sales were Fernley, Nev. (11.4 percent), Miami, Fla. (9.6 percent), Palm Coast, Fla. (9.2 percent), Memphis, Tenn. (9.0 percent), Tampa, Fla. (8.9 percent), Deltona, Fla. (8.7 percent), and Sarasota, Fla. (8.1 percent).

Among zip codes with at least 15 completed single family home flips in the second quarter, those where flips accounted for the highest share of total single family sales were 62206 in East Saint Louis, Illinois (39.3 percent); 33056 in Opa Locka, Fla. in the Miami metro area (34.5 percent); 89104 in Las Vegas (33.3 percent); 48021 in Eastpointe, Mich. in the Detroit metro area (33.2 percent); and 48089 in Warren, Mich. in the Detroit metro area (31.2 percent).

Other major metro areas where the share of homes flipped in the second quarter was above the national average included Las Vegas, Nev. (7.7 percent); Detroit, Mich. (7.1 percent); Baltimore (7.1 percent); Los Angeles (7.0 percent); Orlando (6.8 percent); Phoenix (6.7 percent); and Jacksonville, Fla. (6.7 percent).

Among zip codes with at least 15 completed single family home flips in the second quarter, those with the highest average flipped price were 95125 in San Jose ($1,953,033); 90065 in Los Angeles ($716,656); 85018 in Phoenix ($679,040); 33134 in Miami ($561,447); and 97202 in Portland ($548,903). There were a total of 211 zips with an average flipped price above $1 million, but the majority of those had fewer than 15 total homes flipped in the second quarter.

Markets with the highest average returns on flipped homes

Among markets with at least 50 completed single family home flips in the second quarter, those with the highest average gross ROI were Chicago, Ill. (61.2 percent), Dayton, Ohio (60.6 percent), Harrisburg, Pa. (60.6 percent), Ocala, Fla. (56.8 percent) and Baltimore, Md. (56.7 percent).

Among zip codes with at least 15 completed single family home flips in the second quarter, those with the highest average gross return on investment were 32209 in Jacksonville, Fla. (231.9 percent); 45424 in Dayton, Ohio (189.5 percent); 21215 in Baltimore (163.5 percent); 63116 in Saint Louis (161.1 percent); and 38127 in Memphis (141.4 percent).

Metro areas with the highest average gross profits in dollars on completed single family home flips in the second quarter were San Jose ($261,946), Los Angeles ($171,954), San Diego ($141,483), Washington, DC ($139, 927) and Seattle ($131,028).

View the full report here.