Appraisers and homeowners are syncing up on value, with appraisals in April just 0.33 percent below what homeowners predicted, according to the Quicken Loans National Home Price Perception Index (HPPI). The Quicken Loans National Home Value Index (HVI) shows appraised values rose 6.47 percent year-over-year.

The findings indicate homeowners are less likely to get a rude awakening when going through mortgage process; it is the closest the national appraiser and owner opinions have been in more than three years.

“The appraisal is one of the most important, although sometimes least predictable, parts of the mortgage process,” says Bill Banfield, executive vice president of Capital Markets at Quicken Loans. “The Home Price Perception Index is a way to illustrate the differences of opinion, and these differences affect everything from the type of mortgage a borrower can get to the expectations a seller has about the proceeds available upon sale of their home.”

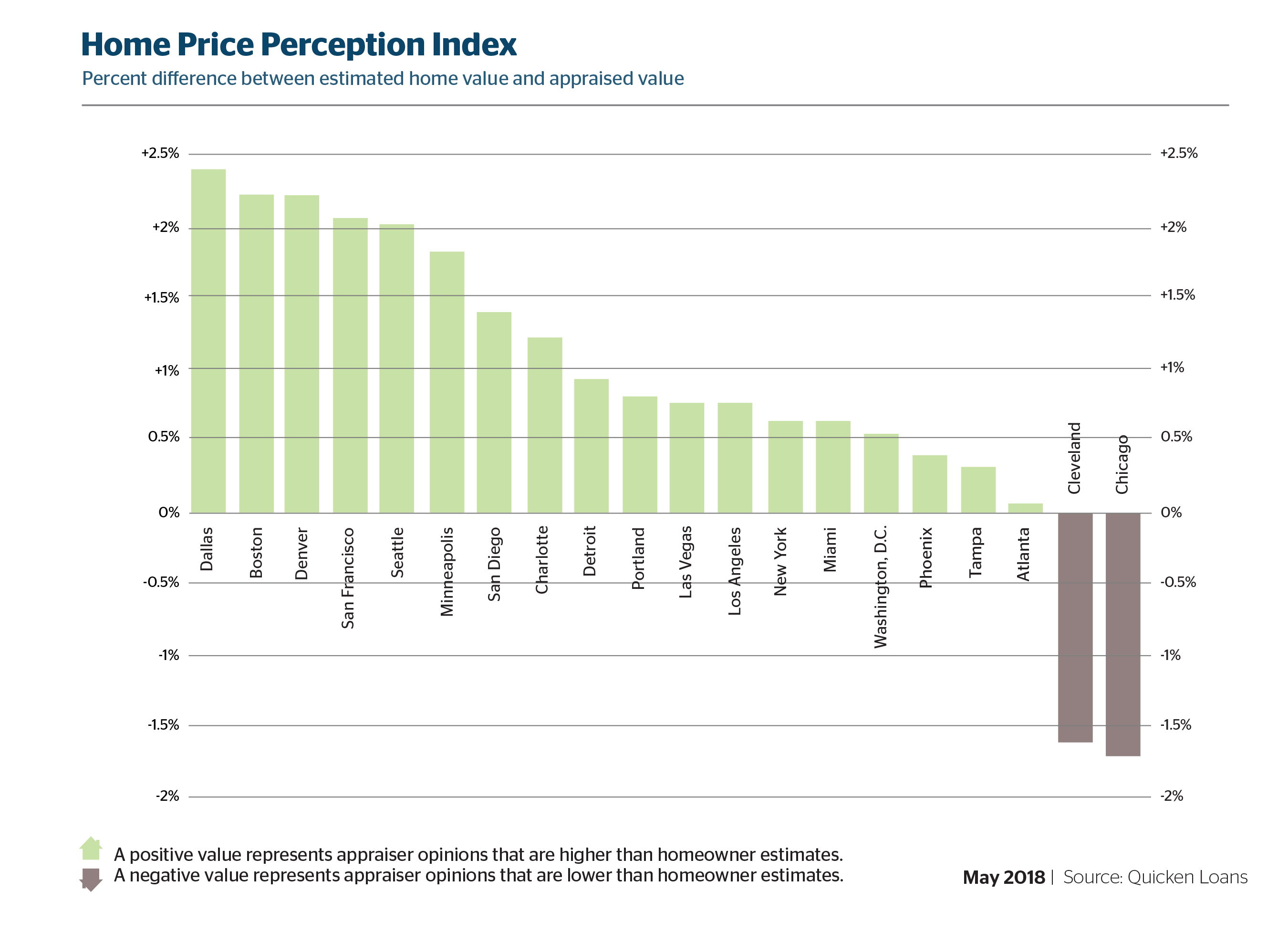

Homeowner opinions are also improving when viewed locally. Less than 20 percent of the areas measured have appraisal values lower than estimated. San Jose is leading the way, with the average appraisal 2.75 percent higher than expected, and Chicago is trailing all cities, with appraisals an average of 1.68 percent lower than estimated. Only five of the 27 metro areas observed in the HPPI reported appraisals lower than what owners estimated.

While they are more in line with what owners expected, home values are continuing their ascent over last year’s level. The HVI reported a healthy 6.47 percent year-over-year increase, despite near-stagnant monthly change, with a 0.05 percent dip in home values since March. The HVI was pulled into the negative by the Northeast—the only region showing a decrease in home value, at a 1.24 percent decline. The Northeast was still the lowest when reviewing annual changes; however, all regions were positive, ranging from the Northeast’s 2.22 percent growth to the 9.44 percent jump in the West.

“The skyrocketing home values in the West is a trend with no end in sight,” Banfield says. “Until home-building pace picks up, in combination with more existing homes being listed for sale, affordability will continue to wane. The other regions of the country are showing annual price gains as well, but at a more moderate pace. Time will tell if the slightly higher interest rates in 2018 start to slow demand, or if the inventory shortage ends up being a larger contributor to price changes.”

For more information, please visit QuickenLoans.com/Indexes.

For the latest real estate news and trends, bookmark RISMedia.com.