CoreLogic® has released its latest Single-Family Rent Index (SFRI), which analyzes single-family rent price changes nationally and among 20 metropolitan areas. Data collected for March 2018 shows a national rent increase of 2.7 percent, which mirrors the rent increase for March 2017 when it was also 2.7 percent.

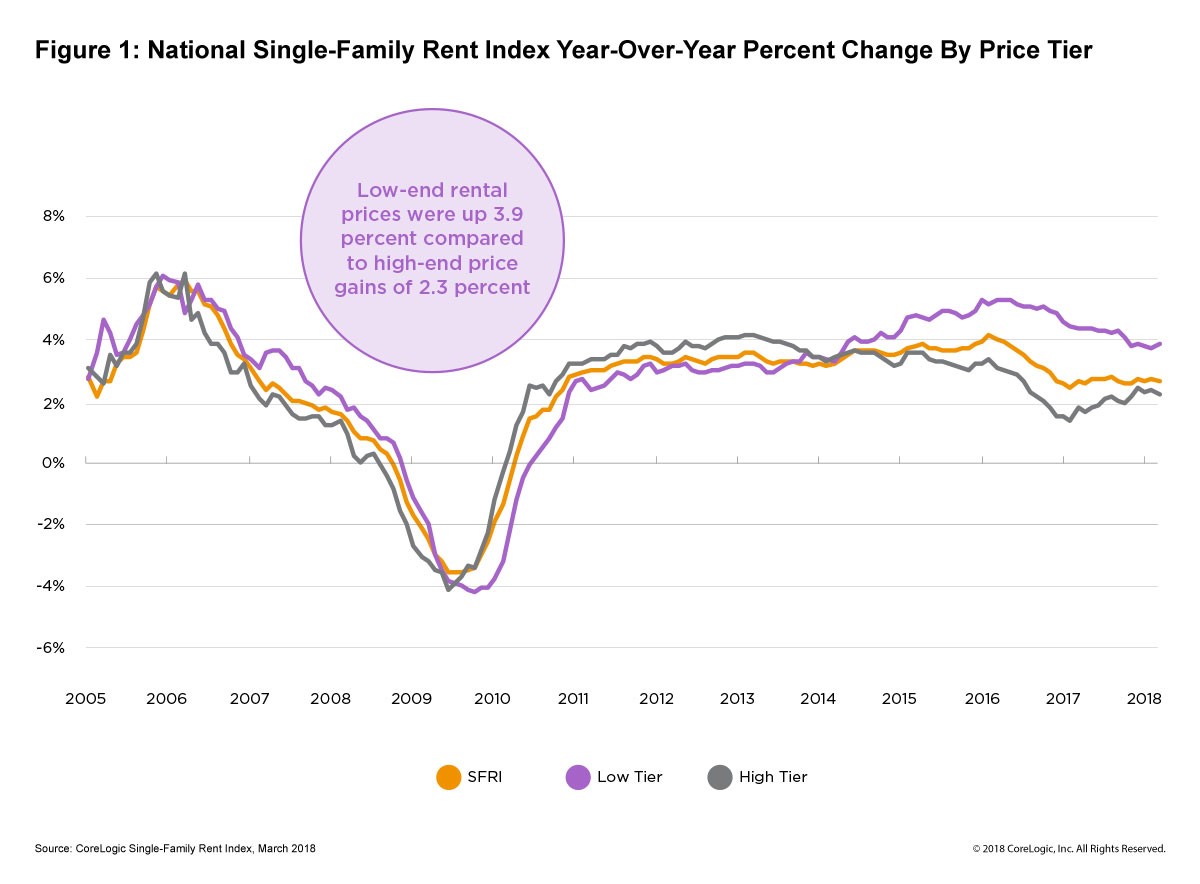

Low rental home inventory, relative to demand, fuels the growth of single-family rent prices. The SFRI shows that single-family rent prices have climbed between 2010 and 2018; however, year-over-year rent price increases have slowed since February 2016, when they peaked at 4.2 percent.

High-end rentals pulled down national rent growth in March 2018—high-end rentals are defined as properties with rent prices greater than 125 percent of a region’s median rent. High-end rent prices increased 2.3 percent year over year in March 2018, up from a gain of 1.8 percent in March 2017. Rent prices among low-end rentals – properties with rent prices less than 75 percent of the regional median – increased 3.9 percent in March 2018, down from a gain of 4.4 percent in March 2017. While prices for low-end rentals are still outpacing the high-end cohort, a decrease in the growth rate could signal that prices are beginning to stabilize.

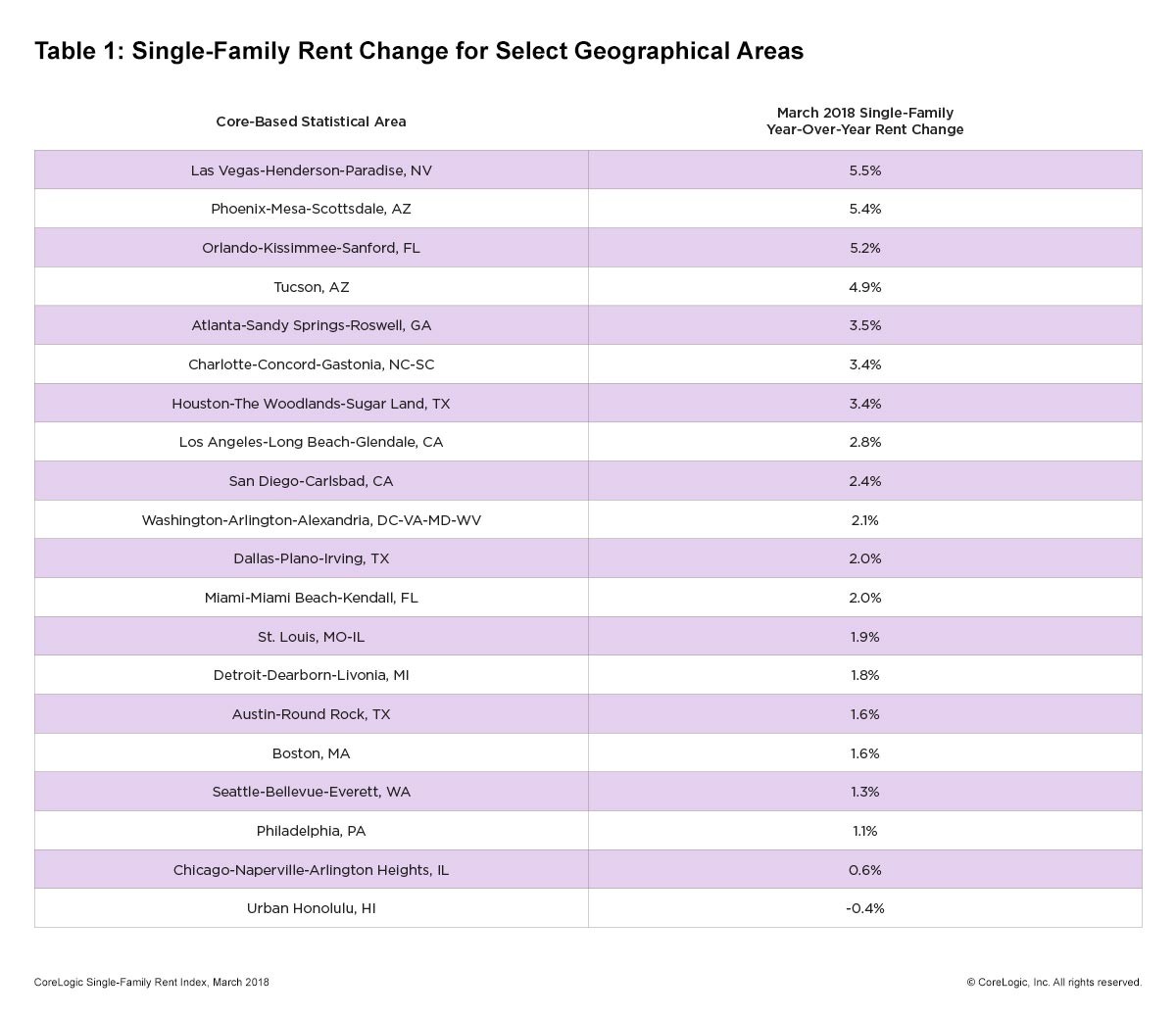

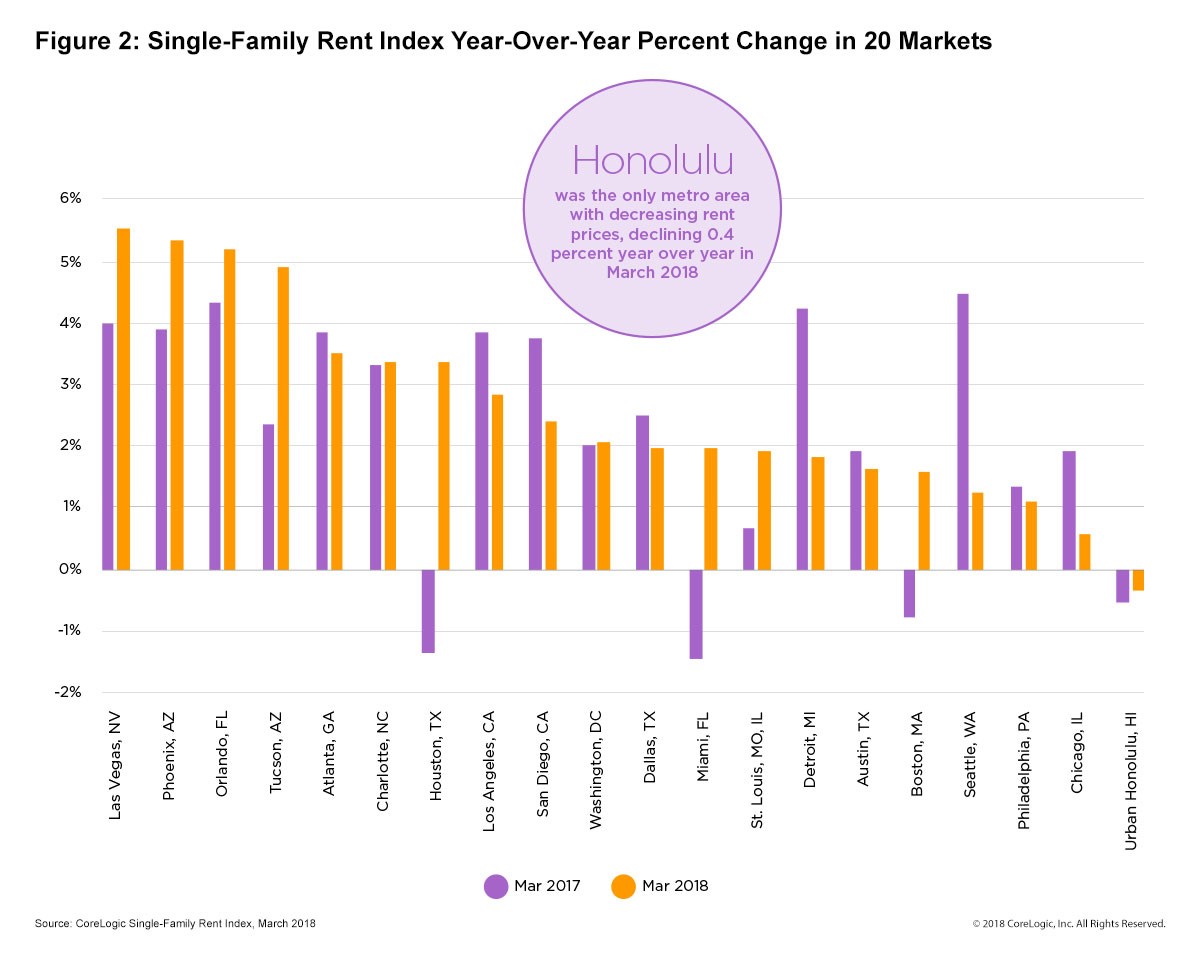

Among the 20 metro areas shown in Table 1, Las Vegas had the highest year-over-year increase in single-family rents in March 2018 at 5.5 percent (compared with March 2017), followed by Phoenix (5.4 percent increase) and Orlando (5.2 percent increase). For the fifth consecutive month, Honolulu was the only metro with decreasing rent prices, declining 0.4 percent year over year in March 2018.

Metro areas with limited new construction, low rental vacancies and strong local economies that attract new employees tend to have stronger rent growth. Both Orlando and Phoenix experienced high year-over-year rent growth, driven by employment growth of 3.5 percent and 3.2 percent year over year respectively. This is compared with the national employment growth average of 1.6 percent, according to data from the United States Bureau of Labor Statistics. Of the 20 metros analyzed, Chicago experienced the lowest employment growth, which could be a factor in its low rent growth of 0.6 percent. Rent prices continue to increase in disaster-struck areas like the Houston metro area, which experienced growth of 3.4 percent year over year in March 2018. This is up from a 2.7 percent increase in February 2018 and a 1.1 percent increase in October 2017, which was the first rent increase for Houston since April 2016.

“The National Single-Family Rent Index continues to grow at a rate of 2.7 percent year over year,” said Molly Boesel, principal economist at CoreLogic. “Most metropolitan areas are seeing steady rent increases both month over month and year over year, with southern metros showing the fastest growth.”

For more information, please visit www.corelogic.com.

For the latest real estate news and trends, bookmark RISMedia.com.