‘Will Be Choppy When Inventory Levels Are Low’

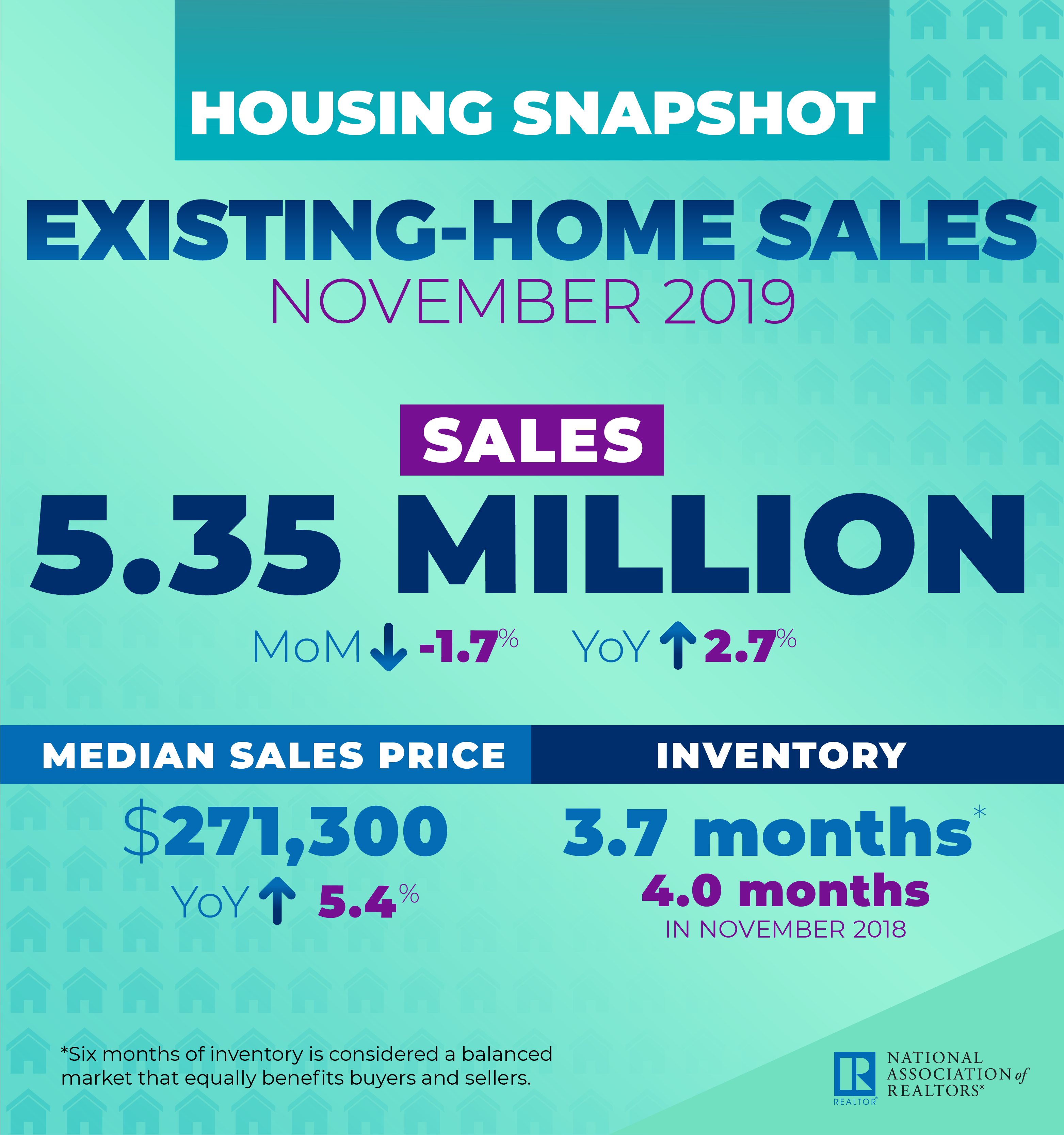

After gaining ground in October, existing-home sales slid, according to the latest National Association of REALTORS® report. November’s seasonally adjusted annualized rate of sales totaled 5.35 million, a 1.7 percent decline month-over-month, but a 2.7 percent increase year-over-year.

The amount of existing for-sale homes in November totaled 1.64 million, down 7.3 percent from the month prior and 5.7 percent year-over-year.

Across all house types (single-family, condo, co-op and townhome), the median price was $271,300—a 5.4 percent increase year-over-year, according to NAR’s report. The median price for sales in the single-family space was $274,000, while the condo median was $248,200.

By region:

Midwest

Existing-Home Sales: 1.32 million (+1.5% YoY)

Median Price: $209,700 (+5.9% YoY)

Northeast

Existing-Home Sales: 700,000 (-1.4% YoY)

Median Price: $301,700 (+3.9% YoY)

South

Existing-Home Sales: 2.24 million (+3.7% YoY)

Median Price: $234,400 (+4.8% YoY)

West

Existing-Home Sales: 1.09 million (+4.8% YoY)

Median Price: $410,700 (+7.1% YoY)

Currently, inventory is at a 3.7-month supply, the report shows. In November, the average listing was on the market for 38 days, four days less than the previous year. Forty-five percent of homes were on the market for less than one month.

Of November’s seasonally adjusted annualized rate of sales, 4.79 million were single-family, and condo and co-op sales totaled 560,000. Twenty percent of sales were all-cash, and 16 percent by individual investors or second homebuyers. Two percent were distressed. First-time homebuyers comprised 32 percent of sales, aligning with the overall trend for the year, 33 percent.

“Sales will be choppy when inventory levels are low, but the economy is otherwise performing very well with more than 2 million job gains in the past year,” Lawrence Yun, chief economist at NAR, says.

The association hosted the NAR Forecast Summit recently, which addressed the economy’s path, as well as critical housing indicators.

“The consensus was that mortgage rates may rise, but only incrementally,” says Yun. “I expect to see home-price affordability improvements, too. This year we witnessed housing costs grow faster than income, but the expectation is for prices to settle at a more reasonable level in the coming year, in line with average hourly wage growth of 3 percent on a year-over-year basis.”

“I would encourage would-be buyers to take advantage of historically-low mortgage rates, which make a home purchase more affordable, particularly when home prices are rising,” NAR President Vince Malta says.

According to Freddie Mac, the average 30-year fixed mortgage rate remains steady, at 3.73 percent (at press time).

“New-home construction seems to be coming to the market, but we are still not seeing the amount of construction needed to solve the housing shortage,” adds Yun. “It is time for builders to be innovative and creative, possibly incorporating more factory-made modules to make houses affordable rather than building homes all on-site.”

For more information, please visit www.nar.realtor.

Where do you people get your information??? Does no one edit what you write? Or do you just type out big headlines and hit send???This is the second time in the last few weeks I have seen MAJOR errors in RISMedias articles.This one states 5.35 million homes sold in November… That should have read 5.35 million in 2019!!!! Not November. AND… You are misquoting the NAR. Sure, mistakes get made,,,but RISMedia presents itself like a knowledgeable resource. Now I read the articles to see how much you get wrong.Dear Public… Check what you read before you rely on the information from these articles.

NAR member 28 years.

In Florida where months of supply hover between 2-3 % yoy, we are seeing a huge swing in lifestyle and housing. When you compare all transactions solds compared to # of rentals – mls data

rentals have grown to 60 a percent in South Tampa Market. More boomers are not buying. They want to travel and rent quarterly. millennials want to rent verses buy too. And overall many who are employed today can work from anywhere. And those people like to move around and be tied to a purchase. I believe total number of sales sold are down to lifestyle change more so than low inventory. all median sales prices are high- we have many sellers who would like to profit but cannot identify a home to move too therefore they do not go on the market to sell. That is why our inventory is low.

DeDe Ross, Realtor/Owner

Keller Williams Realty S Tampa, Premiere Home Team

I agree with DeDe, there is an increase the rental market along with an increase in monthly rental amounts. In addition I would add that taking away the mortgage tax credit/itemizing deductions to a standard tax deduction also contributes to more people at various ages willing to rent.