U.S. homeowners with mortgages—accounting for about 63 percent of all properties—saw home equity gains of 6.5 percent YoY on average, a $590 billion increase since Q1 in 2019, according to CoreLogic’s Q1 2020 Home Equity report.

Since the fourth quarter in 2020, underwater mortgages decreased by 3.1 percent to 1.8 million homes (2.4 percent of all mortgage properties). Negative equity mortgages decreased by 16 percent in Q1 of 2020 YoY.

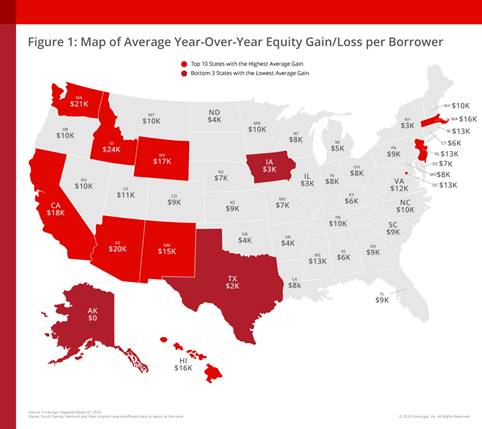

On average, homeowners gained $9,300 in home equity YoY in the first quarter of 2020. The states with the highest average equity gains YoY were Idaho ($24,400), Washington ($20,800) and Arizona ($19,900).

Since the last recession, equity has grown substantially as home prices continue to rise. In the first quarter of 2010, 12.1 million homes (25.9 percent) were underwater—a drastic difference to the 1.8 million properties (3.4 percent) that were underwater in the first quarter of 2020. In the last decade, homeowners have gained about $106,100 in equity, on average, totaling over $6 trillion. But what does the current pandemic mean for the housing markets and equity gains?

“The pandemic recession will likely lead to price declines in many areas during the next year and weaken home equity gains,” said Dr. Frank Nothaft, chief economist for CoreLogic. “However, price declines will be far less than those experienced during the Great Recession, when the national CoreLogic Home Price Index fell 33 percent peak-to-trough. Our latest forecast shows the national index to have a peak-to-trough decline of 1.5 percent.”

“Many homeowners will experience a recession during their lifetime, and it is reasonable to compare the current recession to those in the past,” said Frank Martell, president and CEO of CoreLogic. “But the comparison is not apples to apples—every recession is different. Primary drivers of the Great Recession were an overbuilt housing stock, risky mortgages and the collapse of home prices, creating a massive increase in negative equity that proved difficult to recover from. Today’s housing environment has low vacancy and delinquency rates and a large home equity cushion. While the CoreLogic HPI forecasts a decline in home prices in the coming year, we can also expect the majority of homeowners to remain above water.”

For more information, please visit www.corelogic.com.