On June 7, Quicken Loans publicly announced that Rocket Companies filed a registration statement on Form S-1 with the U.S. Securities and Exchange Commission (SEC).

On the New York Stock Exchange, Rocket Companies will be represented by ticker symbol “RKT.” While the company lists $100 million for the IPO, Quicken Loans states that “the number of shares to be offered and the price range for the proposed offering have not yet been determined.”

Rocket Companies is composed of several companies owned by Quicken Loans Founder and Chairman Dan Gilbert, including Rocket Mortgage, Rocket Homes, Rocket Loans, Rocket Auto, Rock Central, Core Digital Media, Rock Connections, Lendesk and Edison Financial. Following the IPO, Gilbert will retain significant control of these companies.

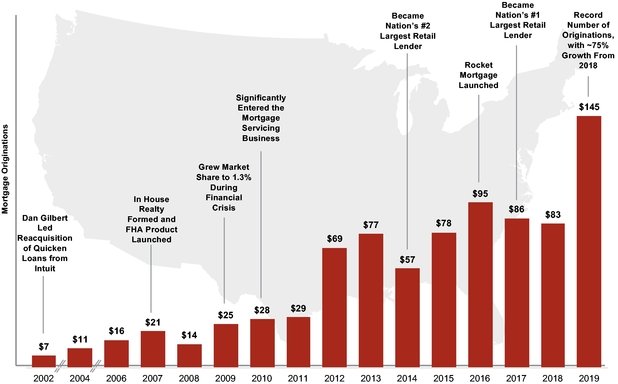

The filing publicly discloses several financial details about Rocket Companies, which accrued a total of $5.1 billion in revenue (and $894 million in net revenue) in 2019. The Rocket Mortgage platform reportedly closed $145 billion in loan originations in 2019. According to the filing, the company leads the mortgage industry in market share, making up 9.2 percent of the mortgage originator market.

The company lays out several risk factors in the registration—many of which are tied to the current COVID-19 pandemic. According to the filing, about 5.1 percent of the company’s serviced loans were in forbearance as of June 30.

“The COVID-19 pandemic has had, and continues to have, a significant impact on the national economy and the communities in which we operate,” according to a statement in the public filing. “While the pandemic’s effect on the macroeconomic environment has yet to be fully determined and could continue for months or years, we expect that the pandemic and governmental programs created as a response to the pandemic, will affect the core aspects of our business, including the origination of mortgages, our servicing operations, our liquidity and our employees.”

In addition, the public SEC filing introduces a new product from Rocket Companies: RocketLogic is an underwriting product that will reportedly “overhaul the way we originate loans, from application to closing.”

“RocketLogic leverages data and asks dynamic questions, resulting in clients closing their mortgage faster and with greater accuracy. This will continue to drive efficiency for our team members and bring certainty to our clients,” says the SEC filing.

According to the filing, consumers are constantly looking for a “higher level of service and technology-driven user experiences,” with the millennial generation valuing instant gratification and a digital process. However, due to challenges with technology, disruption is sorely needed, resulting in closing delays, according to Quicken Loans.

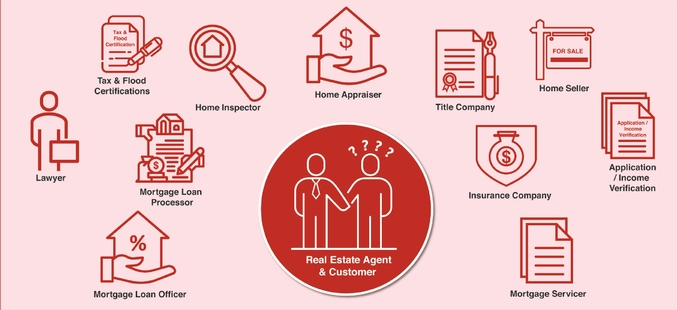

“The traditional mortgage application process requires manual interactions and a complex series of data-intensive transactions. These transactions involve carefully filing and cataloging thousands of pages of documents from over a dozen entities, using incompatible systems and disjointed databases,” says the filing.

These factors, they say, have resulted in a 43-day industry average time to close in 2019. And that’s why the company says it has, over the years, stepped in to provide streamlined technology solutions across several sectors involved in the real estate transaction, forming partnerships through its Quicken Loans Mortgage Services (QLMS) network “with other preeminent companies and professionals whose clients benefit from our solutions.”

Rocket Companies has become intrinsically involved in, and disrupted, some of these traditional home-buying processes:

Its solutions cover a wide range of services, according to the SEC filing, including:

Rocket Homes: A real estate portal and lead generation system for agents. “Rocket Homes manages a partner network of more than 15,000 real estate agents and has assisted over 500,000 clients with their home buying and selling needs.”

Rocket Loans: An online-based personal loans business for borrowers in good standing that can provide same-day funding.

Rock Connections: A lead conversion tech platform with in-depth data reporting abilities

Below is a timeline of Quicken Loans’ mortgage origination business ventures:

“Rocket Mortgage is the leader in the largest consumer lending market in the United States, with approximately $10.7 trillion of residential mortgage debt outstanding as of December 31, 2019, according to the Mortgage Bankers Association,” states the filing.

Jay Farner, CEO of Rocket Companies, published a letter with the IPO. Below is an excerpt:

“As you consider our company, I want you to think about who we are just as much as the success we’ve had. We are strong, both in our financial results and in our resolve to be a force for good. When thinking about where our company is headed, look at our past. We have a proven record of leading the industry and being prepared no matter where the market takes us…In closing, I’ll quote our founder, Dan Gilbert when we made the well-publicized decision to move our company to downtown Detroit 10 years ago: ‘Who’s coming with us?!'”

Since the company’s inception in 1985, it has focused on launching new consumer experiences, scaling and automating operations, and extending its proprietary technologies to partners. Rocket Mortgage has provided more than $1 trillion in home loans since its inception, growing the company’s market share from 1.3 percent in 2009 to 9.2 percent in the first quarter of 2020, a CAGR of 19 percent.

This is a developing story. Stay tuned to RISMedia for more updates.