CoreLogic® recently released its latest Single-Family Rent Index (SFRI), which analyzes single-family rent price changes nationally and across more than 20 metropolitan areas. Data collected for August 2020 shows a national rent increase of 2.1 percent year-over-year, down from a 2.9 percent year-over-year increase in August 2019.

The chain reaction of record job loss due to the onset of the pandemic reached the rental market and slowed rent growth through the summer months. Annual rent growth hit its lowest rate in ten years in June. However, rent price growth began to see gains again in July and strengthened more in August as the U.S. job market started to build back and businesses continued to reopen.

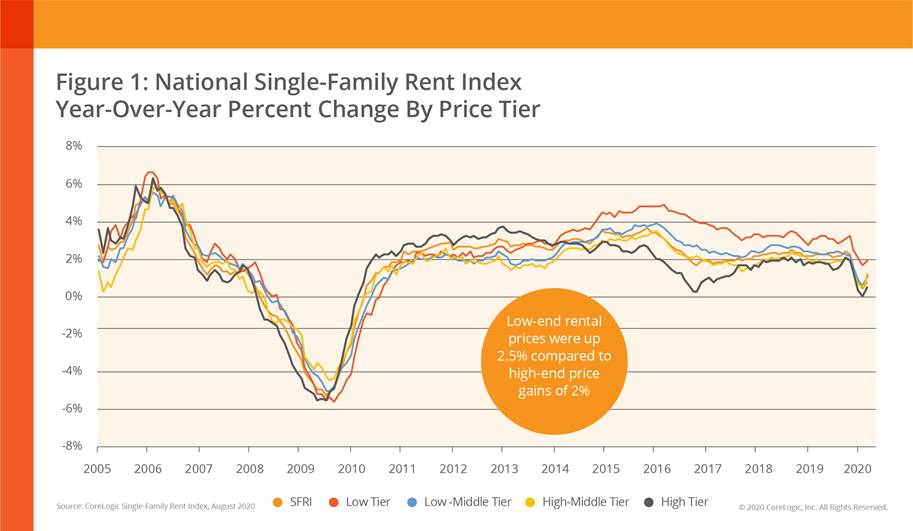

“Single-family rent increases picked up pace in August, signaling continued high demand for these property types,” said Molly Boesel, principal economist at CoreLogic. “This is in stark contrast to the Great Recession, when rent prices dropped by 5 percent between 2008—when the market was at its height—and early 2010 when it had reached the bottom.”

To gain an accurate view of single-family rental prices, CoreLogic examines four tiers of rental prices. On an annual basis, rent price growth slowed across all tiers in August. However, three tiers showed a slight uptick in annual rent growth compared with July, with the high-end price tier experiencing the largest increase. In August 2020, the national single-family rent growth across the four tiers, and the year-over-year changes, were as follows:

Lower-priced (75 percent or less than the regional median): 2.5 percent, down from 3.7 percent in August 2019, and down from 2.6% in July 2020

Lower-middle priced (75 percent to 100 percent of the regional median): 2.1 percent, down from 3 percent in August 2019, and up from 1.8 percent in July 2020

Higher-middle priced (100 percent to 125 percent of the regional median): 2.2 percent, down from 2.7 percent in August 2019, and up from 1.7 percent in July 2020

Higher-priced (125 percent or more than the regional median): 2 percent, down from 2.6 percent in August 2019, and up from 1.4 percent in July 2020

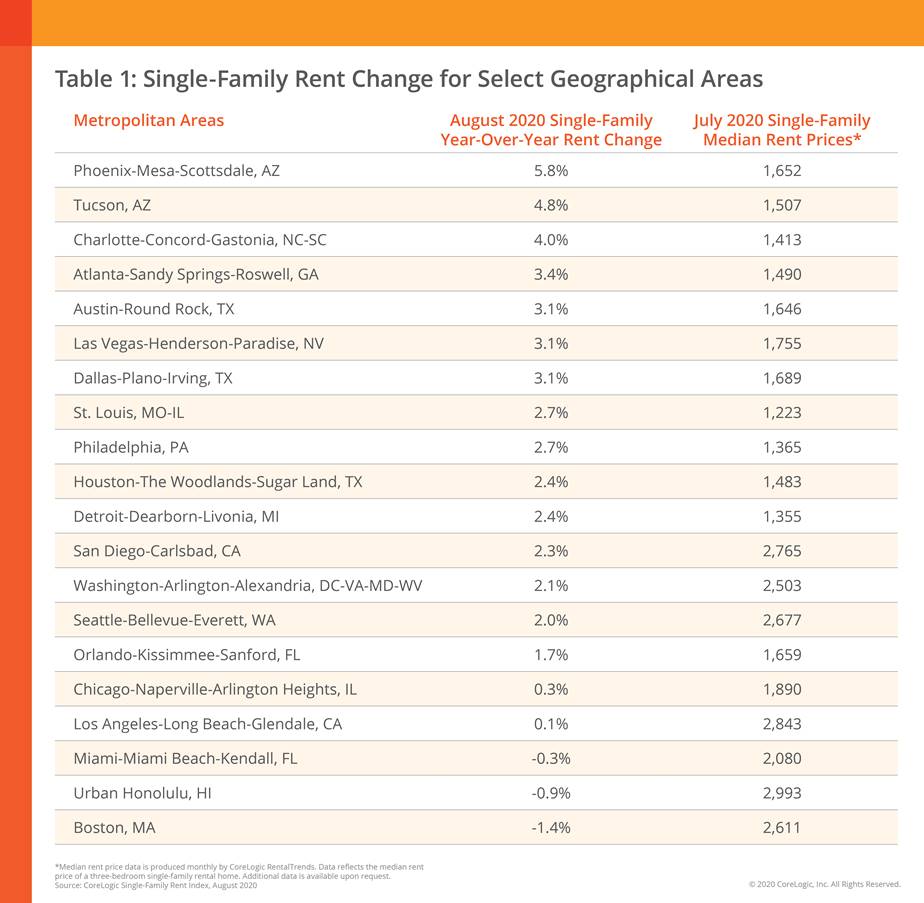

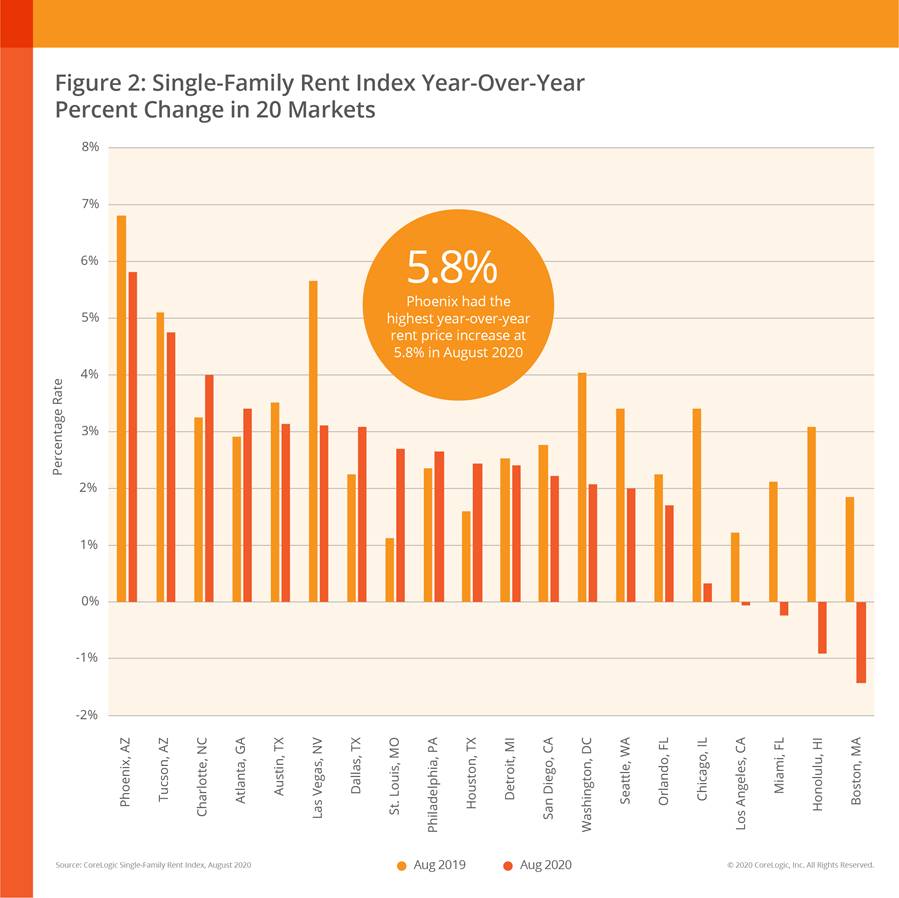

Among the 20 metro areas shown in Table 1, and for 21 consecutive months, Phoenix had the highest year-over-year increase in single-family rents in August 2020 at 5. 8percent. Tucson, Ariz., had the second-highest rent price growth in August 2020 with a gain of 4.8 percent, followed by Charlotte, N.C., at 4 percent. Conversely, Honolulu, Miami and Boston all posted an annual decline in rent prices, with the latter experiencing the most significant decline at -1.4 percent. The drop could be attributed to a large number of students choosing to not return to Boston—a city that’s home to 35 colleges and universities—but instead opting to continue virtual learning in their hometowns.

Unemployment rates remained elevated across the country, with some regions and metros experiencing higher rates of job loss and downward pressure on rent prices than others. For example, employment decreased by just 2.7 percent year-over-year in August in Austin, Texas—where the tech hub has enabled many to keep their jobs while working from home and subsequently, rent prices have stayed comparatively strong. Meanwhile, popular tourist destinations like Honolulu posted an employment decrease of 14 percent, compared to August 2019, and ongoing decline in rent prices. As the economy slowly recovers from the initial impact of the pandemic, we may see continued fluctuation of rent prices in metros across the nation.

For more information, please visit www.corelogic.com.