Despite a strong demand in the housing market, persisting inventory constraints weighed down contract signings in February, marking the fourth consecutive month of declines, according to recent data from the National Association of REALTORS® (NAR).

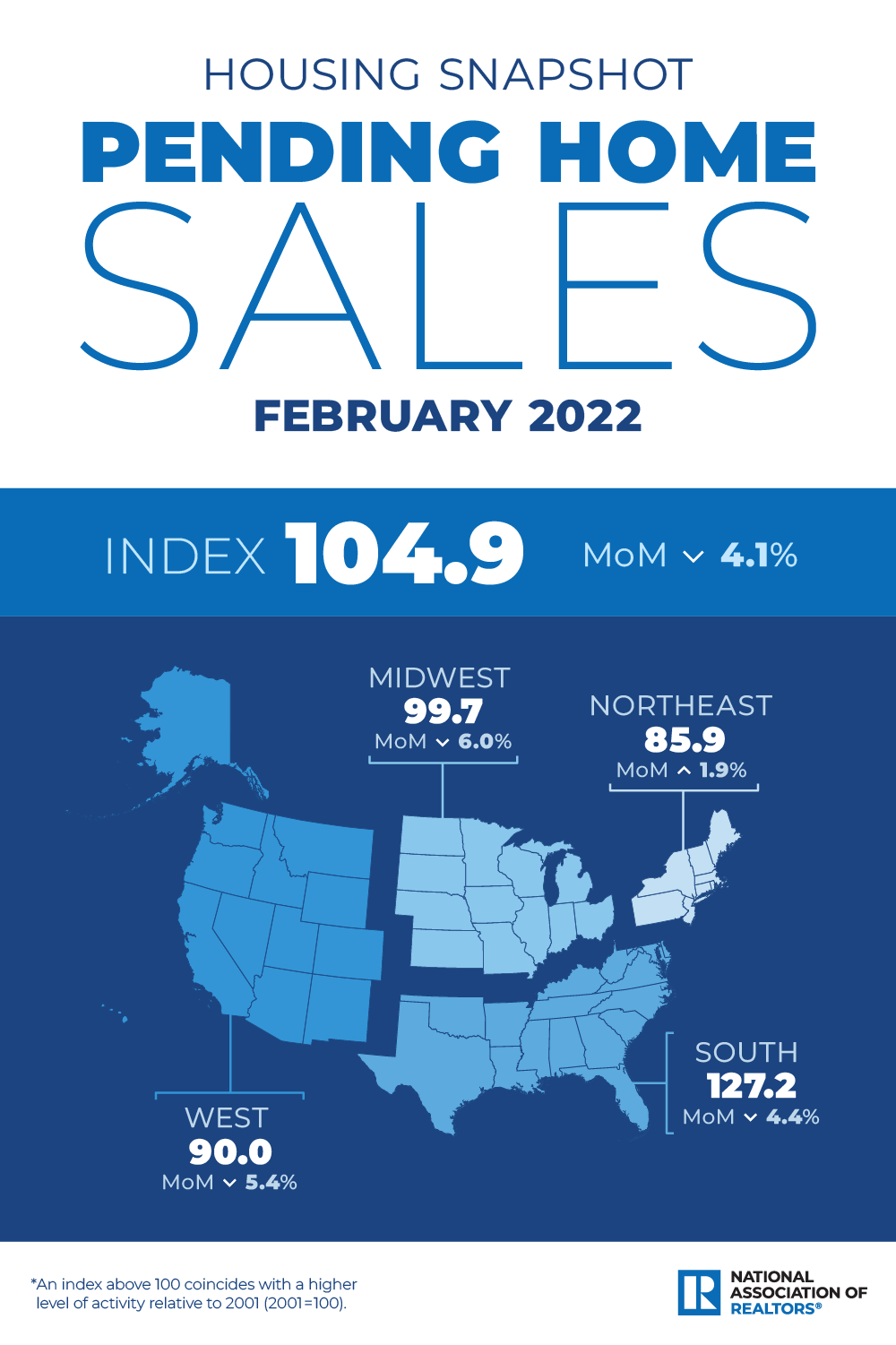

NAR’s Pending Home Sales Index (PHSI), a forward-looking indicator of home sales based on contract signings, dropped by 4.1% last month, falling to 104.9. All regions saw year-over-year contract signings decline, dipping 5.4% nationally.

Rising mortgage rates coupled with growing price tags for a record-low number of homes for sale continue to strain affordability issues in the market, according to experts who forecast a decline of about 7% in home sales this year compared to 202.

NAR also indicated that higher mortgage rates and sustained price appreciation have led to a year-over-year increase of 28% in mortgage payments. Experts predict that mortgage rates hit about 4.5% to 5% for the remainder of the year.

Regional Breakdown:

Northeast

+1.9% MoM — Now 85.0 PHSI

-9.2% YoY

Midwest

-6.0% MoM — 99.7 PHSI

-5.2% YoY

South

-4.4% MoM — 127.2 PHSI

-4.3% YoY

West

-5.4% MoM — 90.0 PHSI

-5.3% YoY

What the Industry Is Saying:

“Pending transactions diminished in February mainly due to the low number of homes for sale,” said Lawrence Yun, NAR chief economist. “Buyer demand is still intense, but it’s as simple as ‘one cannot buy what is not for sale.’

It is still an extremely competitive market, but fast-changing conditions regarding affordability are ahead. Consequently, home sellers cannot simply bump up prices in the upcoming months but need to assess the changing market conditions to attract buyers.

The surge in home prices combined with rising mortgage rates can easily translate to another $200 to $300 in mortgage payments per month, which is a major strain for many families already on tight budgets. Home prices themselves are still on solid ground. They may rise around 5% by year’s end, and we should see much softer gains in the second half of the year.”

“In February, homebuyers were greeted by record-high listing prices, along with a surge in the cost of gasoline due to Russia’s invasion of Ukraine,” said George Ratiu, manager of economic research for realtor.com. “Real estate markets started 2022 on a high note, with many buyers stymied by last year’s overheated pace looking forward to a better year. However, housing dynamics have shifted quickly, creating a challenging environment.

The number of homes for sale remains very low and continues to shrink from last year, keeping the pace of sales elevated. In turn, list prices re-accelerated after the reprieve experienced during fall 2021, reaching a new high of $392,000 in February. For buyers looking for a home, the higher price came at the same time as speeding inflation not only took more out of each paycheck but also pushed mortgage rates higher. The net effect, especially for first-time buyers, was a shrinking of their budgets, which only served to narrow available options.

As we move into the spring season, markets remain clearly tilted in sellers’ favor. However, with mortgage rates moving toward 5.0%, we are seeing early signs of a shift in housing fundamentals, as many people looking for a home have hit a ceiling on their ability to afford a home.”

For more information, please visit www.nar.realtor.

Jordan Grice is RISMedia’s associate online editor. Email him your real estate news ideas to jgrice@rismedia.com.

Jordan Grice is RISMedia’s associate online editor. Email him your real estate news ideas to jgrice@rismedia.com.