Broker confidence tumbled to a two-and-a-half year low in June, according to RISMedia’s most recent survey of real estate business owners, with long-run affordability concerns tipping against a generally resilient economic environment.

The June edition of RISMedia’s Broker Confidence Index (BCI) came in at 5.6, a precipitous drop from 6.3 in May. Low sales and macro turmoil appear to have weighed heavily on most markets throughout this spring, with the aforementioned affordability problems an albatross for almost the entire industry.

“Affordability is not due to interest rates, it’s due to the fast increase in property values above 40-year average appreciation, and incomes not rising at a commensurate rate,” said Todd Menard, CEO of West USA Realty in Arizona. “People have increased their expenses to new highs. Debt to income is crippling the industry.”

“Affordability is not due to interest rates, it’s due to the fast increase in property values above 40-year average appreciation, and incomes not rising at a commensurate rate,” said Todd Menard, CEO of West USA Realty in Arizona. “People have increased their expenses to new highs. Debt to income is crippling the industry.”

The BCI has not seen a lower monthly reading since December of 2022, when the Federal Reserve’s rate hiking campaign froze out the market as inflation hovered around 6.5%.

In 2025, home sales remain at lows not seen since the Great Recession, and while many—including the National Association of Realtors® (NAR)—believe new Trump administration priorities as addressing at least some of these structural issues, affordability remains the main barrier for getting prospective buyers off the sidelines.

Notably, in June, the Harvard Joint Center for Housing Studies (JCHS) released its annual report on the “State of the Nation’s Housing,” and found that homeownership rates fell in 2024 for the first time in almost a decade.

In their qualitative response to the BCI, 45% of brokers mentioned affordability as something that was currently affecting their confidence.

“Listings are getting harder and harder to sell—especially the ones that are near new construction areas. Buyers are holding off until rates drop,” said Scott Myers, broker/owner of CENTURY 21 Scott Myers REALTORS® in Texas.

Numbers and needs

Far from a sudden or surprising crisis, affordability issues grew steadily—and significantly—in the wake of the 2008 housing crash, as many smaller builders disappeared and new home constriction slowed, creating supply-demand imbalances. Simultaneously, incomes, especially in the lower and middle quartiles, stagnated, pricing more and more of the population out of homeownership.

The same JCHS study last month found that only around 17% of current renters can afford to buy a home, based on incomes, current mortgage rates and spiraling costs. Those kinds of data paint a dire picture of the long-term health of housing—but policymakers have long noted that solutions require complex and interdisciplinary approaches, looking at everything from local land use regulation to income inequality.

And importantly, most (or at least many) of these issues can only be addressed at the local level, making broad-based reforms or initiatives nearly impossible.

Richard McKinney, broker/owner of RE/MAX Gold in Florida, highlighted the specific, acute challenges facing the housing market in that state, pointing to insurance costs, higher inventory, taxes and competition with new builds as putting “downward pressure” on the market—with affordability as the overarching theme.

“There is no way but down in most Florida sub-markets,” he said.

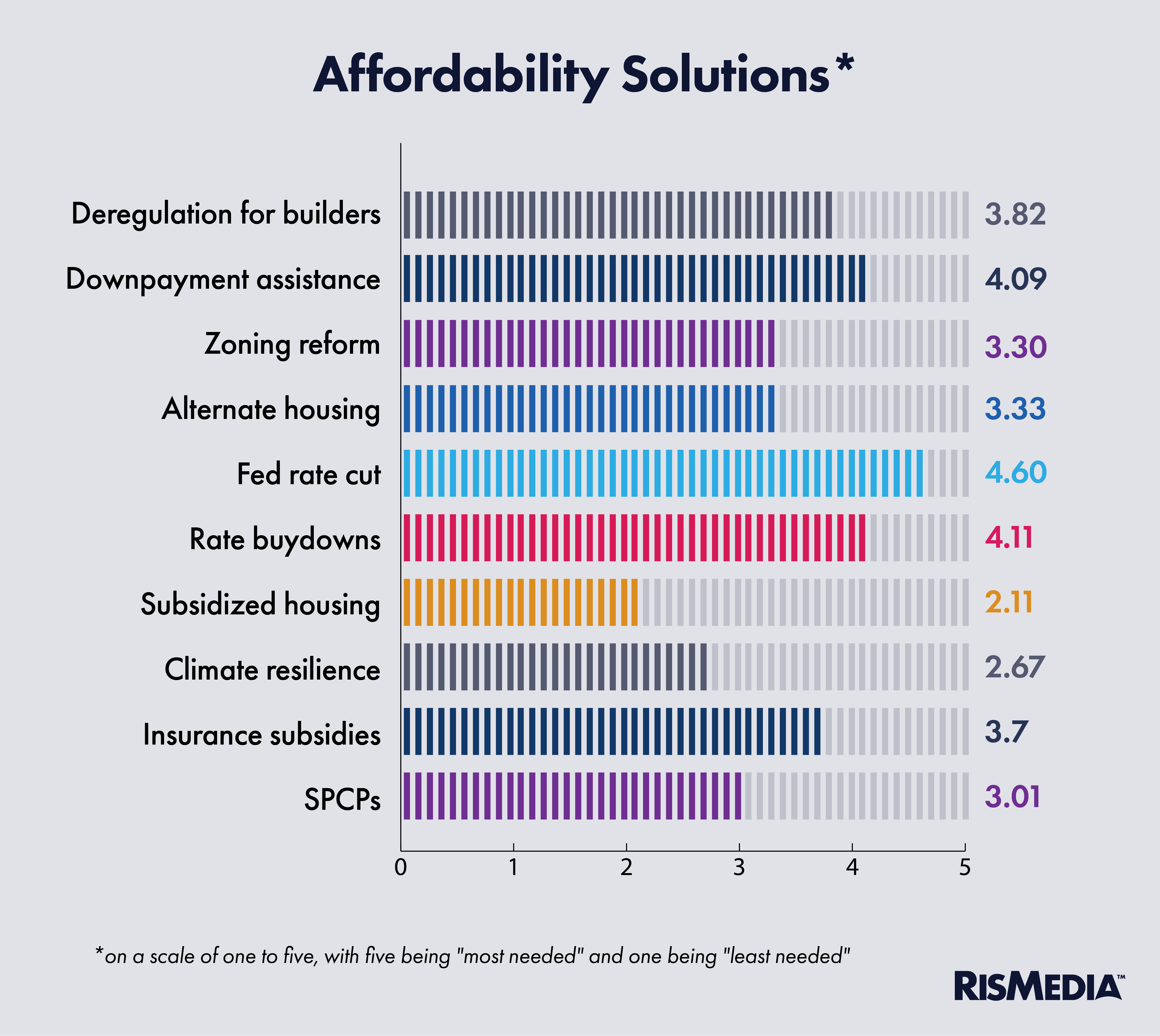

Brokers were asked to highlight what they saw as the most important solutions to affordability issues in their market, ranking programs or policies on a scale of one to five, from “least needed” to “most needed.”

Unsurprisingly, the broadest consensus across geographies was for a lower federal funds rate. Almost three-quarters (72%) of brokers ranked this as the “most needed” step to address affordability, with rates still hovering around 6.6%

President Donald Trump, as well as Federal Housing Finance Agency Director Bill Pulte, have viciously attacked Federal Reserve Chair Jerome Powell for delaying interest rate cuts, calling for his resignation and accusing him of political bias. Powell has refused to address these attacks publicly, and continued to say the Fed is waiting on more economic data related to tariff impacts before cutting rates again.

Another highly-rated policy was downpayment assistance—something that is offered by all levels of government, as well as through private organizations in some circumstances. The new Trump administration has not made these programs a priority, with no new programs in the recently signed mega-bill.

According to the Urban Institute, as of 2023, most down payment assistance programs were run at the state level. The same report found demand for these programs growing exponentially, with three times as many buyers relying on them in 2023 compared to 2010.

Brokers also pointed to deregulation for builders (something that has been a priority at the federal level). A 2021 National Association of Home Builders’ study claimed that around 24% of the cost to build a new home was regulatory—though that study did not break out which level of government imposed those regulations, saying it is “difficult to impossible” for a builder to make those determinations.

Programs that brokers saw as less needed included deed-restrictions and subsidized housing, with only 11% of brokers ranking these programs as a four or higher. So-called permanently affordable housing like this varies widely in how it is executed, but has been cited by many advocates as necessary to help low-income families climb the housing ladder.

Other lower-priority programs include special purpose credit programs (SPCPs), lending products available to disadvantaged groups. While the Mortgage Bankers Association touted these programs in the past, the Trump administration has recently withdrawn support for these programs, limiting their reach and usefulness, according to NAR.